EUR/USD

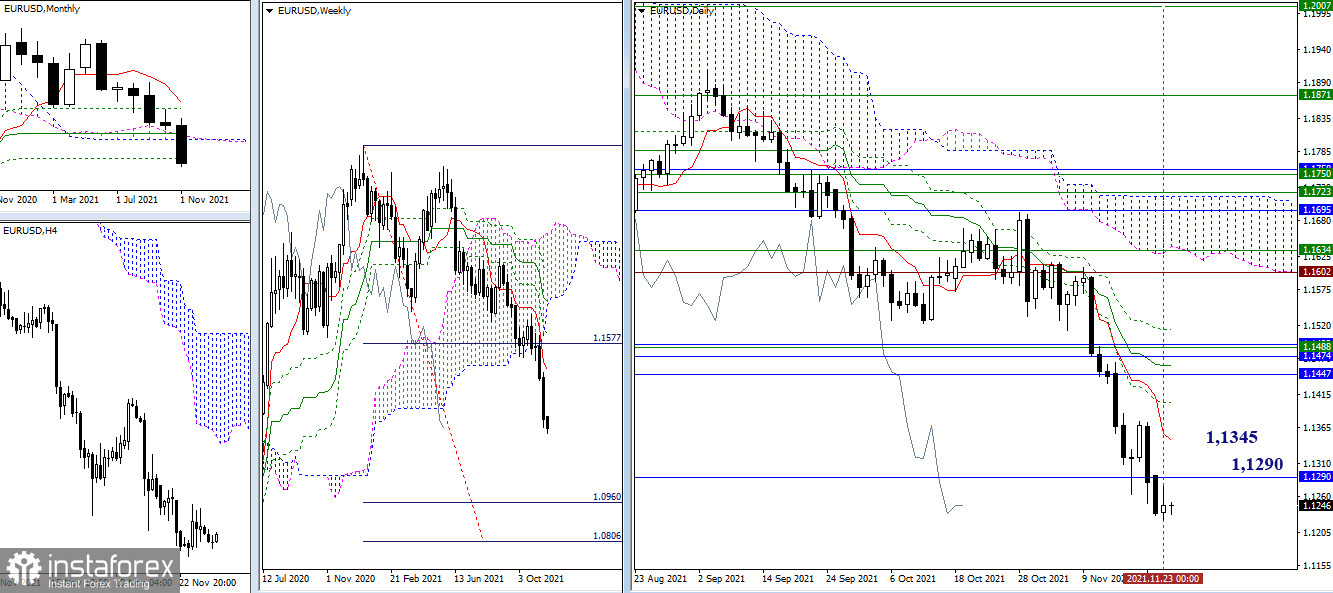

The pair decelerated yesterday after declining on the daily timeframe. As a result, the situation hardly changed in its conclusions and expectations. The monthly level of 1.1290 continues to have an attraction and a certain influence on the situation. The next downward pivot point is still the weekly target for the breakout of the Ichimoku cloud (1.0960 - 1.0806). If the deceleration can turn into a corrective movement, then after consolidating above the level of 1.1290, the main bullish interest will be directed to the daily short-term trend, which is set at 1.1345.

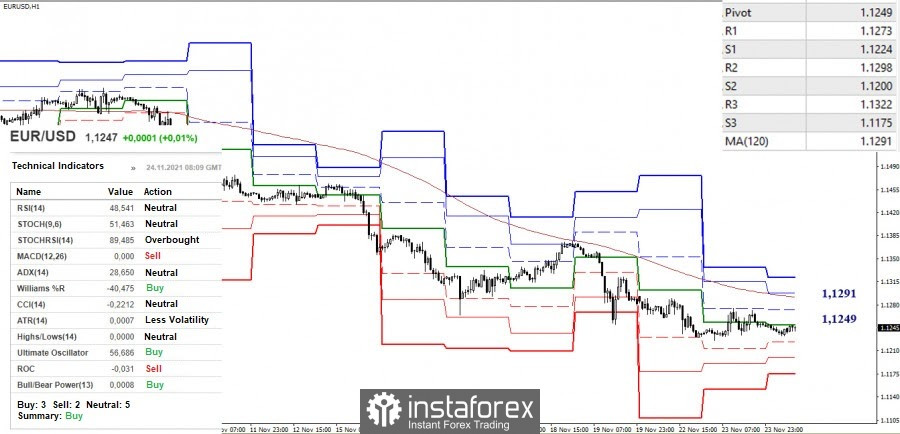

The deceleration in the higher timeframes led to the development of the lateral movement in the smaller ones. The central pivot level (1.1249) has recently been the center of attraction on the hourly chart. At the same time, the main advantage continues to be on the bearish side. The continuation of the decline will return the relevance to the supports of the classic pivot levels (1.1224 - 1.1200 - 1.1175). A sharp consolidation above the weekly long-term trend (1.1291) will help to change the current balance of power.

