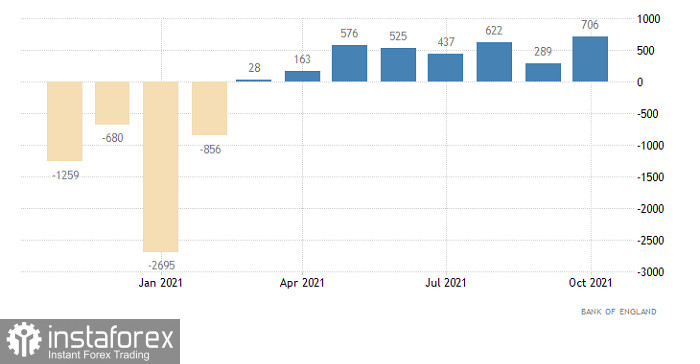

What happened to the pound yesterday clearly showed that it is rather perceived as an object of investment. Let's just say it's more of a status thing than one can brag about at a high-society reception. It sounds too pretentious, so let me explain. The fact is that the pound actually ignored the consumer lending data yesterday, the volume of which rose by 0.7 billion pounds against the expected growth of only 0.5 billion pounds. Moreover, this is the best result in the last fifteen months. The growth of consumer lending reflects the growth of consumer activity and indicates a further increase in aggregate demand. Given the simple fact that the service sector accounts for most of the economy, it is not surprising that this very consumer activity is commonly called the engine of the economy. And logically, the growth of this indicator should have encouraged market participants and contributed to the strengthening of the pound. However, nothing like that happened. On the contrary, the pound almost immediately began to become cheaper.

Consumer lending (UK):

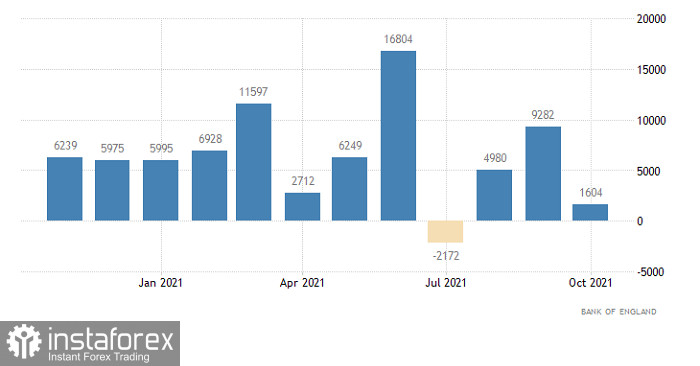

Everything is somewhat more interesting. Historically, UK real estate is quite an object of investment. If British subjects themselves purchase housing in order to live in it, then entrepreneurs from all over the world perceive it as an object of investment. Moreover, it is quite possible that such an investor, in principle, will never visit a newly acquired house in a prestigious area of London. It is exclusively an investment object or maybe also the status, as well as the opportunity to show off to friends at a high-society party. In any case, this is an investment from which income is expected. Now, what reflects the profitability of investments in real estate? This is its price, which should grow. But what if the price does not rise or even falls? These are direct losses.

The only thing that can be done here is to try to determine the future price dynamics in advance. This can be done solely on the basis of the dynamics of supply and demand. So, in the case of British real estate, mortgage lending is almost the best indicator of future demand. It just so happened that its volume increased by only 1.6 billion pounds. And apart from the accidental failure of July this year, this is the worst result in a year and a half. Therefore, it is not surprising that investors from all over the world rapidly lost all interest in the British currency, which quickly began to lose its positions.

Mortgage lending (UK):

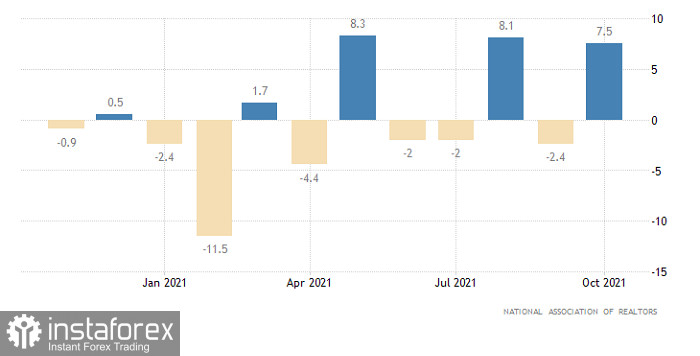

The pound's position was further aggravated by the situation in the US real estate market, where the volume of pending home sales rose by 7.5%. The same indicator clearly indicates the future growth of real estate sales already next month. Nevertheless, the pound began to grow around the American trading session like other currencies. It's just that the US dollar has recently strengthened so much that its overbought status is not some kind of secret. Thus, we are talking more about a small rebound, which in no way contradicts the general trend for the growth of the US dollar. The resumption of which may occur today.

Unfinished Home Sales (United States):

It is quite obvious that everything will revolve exclusively around the preliminary estimate of EU inflation, which should grow from 4.1% to 4.5%. It is clear that the further increase in inflation, which is already quite high, does not even cause concern, but simply panic. However, the market reaction is not so unambiguous. The fact is that the European Central Bank does not intend to do anything about it. Allegedly, the increase in inflation is only temporary and any movements on the part of the regulator can only aggravate the situation. In this scenario, an increase in inflation will lead to a further decline in the euro. After all, other central banks are already taking very concrete steps towards tightening monetary policy precisely in order to contain and even reduce inflation.

However, Christine Lagarde's Friday speech gave hope that the beginning of the process of tightening this very monetary policy may be announced during the next meeting of the Board of the European Central Bank. In this light, inflation growth can be perceived as an incentive for the regulator to move in this direction as quickly as possible and so, it will contribute to the strengthening of the Euro currency. So the question is quite simple – do investors still believe in a change in the ECB policy or not?

Inflation (Europe):

The EUR/USD pair is in the correction stage from the support area of 1.1160/1.1180. It can be assumed that holding the price above the level of 1.1330 will lead to the subsequent formation of a corrective move. The 1.1400 area is considered as resistance. At the same time, the first signal to resume the downward cycle will appear in the market when the price is kept below the level of 1.1250.

The GBP/USD pair has been moving in the sideways channel 1.3290/1.3350 for several days, which may signal the accumulation of trading forces. Trading tactics here consider the method of downward momentum, which will indicate the subsequent course of the price.