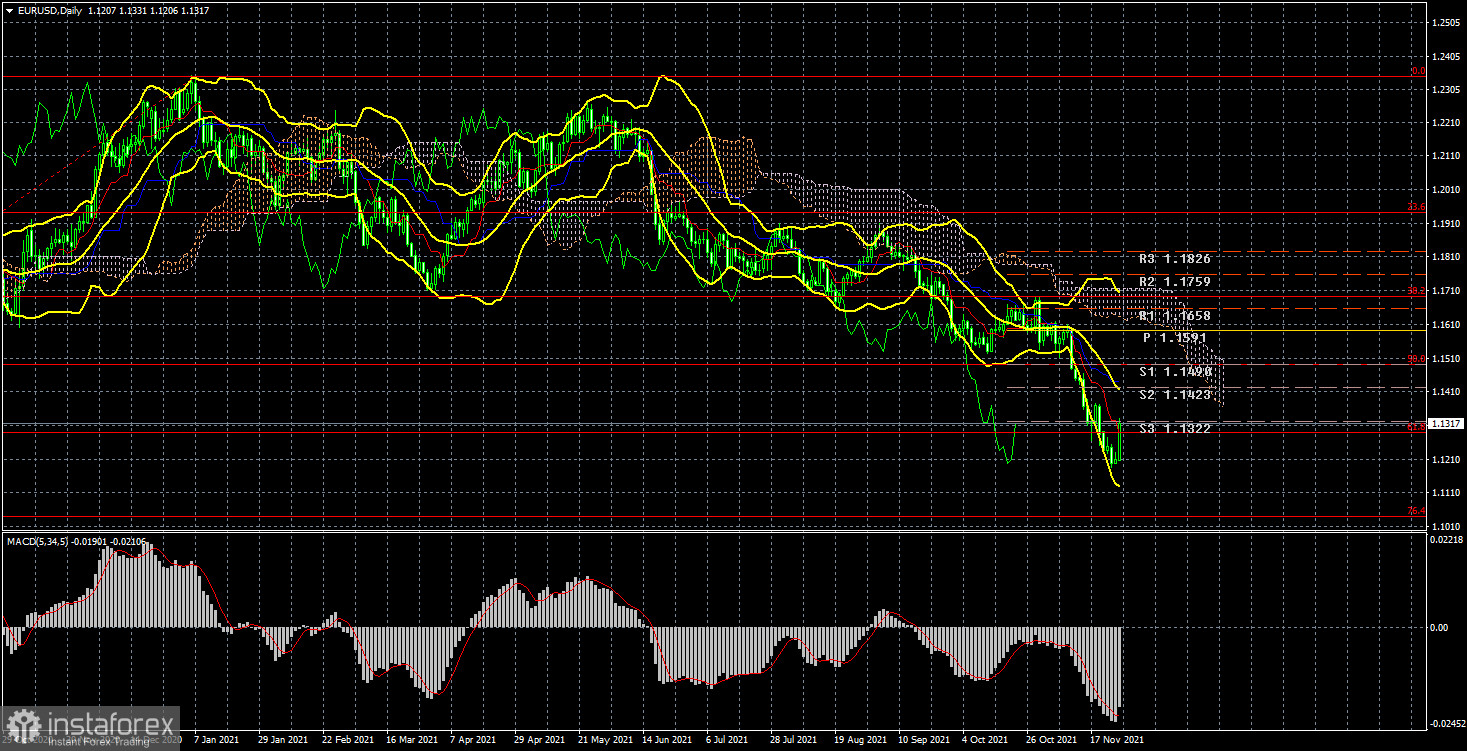

The main question next week will be "is the European currency ready to continue the correction?". Recall that this week ended with a fairly strong strengthening of the US currency, which can only be interpreted as a correction caused by profit-taking on previously opened short positions. Consequently, at this time, the European currency is facing only a small increase and is unlikely to complete a long decline. At the same time, we remind you that we expect the completion of the current global correction in the spring and summer of this year since the entire movement of 2021 is still interpreted as a correction against the trend of 2020. Consequently, the euro now has a chance of correction within the correction. In general, anyway, the pair's quotes need to rise to the Kijun-sen line, which is now around the 14th level. But then everything will depend on whether the bulls will be able to overcome this line. However, naturally, all this will not proceed as quickly as it seems now. In fact, the emergence of a new trend can last several months. The pair can safely trade these months in a limited range, as it did repeatedly in 2021. There may also be a movement with minimal volatility when it takes a month or even more to overcome 200-300 points. Thus, the first step towards the growth of the euro currency has been made and it is convincing, but this does not mean that now the markets will buy euros.

On the other hand, such an option absolutely cannot be ruled out. As we said earlier, the factors that could really help the US dollar growth in the last few months, from our point of view, have long been worked out. Consequently, the markets can continue to take profits on short positions, which will lead to the growth of the pair. The fact that the Fed began to curtail the quantitative stimulus program began to be worked out in September. Consequently, it is unlikely that the US dollar will become more expensive until the very end of this program. If so, then the option with a new upward trend in the long term remains the main one.

