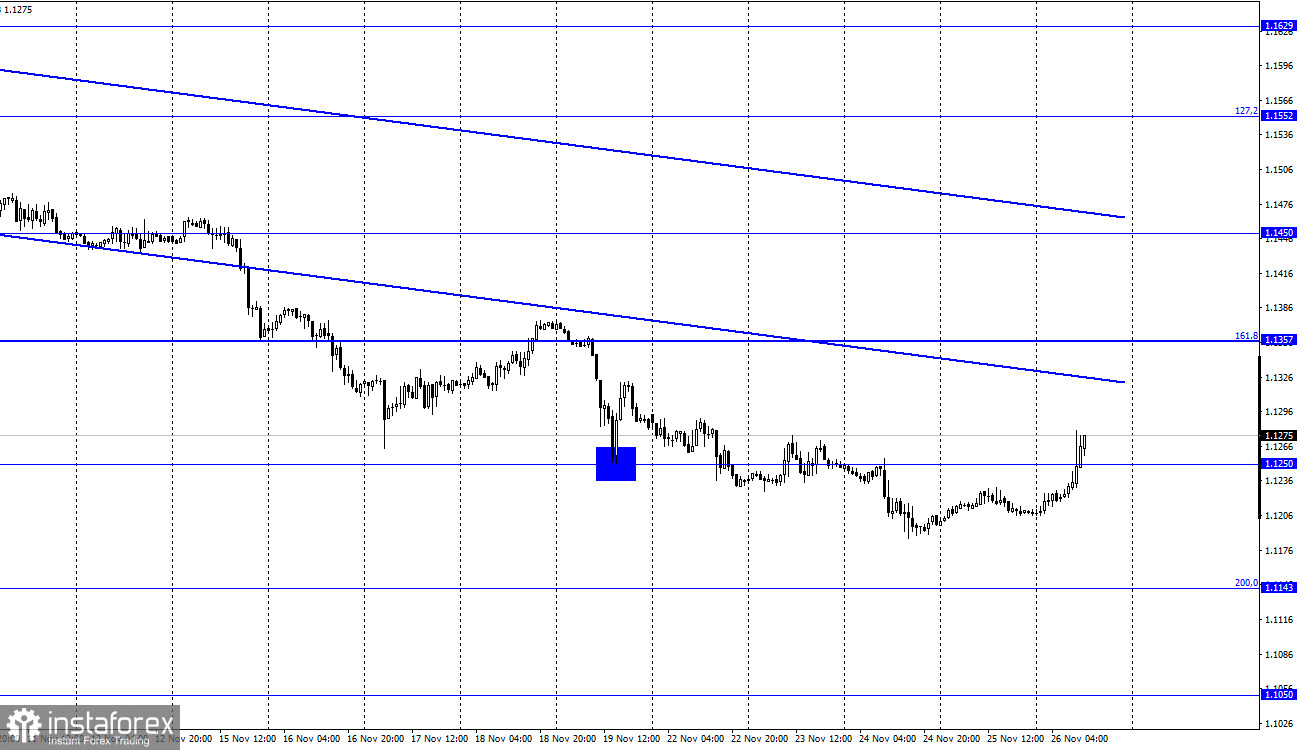

EUR/USD – 1H.

Hello, dear traders! On Thursday, EUR/USD made a reversal in favor of the EU currency and started rising. Besides, it continued growing on Friday. The pair closed above the level of 1.1250. Therefore, its rise may continue towards the next correction level of 161.8% at 1.1357. At the same time, the downtrend corridor is still active and indicates traders' bearish sentiment. Therefore, I consider the current rise as a correction. I think that traders tried to take some profits on already opened sell trades on Friday. There was no information background on Thursday, as well as on Friday. ECB president Christine Lagarde's speech was the only event in the economic calendar on these days. However, Lagarde said nothing relevant.

I have mentioned before that the ECB is taking an extremely dovish position on monetary policy at the moment. If its main rivals, the Bank of England and the Fed are ready to tighten monetary policy, the ECB is not. The only thing traders can expect now is ending the PEPP program on schedule in March 2022. There is a more complicated situation in the US as the Fed is expected to give new hints about raising the interest rate ahead of schedule at the December meeting or maybe even an acceleration of winding down the stimulus program. It is unlikely to occur. However, any tightening of the FOMC members' stance on the monetary policy may gain further advantage to the US dollar against the European currency. Thus, I consider the euro's rise on Thursday and Friday temporary. Next week strong informational background is essential for the pair's further growth.

