The third attempt to break through the $56,361 mark was successful

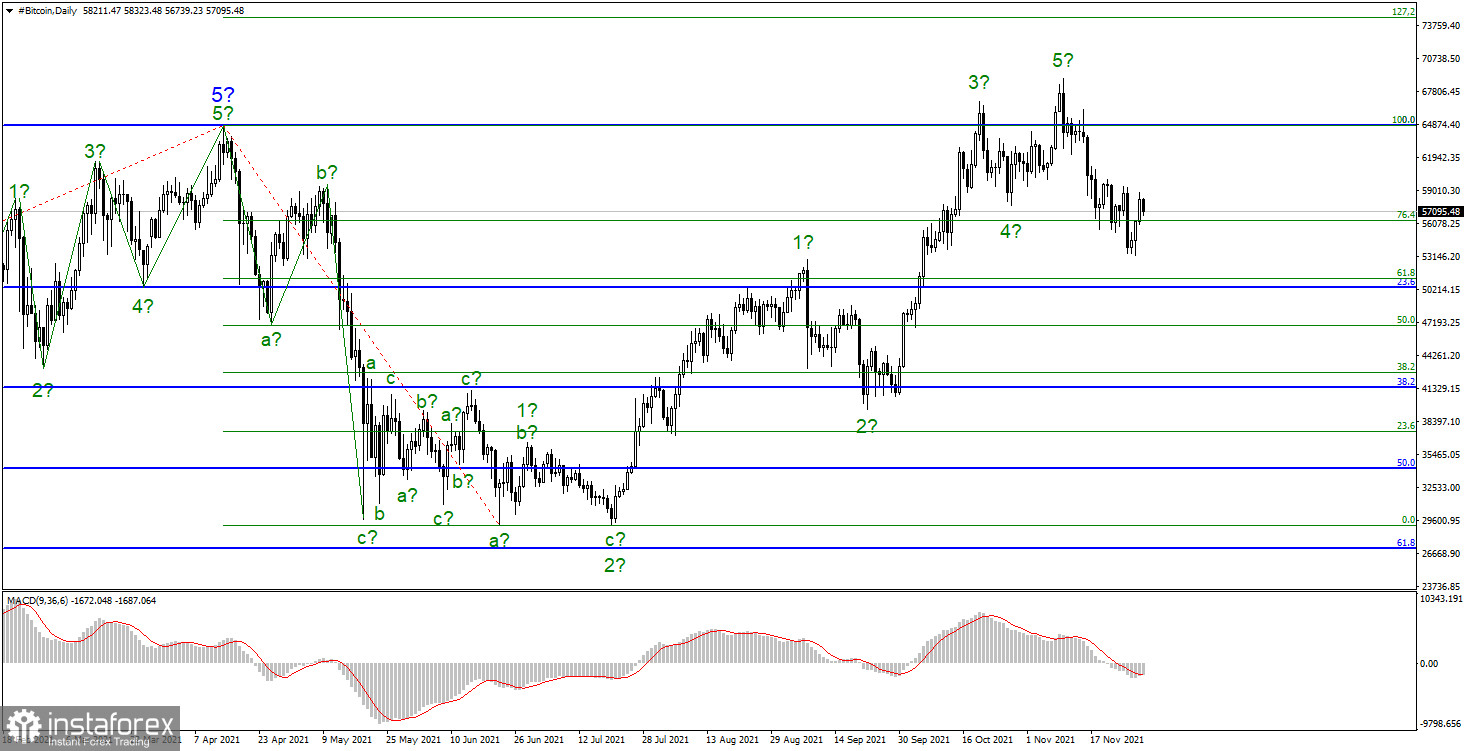

Bitcoin dropped by $5,000 on Friday, November 26, after the whole world was shocked by the information about the new strain of the coronavirus, named Omicron, which could be potentially more dangerous than the Delta strain and all other known strains of the coronavirus. It was thanks to this fall that a successful attempt was made to break through the $56,361 mark, which corresponds to 76.4% Fibonacci level.

It seems that big investors and long-term investors are still holding the course profitable for them. It hardly needs to be said that it is profitable for them as high as possible. However, the entire recent decline of $15,000 can hardly be interpreted as wave 4. And if it really isn't wave 4, then the instrument began building a new bearish wave as part of a new downward trend segment. In the case of Bitcoin, everything can change in the blink of an eye, but the current wave pattern speaks of such an option.

China continues to tighten crypto oversight

China has decided not only to prohibit any cryptocurrencies and operations in the country but is also going to track any cryptocurrency transactions that are now illegal. According to the Chinese government, cryptocurrencies pose a threat to national security and financial stability, so they need to be fought at the state level. The system being developed will be able to track not only the transactions themselves, but also identify the sender and recipient of digital assets.

If China is compelled to prohibit, America, on the contrary, will not. There are recent reports that the United States may also significantly tighten supervision of cryptocurrencies and digital assets. However, this has not happened at the moment. On the contrary, the Securities and Exchange Commission "recognized" bitcoin and began to issue permits for ETF funds in bitcoin.

The new tax legislation, which requires that all transactions in excess of $10,000 be submitted to the IRS, has yet to be adopted. Many investors use this to replenish their own bitcoin reserves. One of the largest public bitcoin holders, Microstrategy, bought additional coins for another $400 million. Another 7,000 bitcoins were bought at an average price of about $59,000. Thus, the company already owns 121,000 coins worth about $6.9 billion.

The current upward section of the trend still does not cause any doubts. The wave pattern was refined after the instrument made a successful attempt to break through the maximum of the assumed wave 3. Now the whole picture looks like an impulsive five-wave upward trend section, which began its construction on July 20.

However, the exit of quotes over the past three weeks from the reached highs may mean the end of the expected wave 5, which in this case will be shortened. At the moment, I'm leaning towards this option. There is no alternative option at this time since the tool does not try to resume the construction of an upward trend section.

This option cannot be completely dismissed, however, if we start only from the wave counting, then now at least a three-wave downward trend section should be built with targets located near the estimated marks of $51,200 and $46,900.

Much will now depend on the Omicron variant and its worldwide spread. We have already seen on Friday how the markets can react to reports of a worsening pandemic situation.