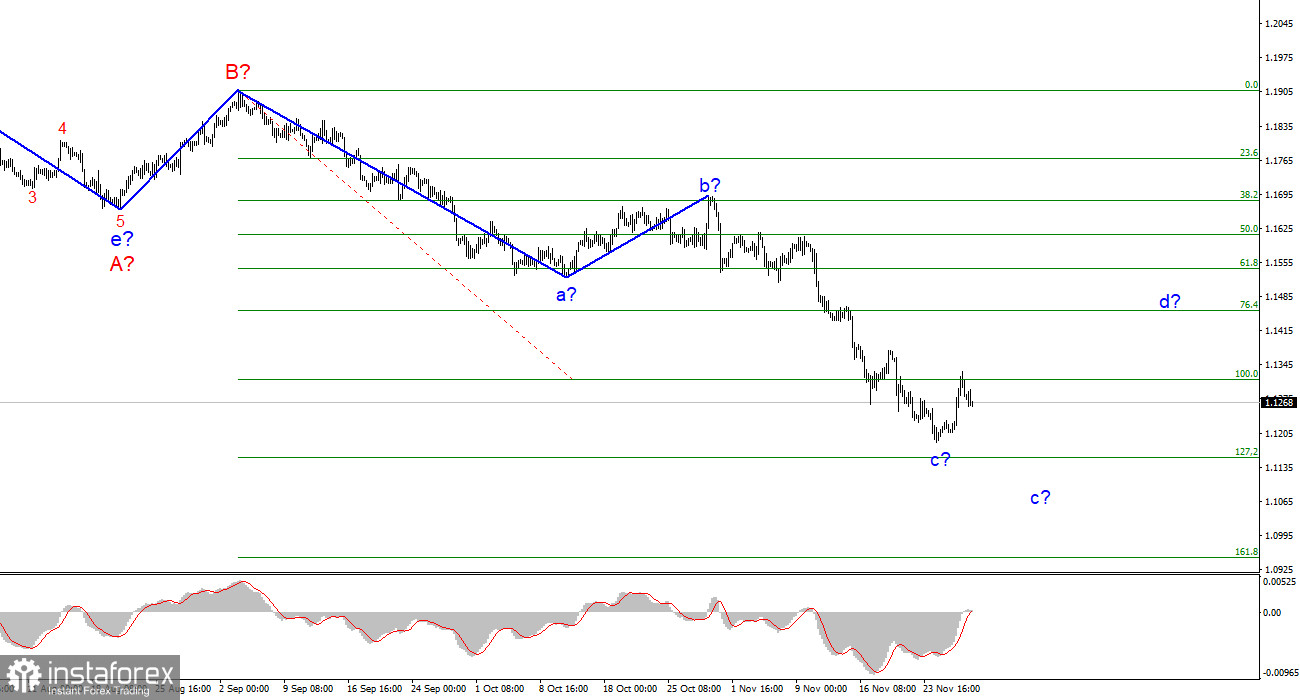

Wave pattern

The wave layout for EUR/USD on the 4-hour chart remains complete and does not require any changes. The a-b-c-d-e section of the trend, which was formed at the very beginning of the year, should be interpreted as a wave A, and the subsequent rise in the instrument is seen as a wave B. Thus, the formation of the assumed wave C continues, and can take a very extended form. Then we have an interesting situation. The rebound of the quotes from the recent lows suggests that the formation of the expected wave c in C is completed. If this is true, then a new ascending wave is being formed at the moment, presumably the wave d in C. The C wave may take a five-wave corrective structure. It is also possible that an internal wave will be formed inside c in C. In this regard, an unsuccessful attempt to break through the 100.0% Fibonacci level will indicate that the market is not ready to go bullish on the instrument. Another scenario is possible when the C wave will take on a three-wave form and turns out to be completed or will be completed soon. In any case, quotes are expected to rise in the coming week.

All eyes on Omicron strain. Is it as bad as feared?