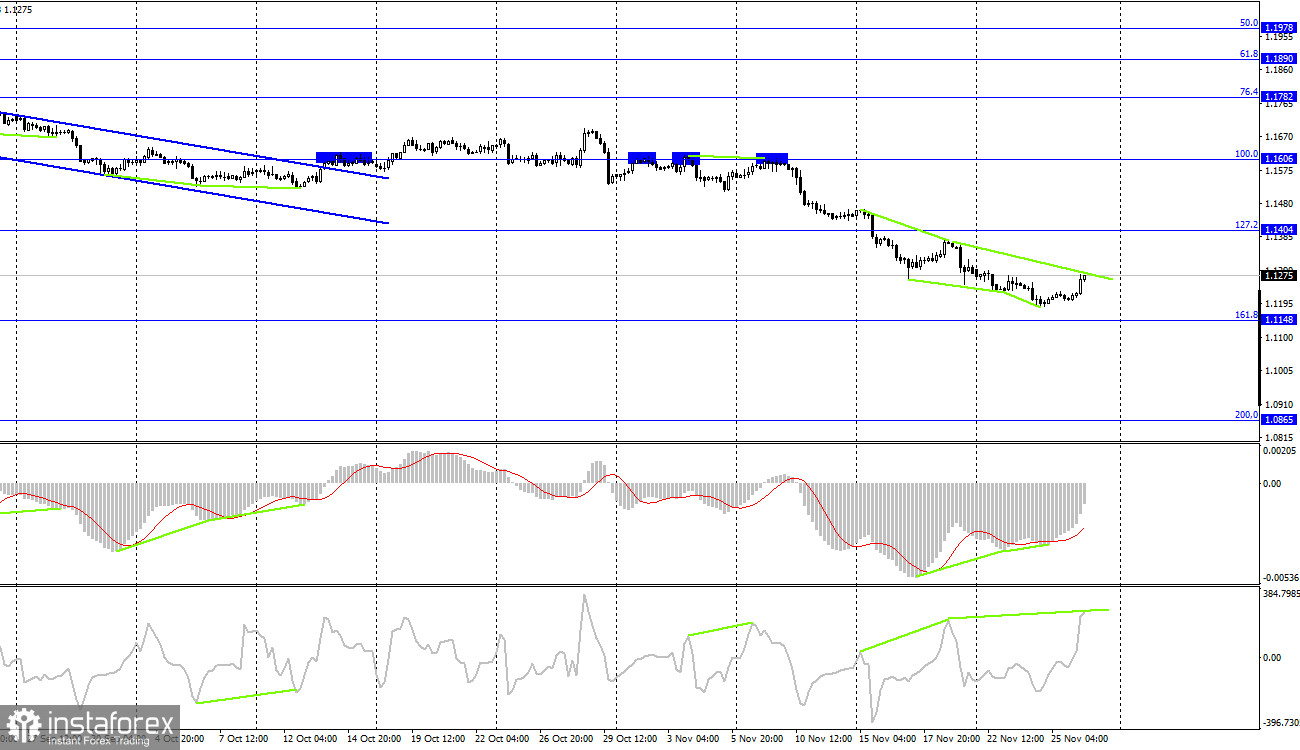

EUR/USD – 4H

On the 4-hour chart, the pair made a reversal in favor of the euro after the second bullish divergence of the MACD indicator. Therefores, the rise towards the 127.2% Fibo level at 1.1404 has started. However a bearish divergence of the CCI indicator is already coming, and its formation will help expect a reversal in favor of the US currency and renewal of the fall towards the correctional level of 161.8% at 1.1148. If this divergence is cancelled, further rise will be possible.

US and EU economic news calendar:

EU - ECB President Christine Lagarde will deliver a speech (08-00 UTC).

On November 26, ECB President Christine Lagarde made a speech in the EU. No other significant events were scheduled on this day. The US economic calendar lacked any relevant events on Friday. Thus, there was no information background.

