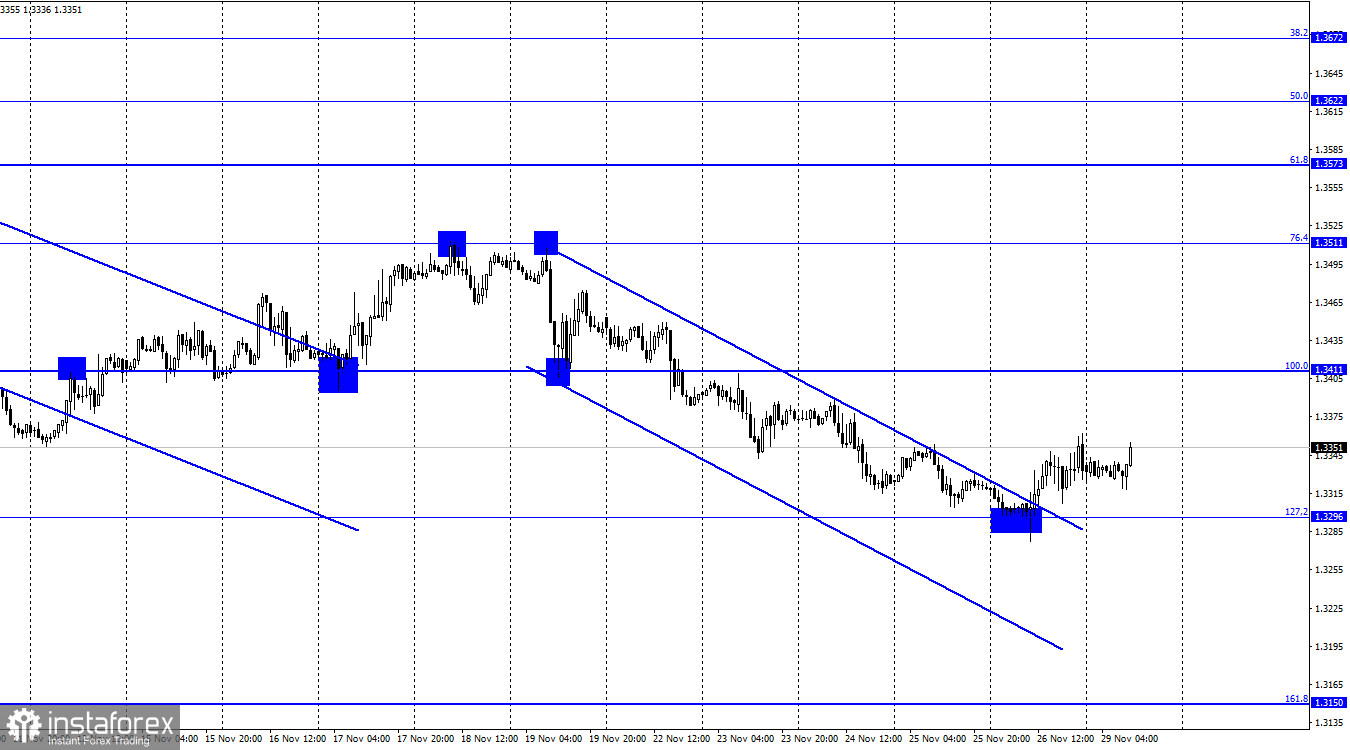

GBP/USD – 1H.

Hello, dear traders! On the hour chart, the GBP/USD pair made a break from the 127.2% correctional level at 1.3296 on Friday, reversed in favor of the British pound and started a sluggish rise towards the 100.0% correctional level at 1.3411. The pair also closed above the downtrend corridor, indicating change to traders' bullish sentiment. However, on the whole, the pound traded quite calmly on Friday. There were no signs of panic or chaos, as in the case with the euro. Besides, it is another reason to doubt that traders are worried about the new COVID-19 variant. It may definitely be even more dangerous and contagious than all other variants, but it is too early to panic about it. Therefore, there are more significant issues for the pound now, which traders will undoubtedly focus on. At the moment, Britain is an accumulation of headline news and statements.

The negotiations between the UK and the EU on the protocol for Northern Ireland are being held further. Moreover, no one expects them to end this year. Notably, there are labor shortages in many UK service and manufacturing sectors. Besides, labor shortages cause a lack of some goods and services. On top of that, the UK cannot cope with the delta variant. According to Johns Hopkins website, the country takes the second place in the world concerning the current rate of virus spreading. On the other hand, traders became aware of all the above mentioned facts long ago. December is approaching and the pound may get support if the Bank of England decides to curtail its asset-buying program or raise the interest rate. Therefore, the factors of ending the downward corridor and a probability of tightening the monetary policy at the December meeting are now favourable to the British pound.

