New COVID-19 variant and reversal signal for EUR/USD

Hello, dear colleagues!

In the previous week, the main FX pair was traded mixed, but we will talk about it later when conducting technical analysis. So far, let's discuss the currency coronavirus situation. As a reminder, the rapid spread of the deadly virus has a significant impact on the market. So, when it spreads at a quicker pace, investors lose appetite for risk and turn to safe-haven assets. In other words, safe-haven demand increases with every new COVID-19 wave. Since the very outbreak of the pandemic, the greenback has been one of the most popular safe-haven assets.

The new COVID-19 variant that emerged in South African contains numerous mutations and is believed to be more dangerous than any other strain. It started to quickly spread around the world. For instance, Belgium has already detected the first case of the new coronavirus variant found in South Africa and classified as B.1.1.529. Notably, the coronavirus situation in Belgium is alarming. The number of new infection cases is increasing and the country now has to deal with yet another problem - the new heavily mutated COVID-19 variant. Under such circumstances, the Belgian authorities had to tighten restrictions. The same goes for the Netherlands where the infection rate keeps growing, especially among children. Schools are still open but theatres, restaurants, museums, stores, and gyms are now open until 5 pm local time.

The EU is very concerned about the spread of the South African variant. The European Commission even restricted entrance to the EU from South Africa and 6 other African countries. The World Health Organization (WHO) labeled the new COVID-19 strain, named Omicron under its Greek letter system, a 'variant of concern'. If the situation with the spread of COVID-19 and a sharp increase in infection cases does not stabilize, the authorities of many countries will be forced to introduce a strict lockdown, which will undoubtedly negatively affect the European economy. If so, the euro risks coming under stronger pressure versus the dollar. Technically, the picture looks not so bad.

Weekly chart

On the weekly chart. There is a Hammer candlestick pattern. Being a reversal candlestick pattern, it makes its bullish (white) body stronger. The EUR/USD pair encountered strong support at 1.1200 as expected and started to recover. As a result, the price closed above 1.1300, precisely at 1.1318, on Friday. According to the Fibonacci grid drawn from 1.2266 to 1.1187, the corrective move could extend to the 23.6% Fibonacci retracement level. If so, the euro/dollar pair could rise to the range of 1.1440-1.1460 with the red Tenkan Sen being located above the 23.6% Fibonacci retracement level. If bears are strong enough to resume the downtrend and close below the low of 1.1187 at the end of this week, the reversal pattern will be broken, indicating the continuation of the downtrend. So far, the quote is likely to strengthen, taking into account the latest weekly candlestick.

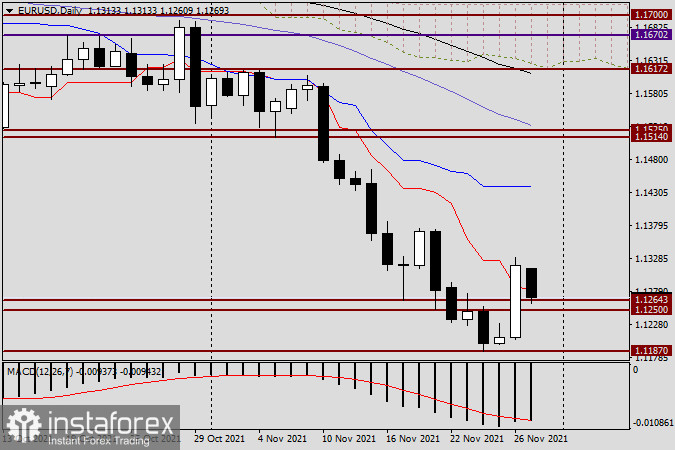

Daily chart

The pair showed strong growth on Friday, breaking through the red Tenkan Sen and closing above it at the close of the trading week. Nevertheless, as it has already been said multiple times, any conclusion that the breakout has been true based on just one closed candlestick could be premature. Nevertheless, taking into account a sharp increase on Friday, the euro/dollar pair may well extend gains, with the nearest target seen at the very same 23.6% Fibonacci retracement level where the blue Kijun Sen is located. If so, the euro/dollar pair is likely to form bearish reversal candlestick patterns on the daily chart or lower time frames. They may signal the end of the corrective move and the start of the downtrend. Although EUR/USD is moving in a downtrend, after the formation of the weekly candlestick, the trend may reverse. It would be wise to monitor market behavior today to set entry points tomorrow based on lower time frames. That is all for today.

Have a nice trading week!