GBP/USD

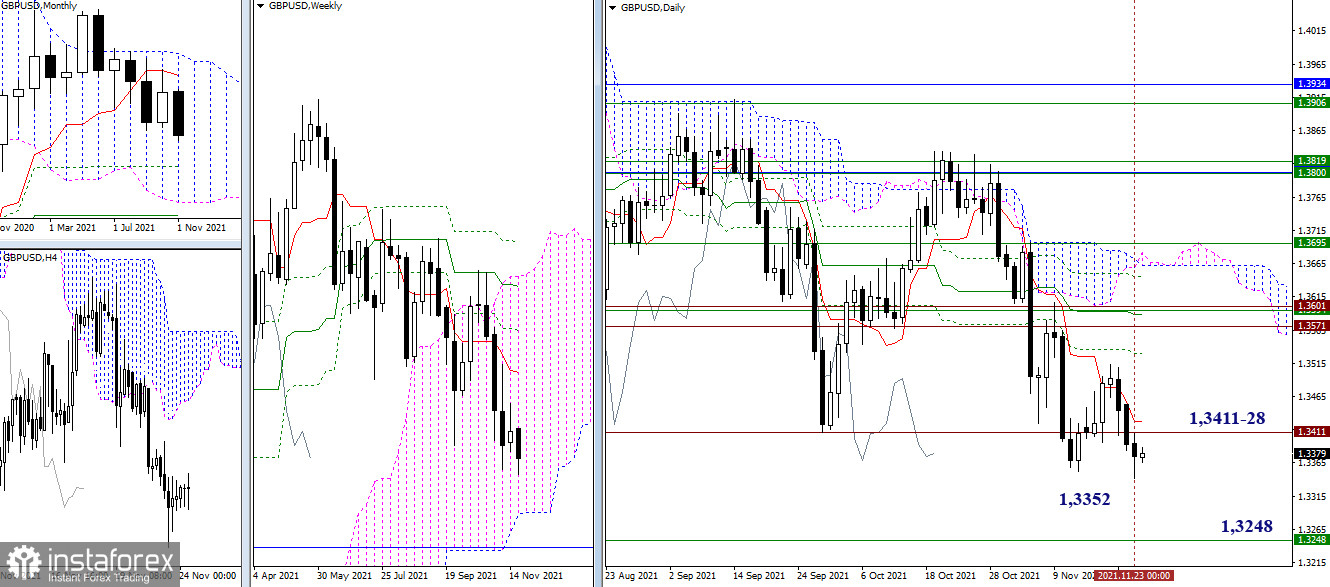

The pound updated its previous low yesterday but failed to close the day below. Therefore, the attraction and influence zone of 1.3411 - 1.3352 retains its strength and significance. This zone was joined by the daily short-term trend (1.3428) today. A consolidation below will allow us to hope for the downward trend to resume. If this happens, we can consider the closest pivot point, which is the lower border of the weekly cloud (1.3248).

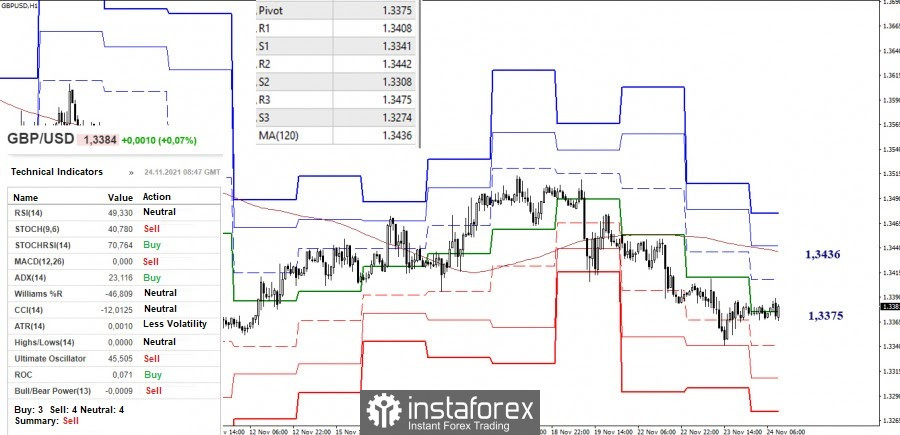

A stop in the daily timeframe is considered as a slowdown and correction in the smaller timeframes. The pair in the H1 chart is now in the correction zone, remaining below the influence and attraction of the central pivot level (1.3375). In order for the bulls to gain an advantage, they need to rise to the weekly long-term trend (1.3436), break through it, and reverse the moving average. The nearest resistance on this path may be provided by the level of 1.3408. Meanwhile, the supports of the classic pivot levels are located today at 1.3341 - 1.3308 - 1.3274. If the decline continues, they will act as intraday pivot points.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.