EUR/USD

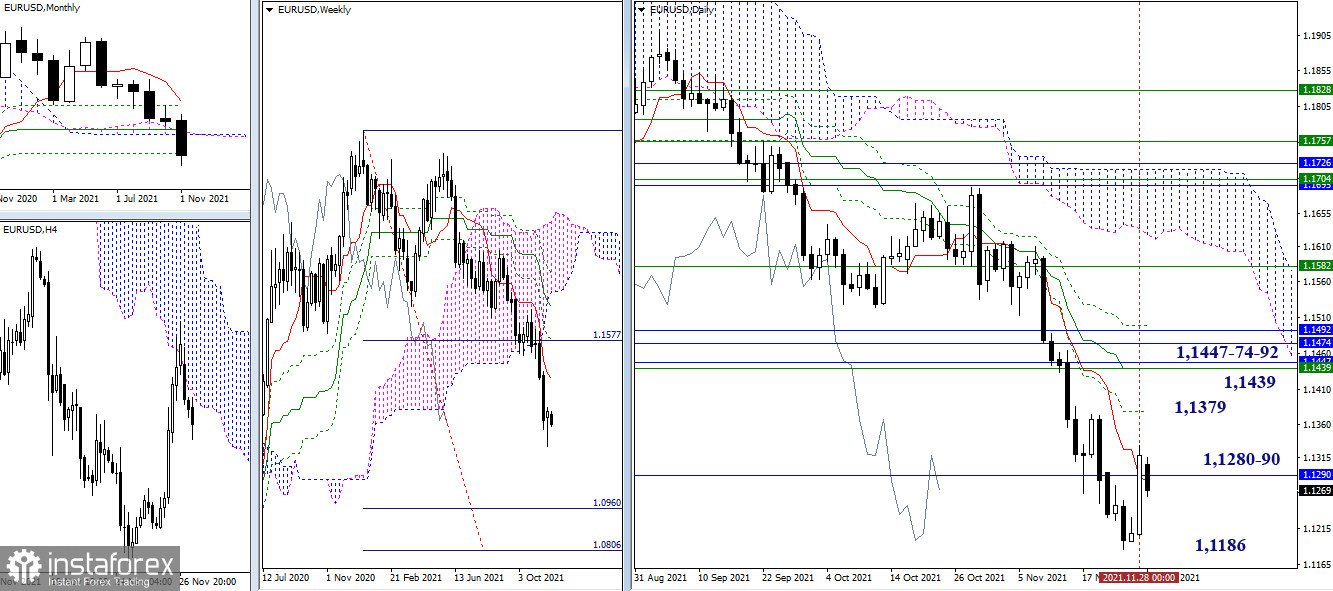

The bulls tried several times to indicate a corrective slowdown last week. On Friday, they managed to consolidate this intention in the results of the weekly candle. It is worth noting that maintaining the mood will allow us to continue the corrective upswing, the main pivot points of which can now be identified at the turn of 1.1439 (weekly short-term trend + daily medium-term trend).

At the same time, strengthening the resistance level of 1.1439 provides several monthly levels located slightly higher (1.1447-74-92). The nearest resistance on this path can be provided by the daily Fibo Kijun (1.1379). The combination of the daily short-term trend (1.1280) and the final level of the monthly Ichimoku gold cross (1.1290) continues to provide the attraction and influence here.

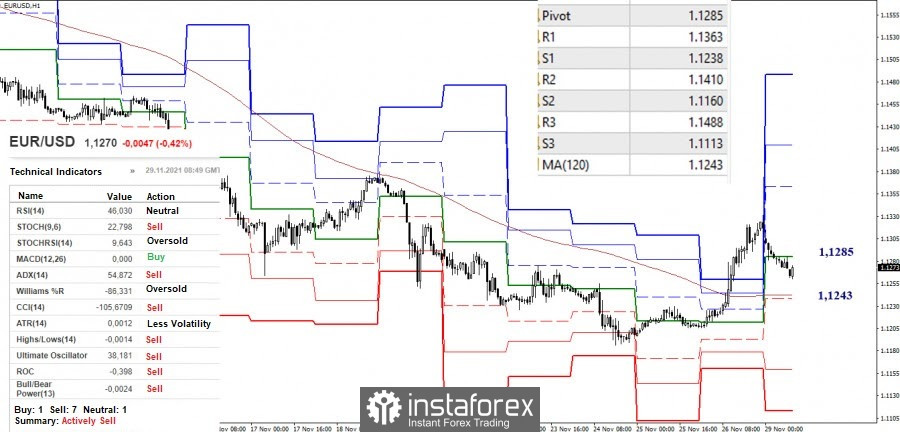

The pair has been declining for quite some time, although the bulls in the smaller timeframes are now supported by a key level – a weekly long-term trend (1.1243). In addition, the bulls are losing their positions. A consolidation below the level of1.1243 will change the current balance of power in favor of the bears. In this situation, the main task will be to restore the downward trend by updating the minimum extremum (1.1186). Other downward pivot points will be the support of the classic pivot levels 1.1160 (S2) and 1.1113 (S3).

