US stocks fell on Tuesday amid a decline in the tech sector. Rising Treasury yields also weakened stocks' upside potential.

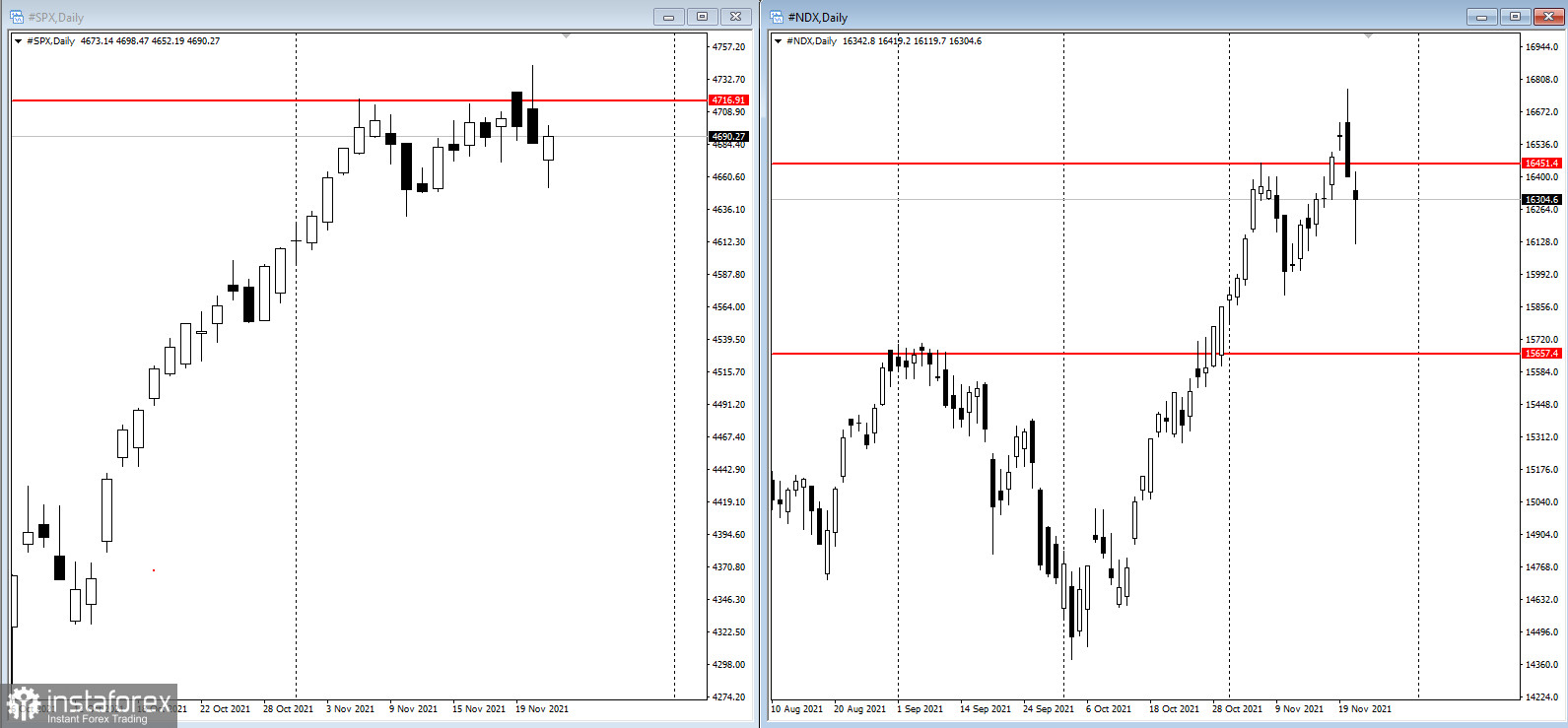

As seen in the chart, the S&P 500 moved down, continuing the bearish trend observed in the past days. The reason was the rallies in energy and financial stocks. The Nasdaq 100 also fell more than 1% because of the sell-offs yesterday evening.

Clearly, the reappointment of Jerome Powell as Fed chief lowered the hopes of investors that the Fed will raise rates earlier than scheduled. Powell has long said he is seeking to strike a balance in his policy approach, so the central bank will most likely use all tools at its disposal to support the economy and prevent inflation from growing further.

"Looking at the market today, obviously things that are sensitive to rates are moving", said Jerry Braakman, CIO of First American Trust. "Tech is showing a little bit of weakness, financials are showing strength. That's reflective of that move in the yield curve."

But Atlanta Fed President Raphael Bostic said the central bank may need to speed up tapering and authorize earlier-than-planned rate hikes.

In any case, despite the recent declines, US stocks have been trading near records, giving rise to concerns about valuations as investors weigh prospects for growth amid rising inflation and a persistent pandemic.

Sam Stovall, chief investment strategist at CFRA Research, said: "The market is still overbought and needs to digest some of the recent gains."

Other events to watch out for this week are:

- policy decision of the Reserve Bank of New Zealand (Wednesday)

- Fed minutes and reports on US consumer income, wholesale inventories, new home sales, GDP, jobless claims, orders for durable goods and consumer sentiment (Wednesday);

- policy decision of the Bank of Korea (Thursday);

- closure of US stock and bond markets amid Thanksgiving (Thursday);

- statements of Bank of England Governor Andrew Bailey (Thursday).