Long positions on GBP/USD:

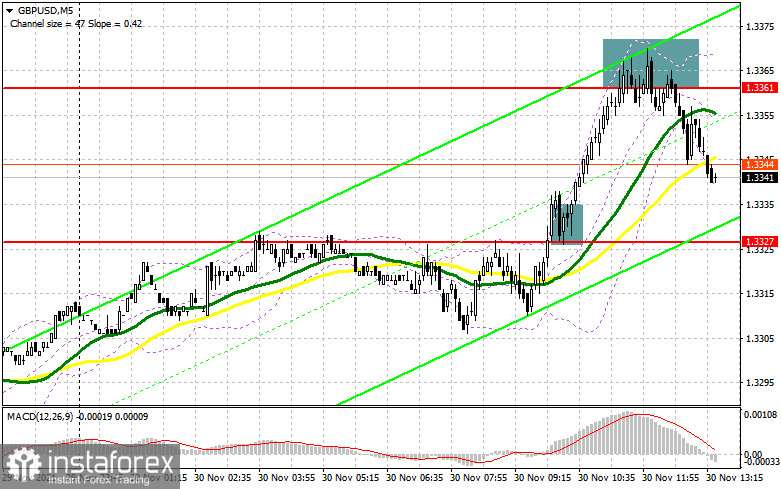

In the first half of the day, the pair signaled several entry points. Let's have a look at the 5-minute chart and analyze the entry points. In my forecast this morning I drew attention to the level of 1.3330 and advised how to use it for opening positions. The price broke through and fixed above 1.3330 with a reverse test top/bottom, which formed an entry point for opening long positions with the target located at 1.3361, where I advised traders to generate profit. The pair increased by 30 pips. After the price reached 1.3361, bears showed active trading. The pair performed a false breakout, which allowed traders to open short positions. As for the time of writing, the pair has declined by more than 20 pips.

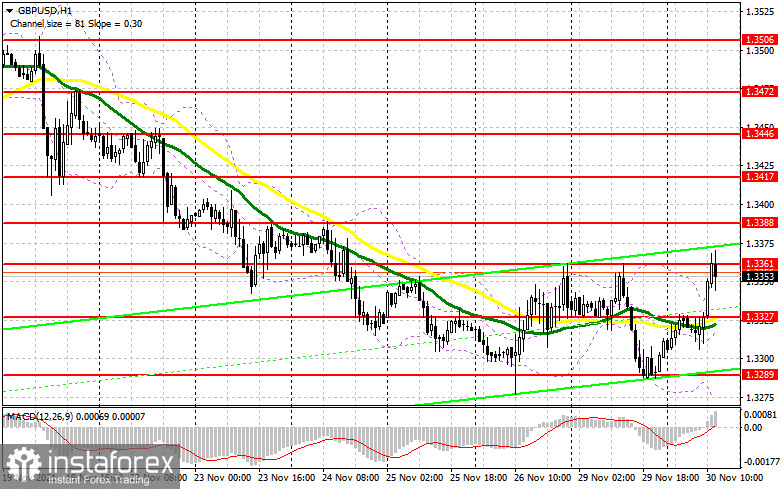

The pair needs to break through 1.3361 with a reverse test top/bottom to return the uptrend. It may signal the entry points for long positions, cancel the downtrend, and return the pair to the 1.3388 area. If the bulls break through this level, the next target for them may become a high of 1.3446, where it is better to lock in profits. However, this scenario is possible only if weak data on the CB Consumer Confidence in the US is released and Fed's chairman Jerome Powell sticks to the dovish rhetoric. The pair's inability to break out of the sideways movement channel does not add confidence to bulls. If the pound declines during the New York session, I recommend opening new long positions only if the price is held above the middle of the trading channel at 1.3327. Moving averages are located at this level, and a formation of a false breakout may help the buyers, creating a new entry point. If bulls do not show that much activity, I would recommend opening long positions on a rebound from the last week's low of 1.3289, while expecting an intraday correction by 20-25 pips.

Short positions on GBP/USD:

While the pair is trading below 1.3361, the signal for selling the pound is still relevant. The main task for bears is to hold the price below resistance at 1.3361. Another false breakout formation at this level after strong US economic data may lead to the formation of a new entry point for opening short positions with another decline towards the middle of the sideways channel at 1.3327, which bears missed today. A larger drop of GBP/USD can be expected today only after a breakthrough and fixation below this range, hawkish statements of Federal Reserve Chairman Jerome Powell and US Treasury Secretary Janet Yellen. A reverse test of 1.3327 bottom/top may provide an excellent entry point that is likely to push the pair to last week's low at 1.3289, where I recommend taking profits. If the GBP/USD pair rises during the New York session and sellers are weak at 1.3361, it is better to postpone selling till the price reaches resistance at 1.3388. However, it would be better to open a short position there only after the formation of a false breakout. Selling the GBP/USD pair on a rebound is possible only from resistance at 1.3446, or even higher from a new high in the area of 1.3494, allowing an intraday correction by 20-25 pips.

The COT (Commitment of Traders) reports for November 23 showed an increase in short positions and a decrease in long positions, which led to an even greater increase in the negative delta. Dovish statements of the Governor of the Bank of England last week kept the pressure on the pound even amid risks associated with higher inflationary pressures than previously expected. The worsening situation with the coronavirus and the new Omicron strain in Europe did not add optimism. The issue of the Northern Ireland protocol has not been resolved yet, which the UK authorities plan to suspend. At the same time, in the United States, there is rising inflation and increased talks about the need for an earlier interest rate hike next year, which provides significant support for the US dollar. However, I recommend sticking to the strategy of buying the pair during large declines, which may occur amid the uncertainty in the central bank policy. The COT report indicated that long non-commercials declined to 50,122 from 50,443, while short non-commercials rose to 84,701 from 82,042. This led to an increase in the negative nonprofit net position, with a delta of -34,579 against -31,599 a week earlier. The weekly closing price declined not so much, to 1.3397 from 1.3410.

Indicator signals:

Moving averages

The GBP/USD pair is trading above 30- and 50-day moving averages, which indicates that bulls are trying to continue the correction.

Note: The period and prices of moving averages are considered on the hourly chart and differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair declines, support is located in the middle boundary of the indicator at 1.3315. A breakout of the upper boundary of the indicator at 1.3361 may lead to a new growth wave of the pound.

Description of indicators

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). The 12- and 26-period EMAs. The 9-period SMA.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, including individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Non-commercial long positions refer to the total long open position held by non-commercial traders.

- Non-commercial short positions refer to the total short open position held by non-commercial traders.

- The total non-commercial net position is the difference between short and long positions held by non-commercial traders.