Today's review of another major currency pair USD/CHF will focus on the technical picture. For more detailed coverage of all the technical nuances, I suggest starting the analysis with a weekly timeframe.

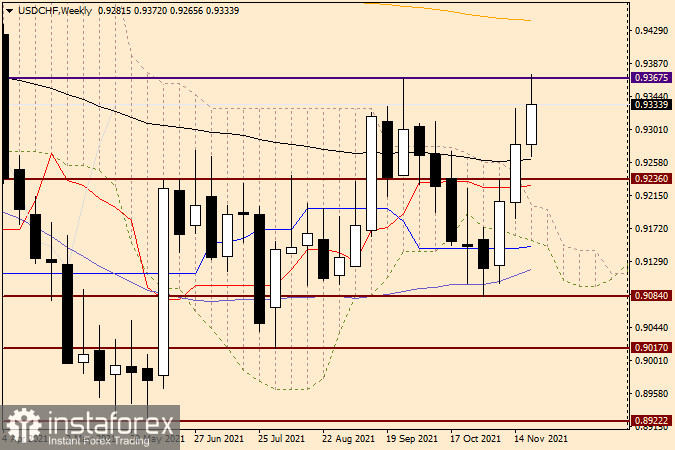

Weekly

As it was assumed in one of the recent dollar/franc reviews, it was most likely possible to assume a further rise in the quote. Although there is still plenty of time before the end of weekly trading, these forecasts come true and the USD/CHF pair is showing growth. However, as expected, the key resistance of sellers at this stage of time in the area of 0.9367 is holding back the bulls' attacks on this trading instrument and does not let the pair go higher. After trying to break through this level from 0.9372, a fairly good rebound occurred, and at the time of writing this article, the weekly candle did not have a small upper shadow at all. The main task of the USD/CHF bulls remains a true breakdown of the 0.9367 resistance level with a confident closing of the weekly session above this mark. Only under this condition can we count on the subsequent strengthening of the exchange rate.

In this case, the next targets of the bulls for the instrument will be the levels 0.9400, 0.9440, and 0.9472. The first mark represents a fairly strong technical level, the orange 200 exponential moving average passes on the second, and at 0.9472 there is another strong resistance of sellers, where the maximum values of trading in March of this year were shown. However, even if the players manage to raise the price above 0.9472, they will have to face an important psychological level of 0.9500. In general, as they say, USD/CHF bulls have something to work on. But even bears have a couple of tasks that are by no means easy. To change the mood, they need to lower the rate under 0.9262 (89 EMA), 0.9228 (Tenkan red line), and then - more. To indicate bearish sentiment for the dollar/franc, a true breakdown of support at 0.9084 is needed, after which players need to lower the price below the most important psychological level of 0.9000.

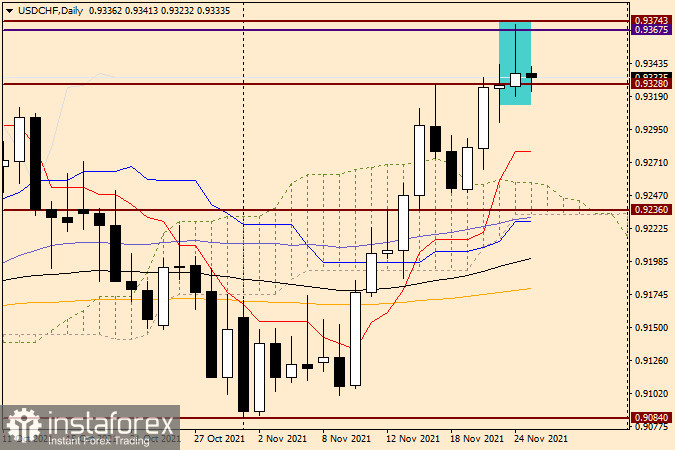

Daily

Despite the strengthening of the US dollar across a wide range of the market, following the results of trading on November 24, a candle with a very long upper shadow appeared on the daily chart, which is several times larger than the bullish body itself. According to candle analysis, in most cases, such candles are perceived as reversal patterns. Nevertheless, USD/CHF bulls managed to finish yesterday's trading above the sellers' resistance at 0.9328. As can be seen on the daily dollar/franc chart, previous attempts to break through this level did not lead to anything. However, considering that only one daily candle has closed above 0.9328 so far, and also taking into account its long upper shadow, I would not draw unambiguous conclusions about the true breakdown of sellers' resistance at 0.9328 yet. In general, given the technical picture on the two timeframes considered, the situation for the USD/CHF pair at this stage of time is extremely ambiguous. Based on this, I would refrain from opening positions on USD/CHF for the time being and would recommend staying out of the market until the situation clears up.