Wave pattern

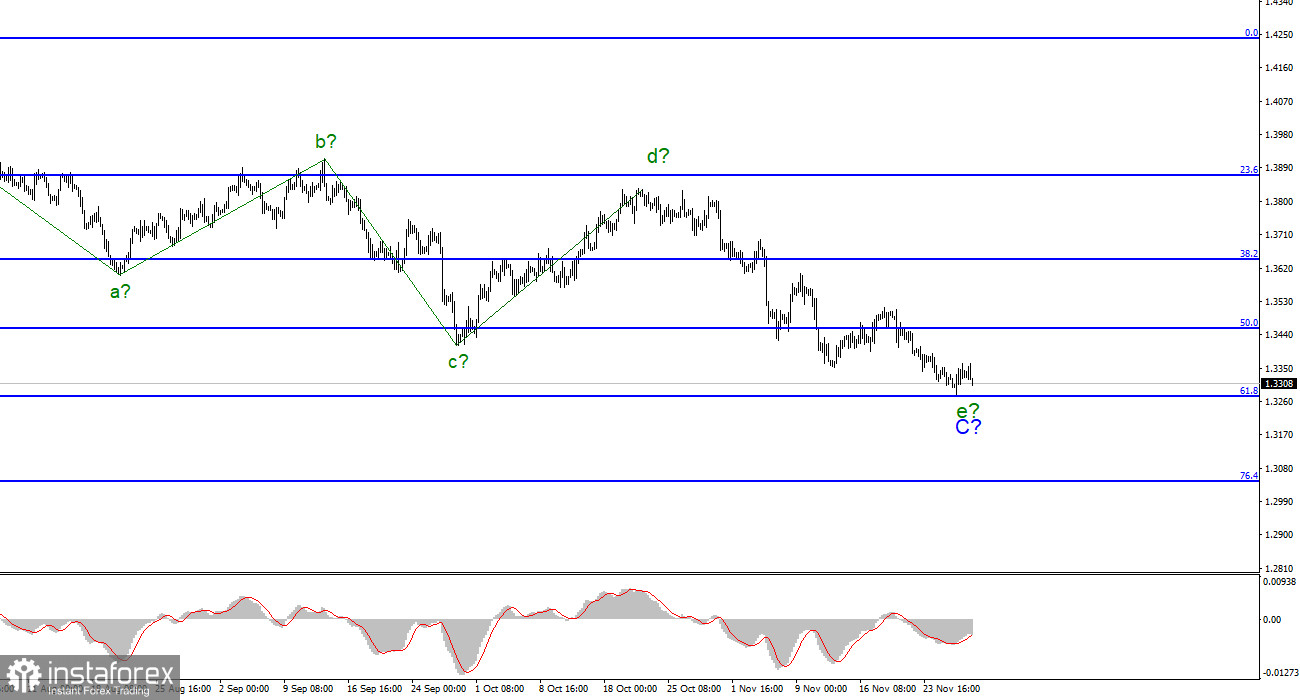

The wave marking for the pound/dollar pair continues to look complicated, but at the same time quite comprehensive. Five internal waves are visible inside the last wave C. Each subsequent one is approximately equal in size to the previous one. However, since all the waves in the composition of C or A are almost equal in size, the last wave e may be nearing its completion or already be completed. An unsuccessful attempt to break through the 1.3271 mark has confirmed that it is completed as well as the entire downward section of the trend. Please pay attention to the fact for the euro/dollar and pound/dollar pairs, the descending structures A-B-C have now been completed (or are nearing completion). Thus, both instruments can start building a new upward trend segment in the near future. The complication of the e wave in C will have to be confirmed only after a successful attempt to break through the 1.3271 mark, which corresponds to the 61.8% Fibonacci retracement level.

