Long positions on GBP/USD:

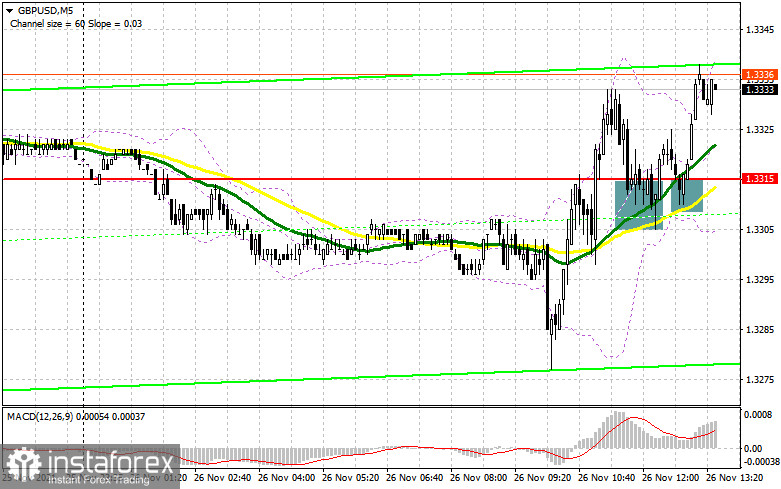

In the first half of the day, there was an excellent signal for opening long positions from 1.3316. Let's have a look at the 5-minute chart and analyze entry points. A slight decline in the pound at the beginning of the European session was met by active support from bulls. However, I did not make any decisions at that time. The market became more interesting after the price broke through and grew above 1.3316. A reverse test of this level top/bottom led to the signal for opening long positions. At the time of writing, the pair went up by 20 pips. From the technical point of view, the levels have changed.

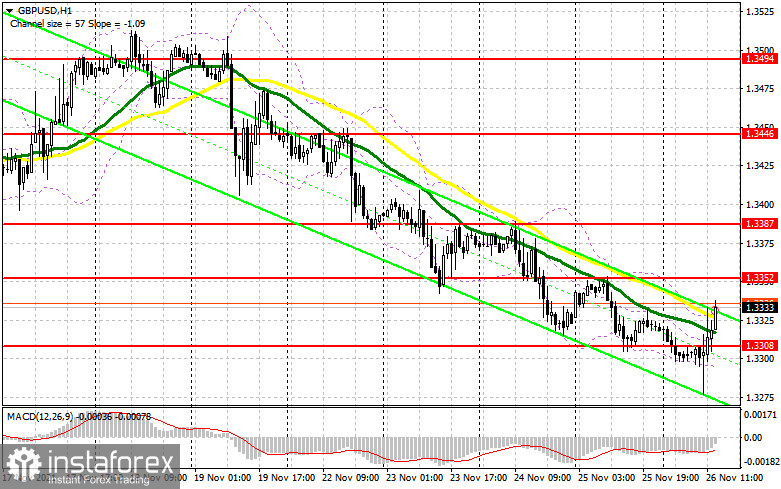

The main target for bulls now is to hold the price above support at 1.3308, which was formed in the first half of the day. Taking into account that no statistics on the American economy today will spoil the bull market, it is possible that the GBP/USD pair will continue its growth. The best entry point to open long positions if you missed the entry points that occurred this morning would be the formation of a false breakout at 1.3308. Growth from this level might drag the pair to the resistance area of 1.3352, where bears may be very active again. A breakthrough and fixation above 1.3352 are likely to pave the way to 1.3387, where traders may generate profit. If the pound declines and there is an absence of activity at 1.3308, bulls will have to try to protect the new weekly low at 1.3264. The formation of a false breakout there amid low trading volume due to Thanksgiving in the US may form an entry point for long positions. It is better to buy the GBP/USD pair on the rebound only around 1.3227, or even lower, from support at 1.3189, allowing an intraday correction by 25-30 pips.

