The events last Friday fully show how fragile the balance in the world markets is. News about the new South African strain of COVID-19 "Omicron", which is allegedly much more contagious than "Delta", has led to a collapse of markets in Europe and the United States. Stock indexes and commodity assets collapsed amid strong demand for protective assets – government bonds of economically developed countries and safe-haven currencies like the yen and the franc. Meanwhile, the US dollar was under pressure.

However, the mood began to change noticeably today. It seems that the first purely speculative reaction in the market that caused the sell-off is changing and market participants have now decided to see how events around the new strain will develop, switching their attention to the publication of important economic data this week that can have a strong impact on financial markets.

Such data will really come out important. This includes the publication of production figures in China, Europe, and America. The values of consumer inflation in the eurozone and the updated employment figures in the United States will also be released. The latter can play an important role in the timing of the start of the Fed's interest rate hike. In addition, the market's attention will be drawn to a series of speeches this week by ECB Chairman C. Lagarde, Fed Chairman J. Powell, as well as a number of his colleagues on the Security Council.

In general, it is expected that the presented figures of production indicators in America and China will show slightly better values, which may cause an increase in demand for risky assets. And if the values for the number of new jobs turn out to be no worse than expected – this may lead to a local rally in the stock markets and to general positive sentiment, which will push up demand in the commodity market as well. In any case, such sentiments are precisely taking shape today before the opening of the European trading session.

But let's pay attention to how the markets will move this week in conjunction with the topic of COVID-19 and the publication of the expected positive economic statistics.

If there is no "catastrophic" news on the topic of the new strain of COVID-19 "Omicron" this week, then investors will focus on economic data, which, in turn, if not pumped up, will lead to a local rally in stock markets with a simultaneous weakening of the US currency.

But if speculation begins around the COVID-19 topic, then no strong statistical data will be able to push the markets to growth and the collapse may resume again. In fact, in this situation, we can talk about the priority of news about Omicron over economic data, since investors believe that no good news on the economies of economically developed countries will simply help in the event of a negative scenario.

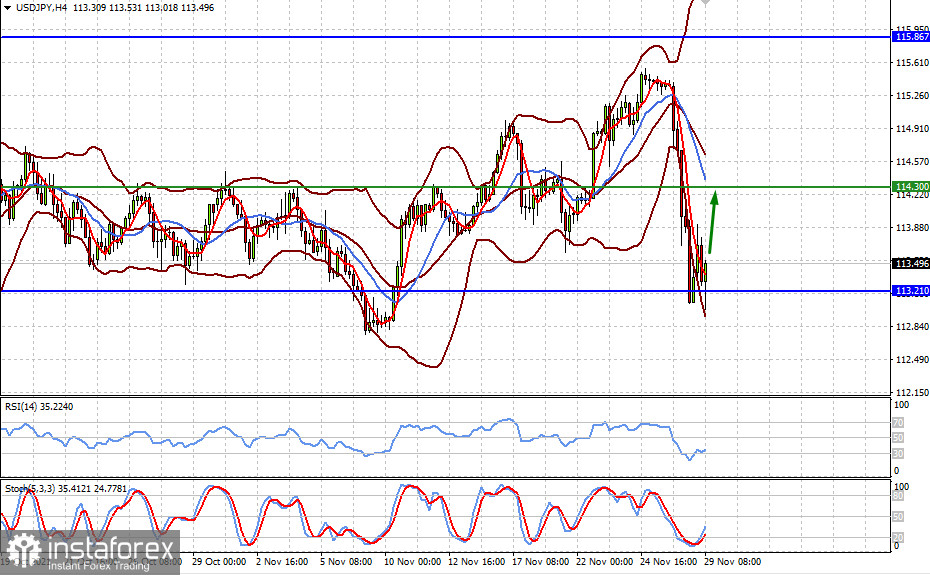

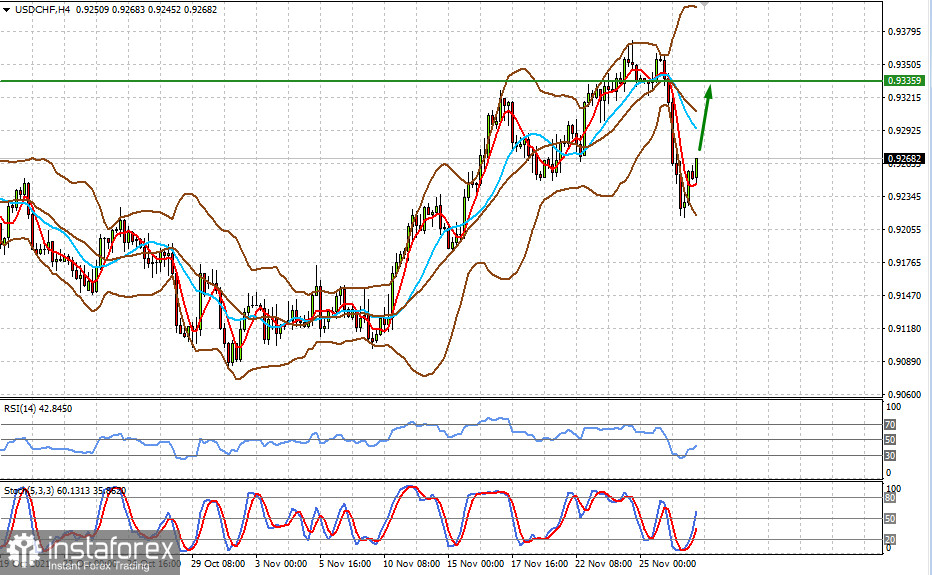

Forecast of the day:

The USD/JPY pair may recover to the level of 114.30 if the market does not receive new negative news about the Omicron strain.

The USD/CHF pair may also recover to the level of 0.9335 on the wave of positive economic news and fading COVID-19 topics.