According to the latest research, gold investors should prepare for increased market volatility in the near future. Wall Street analysts' sentiment is highly mixed.

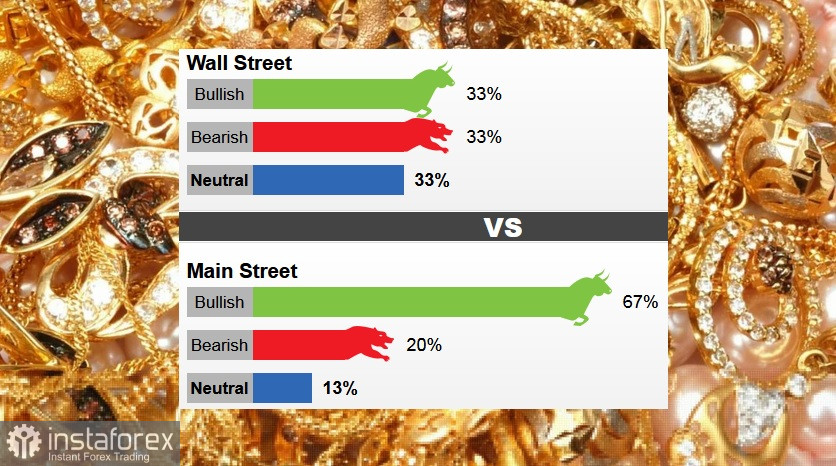

Last week, 15 Wall Street analysts took part in the gold survey. The poll showed a three-way tie for only the second time in history. Each script received five votes.

In an online poll on Main Street, 1,527 votes were cast. Of these, 1024 respondents, or 67%, expect prices to rise, the other 304, or 20%, said prices would drop, and 199 voters, or 13%, reacted neutrally.

Participation in the survey last week was the highest since mid-June when the gold market experienced a sudden collapse, which many regarded as an opportunity for purchases.

The mixed sentiment is not surprising, since the gold market ended an already unstable week when prices sharply declined below $1,800 per ounce at the beginning of the week after the White House announced that President Joe Biden had appointed Jerome Powell as the Fed chairman. The markets took this as a hawkish signal, and gold prices fell.

Many analysts said that the sale of gold at the beginning of last week was excessive. Some analysts noted that, despite the fact that Powell may not be perceived as dovish, compared to another candidate, Lael Brainard, he is by no means hawkish in the field of monetary policy.

According to Adrian Day, the president of Adrian Day Asset Management, Jerome Powell is not a hawk, and the sell-off over his reappointment as chairman of the Federal Reserve System was absurd.

On the bearish side, some analysts have said that the recent sell-off has caused significant damage to the chart, which needs to be fixed.

Ole Hansen, Saxo Bank's head of commodities strategy, said he is neutral towards gold prices if gold does not rise above $1,835. He added that the weakness of silver and platinum does not bode well for gold this week.

Head of Currency Strategy Forexlive.com Adam Barton said he was concerned about a new aggressive shift in the environment of US central banks, and growing inflationary pressures may force the FRS to tighten monetary policy sooner than expected.