Short positions on GBP/USD:

Bears are still in some confusion, although they managed to retest the next weekly low in the first half of the day. Now bears need to prevent the pair from rising in the second half of the day, which may lead to the downtrend cancelation. The best option to sell GBP/USD today is a false breakout at 1.3352, if not missed during the morning trading. It is likely to form a new entry point for opening short positions with the subsequent return to support at 1.3308. A breakout of this range, along with a reverse test bottom/top, may become an additional signal for the opening of new short positions, aiming to 1.3264 and 1.3227, where it is recommended to take profit. A more distant target will be the area of 1.3189. However, today the US is celebrating Thanksgiving, and volatility may be quite low due to the shortened trading session on several American exchanges. In case the pair is rising during the American session and sellers are weak at 1.3352, it is better to postpone selling the pair until the price reaches resistance at 1.3387. It is better to open short positions on a bounce from 1.3446, or even higher from a new high at 1.3494, allowing an intraday downward movement for 20-25 pips.

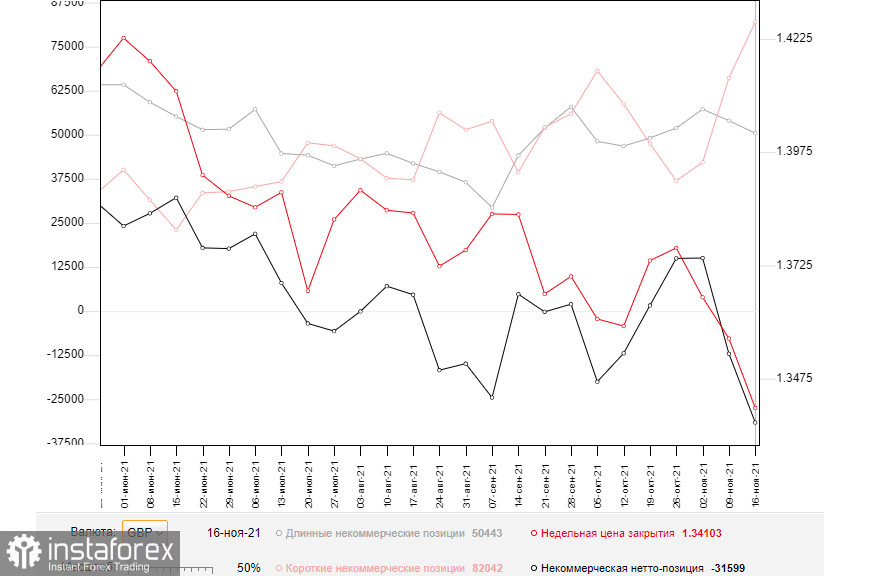

The COT (Commitment of Traders) reports for November 16 showed a sharp increase in short positions and a decrease in long positions, which led to an upsurge in the negative delta. Strong data on UK labor market recovery, inflationary pressures, and retail sales growth were rescuing the pound last week and gave bulls a chance to continue the rise in the pair. However, a worsening situation with coronavirus outbreaks in Europe and statements of representatives of the Bank of England that the regulator is unlikely to change its monetary policy in the current conditions, all above put pressure on the pair by the end of the week. Another important issue is the unresolved question on the Northern Ireland protocol, which the UK authorities plan to suspend in the near future. The EU is preparing to introduce certain countermeasures in response to this, which does not add confidence to buyers of the pound. At the same time, in the US, we see rising inflation and increased talk about the need for an earlier interest rate hike next year, which gives considerable support to the US dollar. However, it is better to buy the pair during very large declines, which may occur amid central bank policy uncertainties. The COT report indicated that long non-commercials declined to 50,443 from 54,004, while short non-commercials rose to 82,042 from 66,097. This led to an increase in the negative nonprofit net position, with a delta of -31,599 versus -12,093 a week earlier. The weekly closing price collapsed as a result of the Bank of England policy to 1.3410 from 1.3563.

Indicators' signals:

Moving averages

Trading is conducted above the 30- and 50-day moving averages, which indicates that bears are actively confronting an upward correction.

Important: The period and prices of moving averages are considered by the author on the hourly chart and differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the lower boundary of the indicator at 1.3294 may put additional pressure on the pair.

Description of indicators:

- Moving average determines the current trend by smoothing volatility and influence from news flow. The period is 50. It is marked with yellow on the chart.

- Moving average determines the current trend by smoothing volatility and influence from news flow. The period is 30. It is marked with green on the chart.

- MACD indicator (Moving Average Convergence/Divergence) Fast EMA period is 12. The slow EMA period is 26. SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total number of long positions opened by non-commercial traders.

- Short non-commercial positions represent the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions opened by non-commercial traders.