For bullish traders, it is important for them to rise above the central pivot level (1.1285) and update the high (1.1331). Further, the upward pivot points will be the resistances of the classic pivot levels (1.1363 - 1.1410 - 1.1488).

GBP/USD

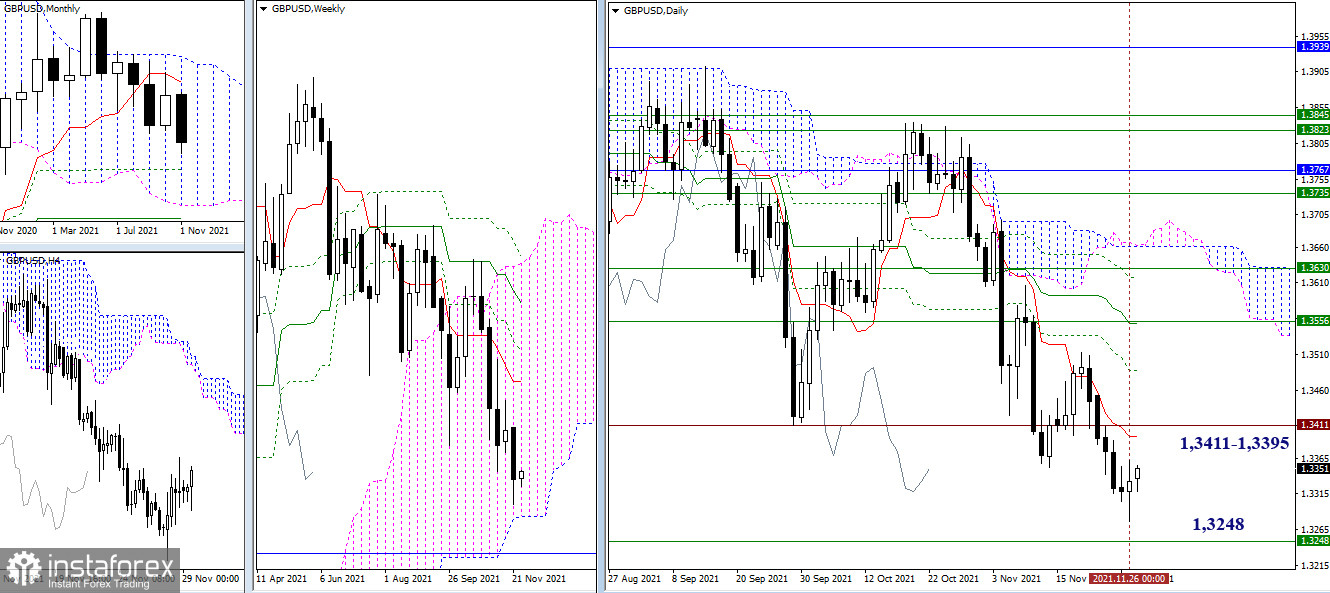

The bears failed to reach the support level of the lower border of the weekly cloud (1.3248) last Friday, indicating the slowdown and the development of the upward correction in the smaller TFs by the result of the day. The lower border of the weekly cloud (1.3248) currently remains an important border for the strengthening of bearish sentiments and the emergence of new prospects. The nearest pivot point for the correction is the daily short-term trend (1.3395) and the historical level (1.3411).

The upward correction that emerged in the smaller timeframes led the pound to fight for the key levels of 1.3324-52 (central pivot level + weekly long-term trend). A consolidation above will help strengthen the bullish mood. In this case, the next pivot points will be the resistances of the classic pivot levels (1.3371 - 1.3409 - 1.3456).

In turn, the formation of a rebound from the key levels and the restoration of the downward trend (1.3277) will return plans to test and break through the important support level of 1.3248 (the lower border of the weekly Ichimoku cloud).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.