What does next week have in store for us? In addition to Christine Lagarde's speeches on duty on Monday and Friday, the European Union will publish an inflation report for November. It is expected that this indicator will continue to grow and increase from 4.1% y/y to 4.4-4.5% y/y. In the case of the US currency, it worked like this: if inflation is rising, then the chances of tightening monetary policy are also growing, so the markets bought the dollar. In the case of the European currency, this may not work, since Christine Lagarde has already stated a bunch of times that rates will not be raised even next year, and the APP program will replace the PEPP program. Thus, the reaction of the markets to the inflation report may follow, but it is hardly possible to predict in which direction. Also in the European Union next week, unemployment reports for October, business activity indices in services and manufacturing, and retail sales will be published. Each of these reports has almost no chance to interest traders so much that they rush to buy or sell euros. The markets have not reacted to reports on unemployment and retail sales for a long time, but at the same time, it should be noted that unemployment in the EU remains quite high, much higher than in the US or Britain - 7.4%. Business activity indices can affect the euro exchange rate only if they seriously differ from forecasts and in a smaller direction. In principle, this option is quite possible, since a new "wave" of the pandemic is spreading in Europe, countries are reintroducing quarantines and "lockdowns". Naturally, all this will lead to a drop in business and economic activity.

Separately, I would like to note that the overall state of the EU economy is not the most positive right now. Christine Lagarde has repeatedly spoken about this directly and indirectly, but it is also clearly visible in the GDP indicator, which barely accelerated to 2.2% in the third quarter. In the States, for example, GDP slowed in the third quarter to 2.2%. Thus, if we look only at the economic component, the euro may continue to decline, but once again we recall that it has already fallen in price enough in the last year. If the European economy is constantly lagging behind the American one, this does not mean that the euro will constantly decline against the dollar. Hence the conclusion: next week the most important will be the mood of the market (as almost always). If the market is set up for a correction, then there will be a correction.

Trading recommendations for the EUR/USD pair:

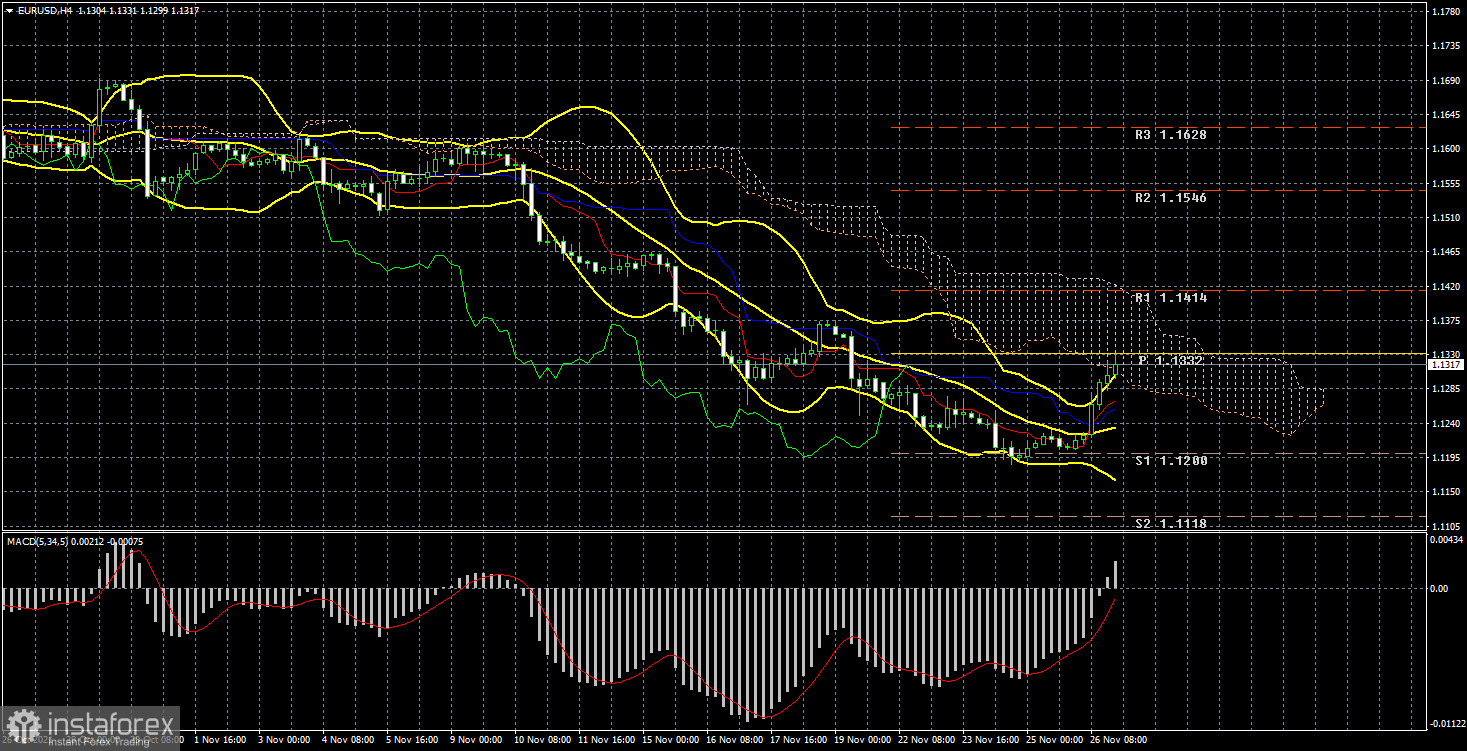

The technical picture of the EUR/USD pair on the 4-hour chart also speaks in favor of starting a correction. The price was fixed on Friday above the critical line, but even if this moment does not confuse traders – this line was very close to the price. At the moment, even the Ichimoku cloud has not been overcome, so the downward movement may well resume in the new week. If the cloud is overcome, then the chances of further growth of the pair will increase significantly and it will be possible to talk about a new upward trend. The most interesting thing next week will happen on Friday – Nonfarms for November will be published in the States. We will talk about this in more detail in the article about GBP/USD. Thus, during the first four days, it will be possible to understand what mood the markets are in now since the influence of the "foundation" will be low.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5).