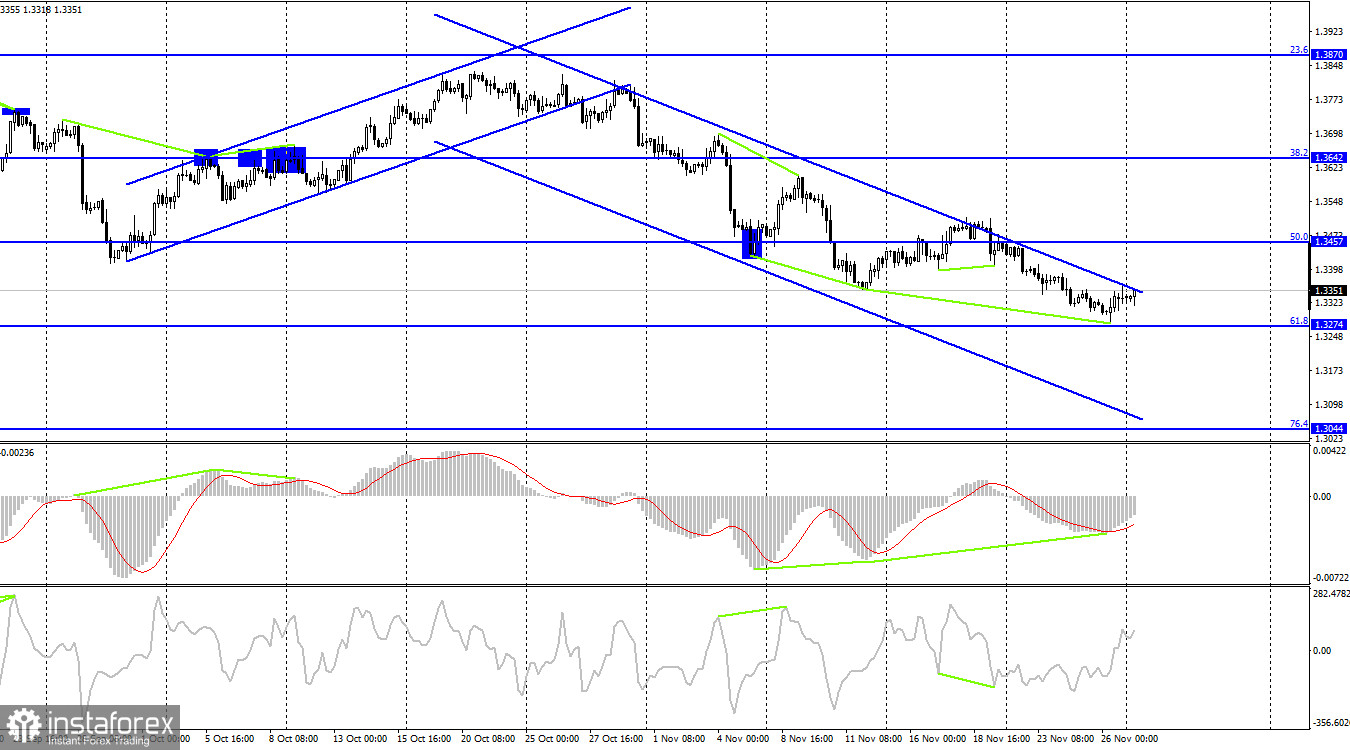

GBP/USD – 4H.

On the 4-hour chart, the pair fell to the 61.8% correctional level at 1.3274. After the formation of bullish divergence in the MACD indicator, the pair made a reversal in favor of the pound and started rising towards the 50.0% correctional level at 1.3457. However, it has failed to close above the descending trend corridor so far, indicating further traders' bearish sentiment on the 4-hour chart. Thus, the option of the pound's rise may be canceled. If the pair fixes under 61.8%, traders can expect further decline towards the 76.4% Fibo level at 1.3044.

US and UK economic news calendar:

US - Chairman of the Board of Governors of the Federal Reserve System Jerome Powell will deliver a speech (20-05 UTC).

On Monday, the US and UK economic calendars almost lack news. Only Jerome Powell's speech is scheduled, though late in the evening. Therefore, the news background is going to be weak today.

