Hi, dear traders!

Today is set to be the most important day of the week. The FOMC meeting minutes are due today at 2:00 pm ET. The minutes are published 3 weeks after the latest Fed meeting date and are a detailed insight into the economic and monetary policies of the Federal Reserve, as well as the predominant position of the Fed board members. Currently, investors expect the Fed to tighten monetary policy. In light of recent comments by Fed officials, more of them advocate for hawkish policy moves. So, the minutes should confirm that more policymakers share the hawkish rhetoric. This will give support to the US dollar and push it higher against the euro.

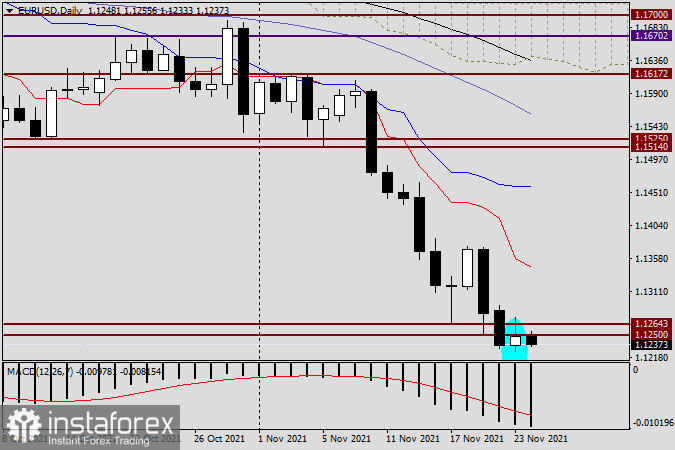

Daily

As expected yesterday, EUR/USD rebounded to the broken support levels of 1.1250 and 1.1264. Bulls tried to push the quote over the 1.1264 level. However, it reversed after reaching the 1.1275 mark. The pair closed at 1.1248 - significantly lower than the intraday high. This indicates that yesterday's recommendations to open short positions after the rebound to the 1.1250-1.1300 zone were correct.

The closing price of EUR/USD on the daily chart signals that the pair would continue to be on the downside. The price movement would be influenced by the market reaction to the FOMC meeting minutes. Disappointing meeting results would trigger a sell-off, weighing the US dollar down and pushing the pair over the important level of 1.1300. It would also turn the breakdown of the 1.1250 and 1.1264 support levels into a false one. If the minutes give support to the dollar, the pair could likely close below the 1.1200 level, boosting the bearish trend.

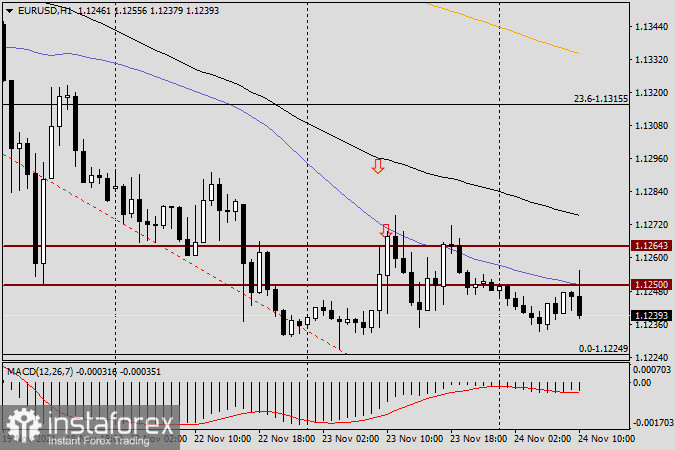

H1

At the moment, the pair is moving sideways, as traders eye the FOMC minutes. This can be seen on the H1 chart. The release of the meeting minutes may trigger increased volatility on the market. It is likely that the dollar would find support in the FOMC meeting minutes, and the downward movement would resume. The price could spike upward during the volatile period, giving opportunities for opening short positions. Yesterday's sell zone of 1.1250-1.1300 is likely to remain actual today.

Good luck!