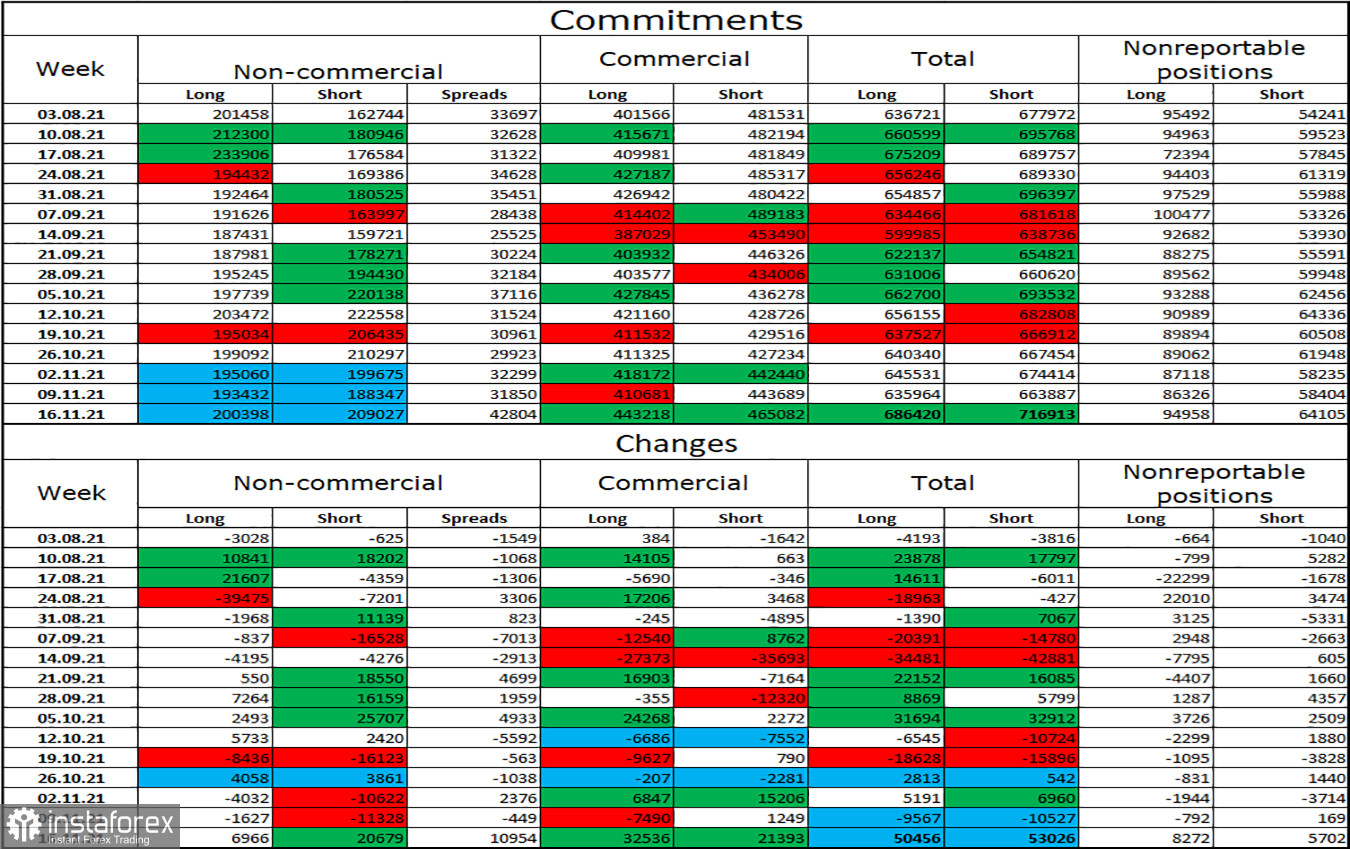

COT report (Commitments of traders):

The latest COT report showed that the sentiment of non-commercial traders became more bearish during the reporting week. Speculators opened 6,966 long euro contracts and 2,679 short contracts. Consequently, the total number of long contracts held by speculators has grown to 200,000, and the total number of short contracts has risen to 209,000. These figures almost coincide for the third week in a row, indicating that speculators do not have a clear mood. However, in general, in recent months there has been a tendency of strengthening bearish sentiment. Therefore, I conclude that traders' sentiment is now at a point where neither bulls nor bears have an advantage. However, at the same time the European currency continues falling, so the trend of strengthening the bearish sentiment among major players is evident.

EUR/USD forecast and recommendations for traders:

I recommend new sales of the pair at closing under the level of 1.1250 with a target of 1.1148. It is possible to buy the euro as closing above 1.1250 on the hourly chart with a target of 1.1357 has been completed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.