On Monday, the news background for EUR/USD was rather weak. The pair passed 20 pips in total during the day, and the demand for the European currency was declining again. It seems that a rebound that took place on Friday was just an accident. On Monday, this trend was not supported by the markets. This suggests that we can soon see another bearish wave. In the meantime, all the focus is on the new Omicron strain which has already been detected in some countries. It is allegedly more contagious than the Delta version. Against this background, the US stock market tumbled on Friday as well as the cryptocurrency market since players began to get rid of high-risk assets which usually suffer first in the event of a crisis or panic. However, I think that there is no reason for panic now. First, according to the WHO, the Omicron strain is "a variant of concern." But the same can be said about the Delta strain, which is now the dominant variant all over the world. Healthcare specialists in South Africa, where the new strain was first discovered, said it might be more resistant to existing vaccines, but this does not mean vaccines will be useless. It is also reported that the Omicron strain does not cause severe complications and in most cases does not require hospitalization. Thus, it can be no more dangerous than the Delta variant.

Conclusion

Based on the analysis above, I can conclude that the construction of the descending wave C can be completed. However, an unsuccessful attempt to break through the 1.1314 level indicates a possible formation of another bearish wave. Thus, I would advise selling the instrument with a limit order set above 1.1314 and targets located near the estimated mark of 1.1154, which corresponds to 127.2% Fibonacci.

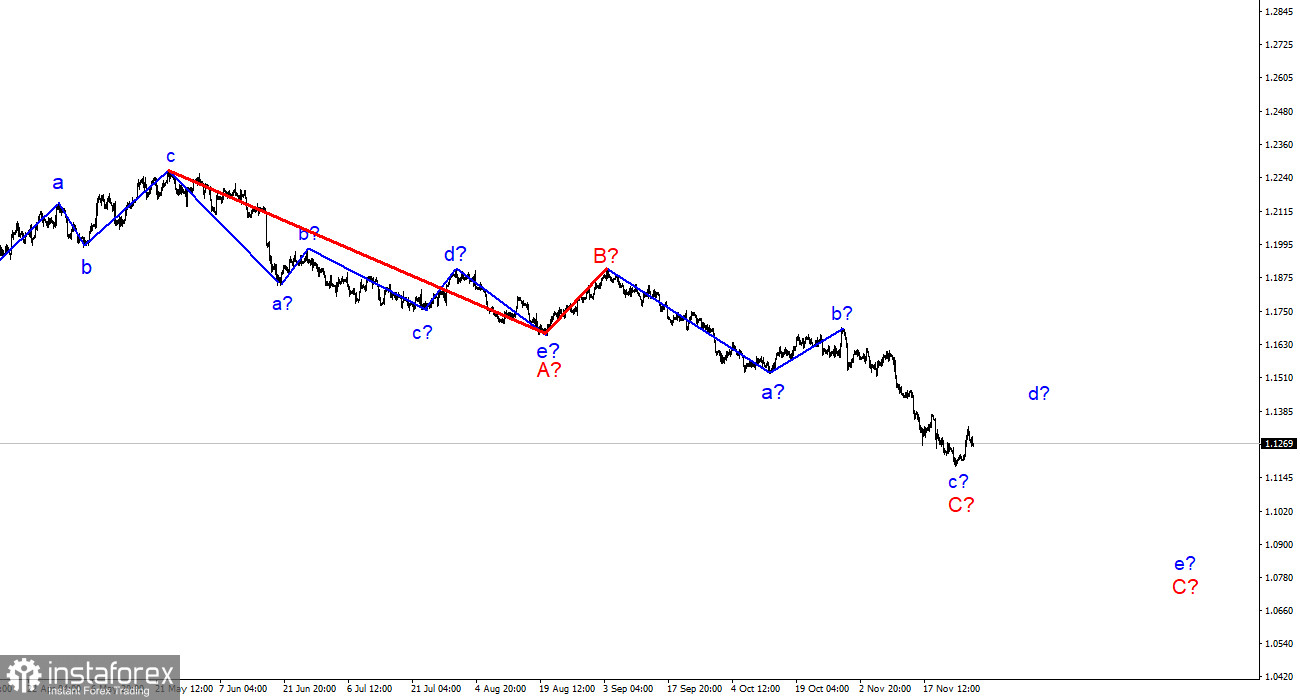

Higher time frame

The wave layout on the higher time frame looks quite convincing. The quotes continue to move lower. The descending section of the trend that was initiated on May 25 takes the form of a three-wave correctional pattern A-B-C. This means that the downtrend may continue for another month or two until the C wave is fully completed. It can have either a three- or a five-wave structure.