The topic of the new South African COVID-19 strain "Omicron" remains at the top of financial news and is kept in the field of view of market participants. So far, it seems that investors have slightly calmed down, as reports from doctors in South Africa indicate a mild course of the coronavirus infection of this strain, but they will react right away if everything turns out to be much worse.

As tensions eased after Friday's collapse on Monday, global stock markets partially recovered on Monday. The full compensation of the previous decline did not occur yet due to the statement of the Fed Chairman, J. Powell at the Senate Banking Committee, where he said that the Omicron version of the coronavirus could carry the risk of worsening the situation in the US economy amid high inflation, forcing workers to refuse to go to work again due to fear of infection. In addition, WHO's statements about the new strain also worsened the situation, unnerving investors.

On this wave, futures on major US stock indexes are trading with a noticeable decline today. Similar dynamics are demonstrated by European stock index contracts, which indicates a negative opening of trading in Europe, and if market sentiment does not change, then in America.

The main reason for everything that is happening in the markets is the growing fears that the COVID-19 pandemic is turning into an endless story. It can be said that investors are not even afraid of the very appearance of Omicron, but of mutations that are already regularly appearing, which may affect the economies of countries and financial markets until this infection is finally defeated. The topic of the new strain clearly shows this. Only one news about the appearance of a new strain was enough, as panic began in the markets with subsequent sales.

The question involuntarily arises: Is everything that is happening not a game of lowering, first of all, the yield of government bonds?

We are far from conspiracy studies. But if we really look at everything that is happening, the emergence of a new strain of "Omicron" is primarily in the Fed's hands, as it can bring down the sharp increase in the yield of Treasuries in the already affected US economy. It seems that neither the major financial players nor Powell himself, together with Treasury Secretary Yellen, are going to react to the statements of reputable doctors from South Africa that, despite the infectiousness of the strain, the disease itself passes easily.

For the Fed and the American financial system, the growth of government bond yields is like a knife to the throat. After all, such dynamics will lead not only to the outflow of significant funds from the United States but also to an increase in interest on servicing public debt, which is more than twice the GDP.

Watching everything that is happening, one starts to wonder, is everything that is happening around Omicron just a product in the interests of America getting poorer in front of our eyes?

Forecast of the day:

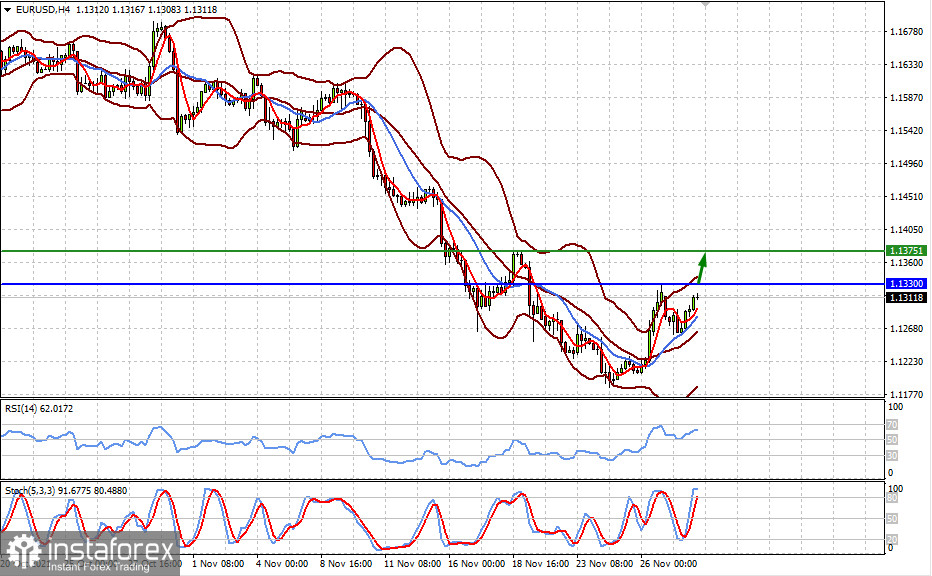

The EUR/USD pair may recover to the level of 1.1375 after rising above 1.1330 amid falling Treasury yields, which is putting pressure on the US dollar.

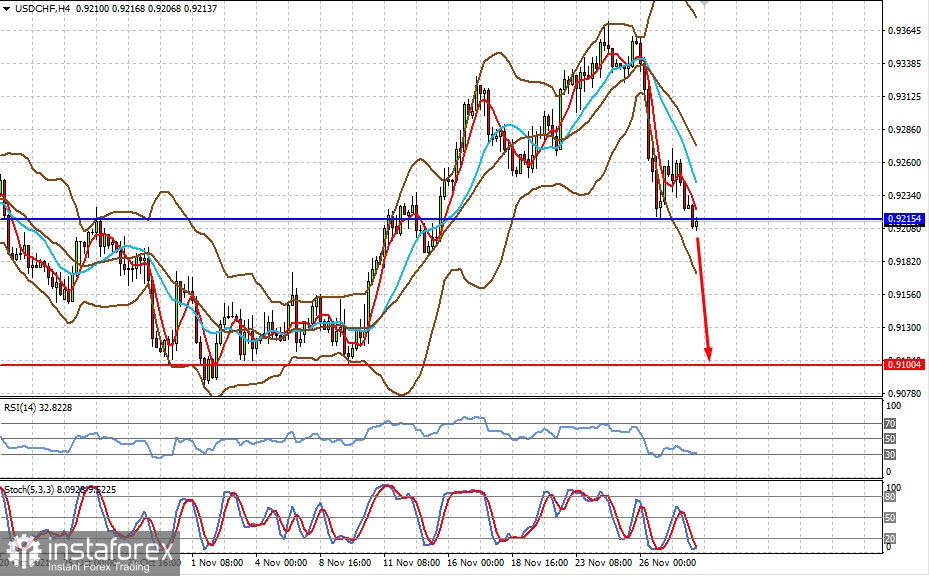

The USD/CHF pair may also continue to decline amid the US dollar's weakness and the recovery in demand for safe-haven currencies. In this case, a price below the level of 0.9215 will lead to the pair's perspective decline to 0.9100.