The pound sterling failed to build a corrective wave

The pound/dollar pair increased by only 10 pips during Friday, taking into account the opening and closing levels of the day. It is rather modest growth. Therefore, the completion of the construction of the descending wave C is doubtful. As a rule, if a long-term movement ends, it ends abruptly. As for the pound sterling, nothing like this is visible now. Thus, it may break through the 1.3271 mark today or tomorrow, which will lead to a further decline in the quotes. Meanwhile, the economic calendar for the pound sterling remained empty on Monday. However, there are plenty of political events. The European Commission is ready to impose sanctions against the UK. Anonymous sources reported that the Vice-president of the European Commission, Maros Sefcovic, called on policymakers to come up with a package of sanctions against the UK in case London refuses to comply with some clauses of the Brexit agreement or trigger Article 16. If this happens, Brussels will be able to promptly impose duties on imports from the UK as well as adopt a number of other sanctions in response to violations of the agreement by London. However, the situation is very serious as Article 16 is very vague and does not give clear answers to many questions. For example, any of the parties can put it into effect if there is a threat to national security, serious economic losses, and other potential risks. If this article is invoked, the other party has the right to take retaliatory measures in response to the actions of the first. It is not clear yet what kind of retaliatory measures may be imposed. So, both parties continue to negotiate and try to avoid further escalation of the conflict.

Conclusion

The wave pattern for the pound/dollar pair looks quite comprehensive now. The wave e may be completed. Thus, it is recommended to open long positions now counting on the development of a new section of the trend. Stop Loss orders can be placed below the 1.3271 mark in case demand for the US currency starts to grow again. if the pair breaks through 1.3271, it is recommended to open small short positions with the target level of 1.3043, which corresponds to the Fibonacci retracement level of 76.4%.

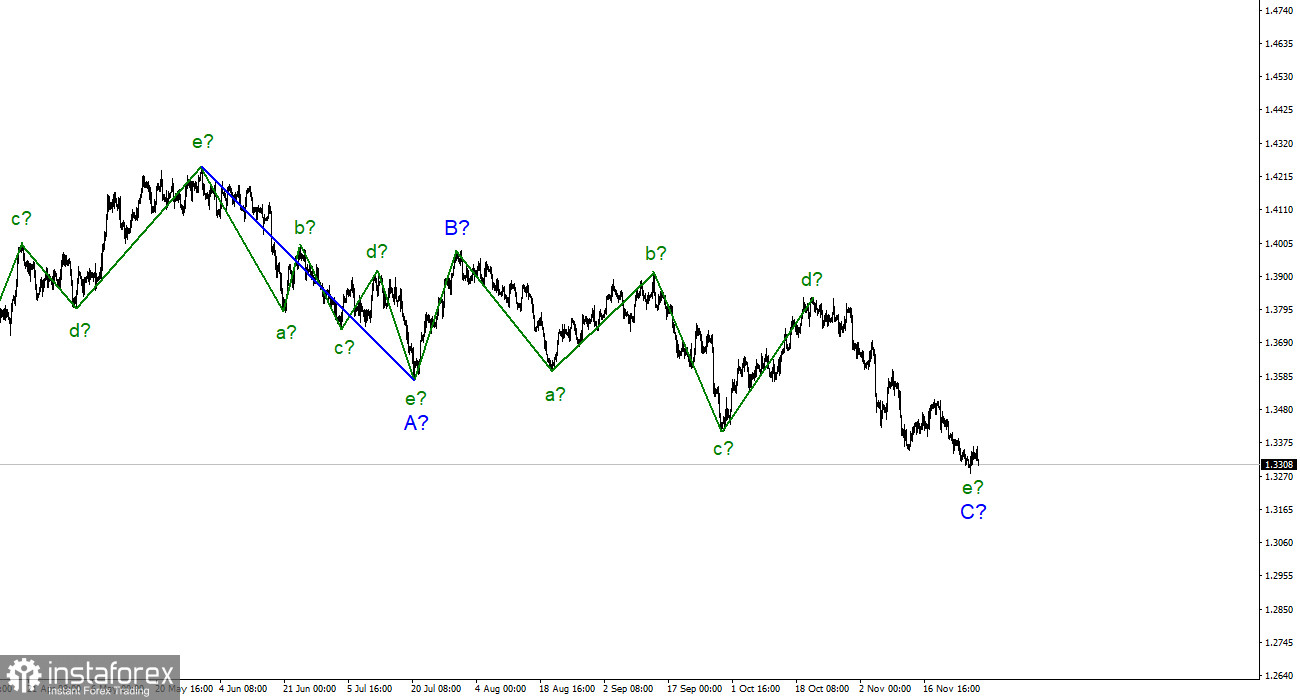

Large timeframe

Starting from January 6, the construction of a downward trend section has been unfolding. It may be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, there is no confirmation of this yet. The entire downward section of the trend may be extended but there are no signals about it as well.