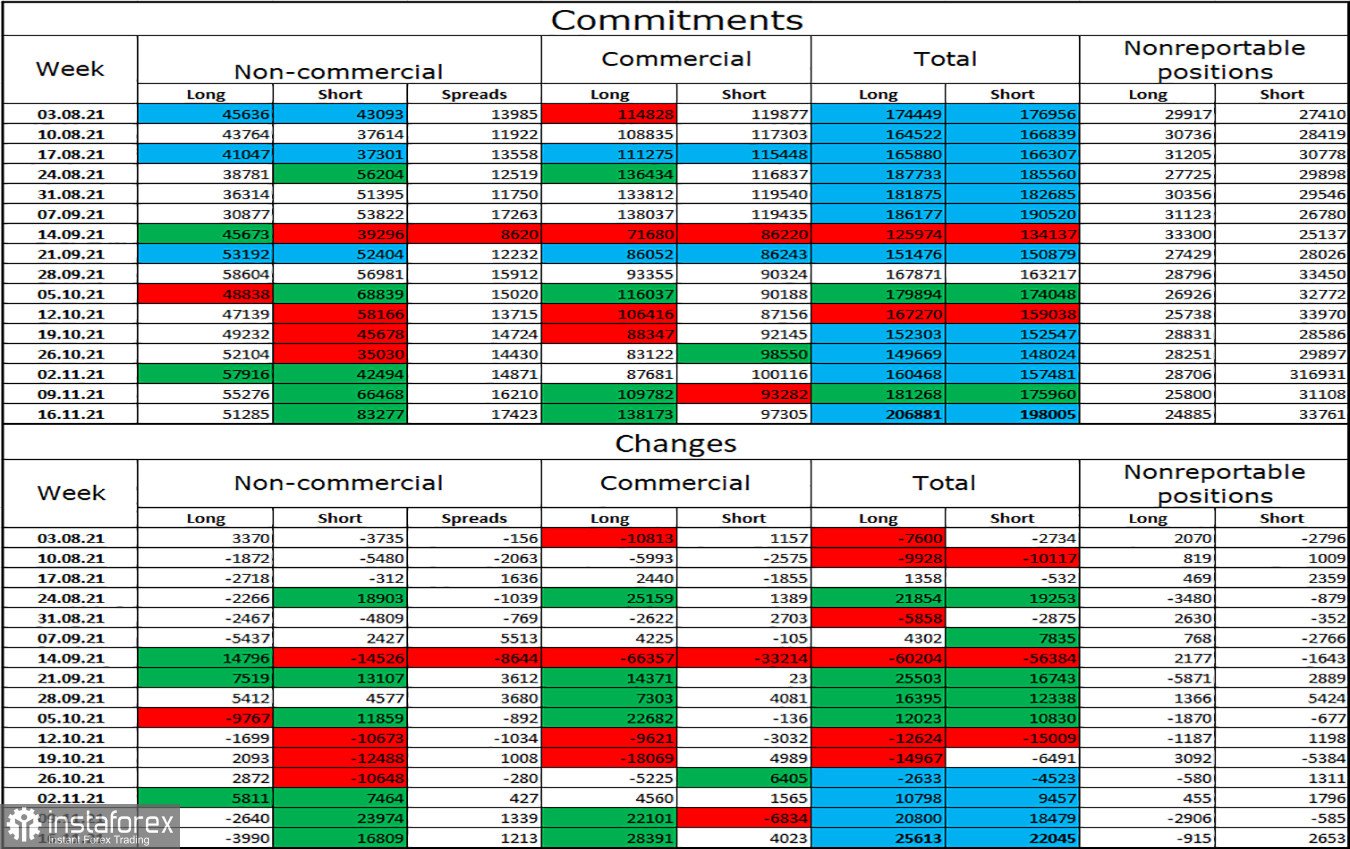

COT report (Commitments of traders):

The latest COT report on the British currency on November 16 showed that major players' sentiment had become much more bearish. During the reporting week speculators closed 3,990 long contracts and opened 1,809 short contracts. Notably, this is the second week in a row, when the number of short-contracts is strongly increasing. During the two weeks, speculators opened about 40,000 of these contracts, i.e. half of the total number. In fact, the advantage of long-contracts was 17,000 a week ago. However, during the last weeks speculators do not have any clear mood. They now and then increase the amount of purchases and sales. Besides, the total amount of long and short contracts for all categories of traders remains practically the same (206,000 - 198,00). Therefore, after several weeks of rapid accumulation of short contracts, a period of rising long contracts may start.

GBP/USD forecast and recommendations for traders:

I recommended buying the British pound at the rebound from 1.3296 on the hour chart with the target of 1.3411. Currently, these deals should be held open. I recommend selling the pair when it closes below 1.3296 with a target of 1.3150.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.