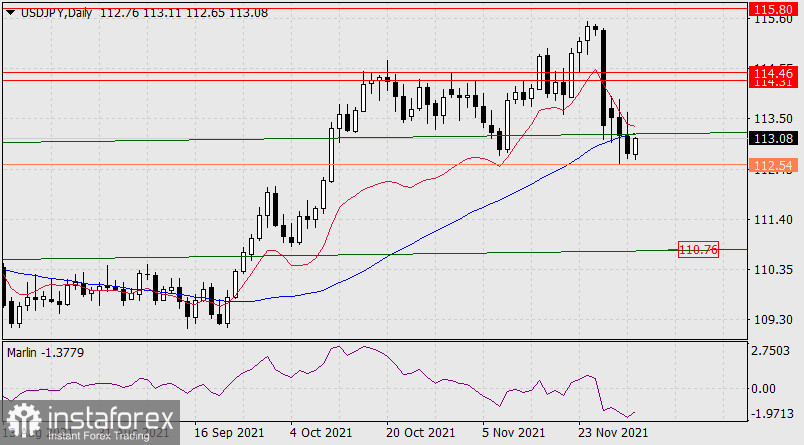

Yesterday, the USD/JPY pair did not realize its 65% chance to develop growth in the target range of 114.31/46. Instead of growth, the price collapsed, settling below the MACD indicator line and the daily scale price channel line. Now the price is waiting for a further decline to the lower embedded line of the price channel in the area of 110.76. The likelihood of such a decrease is the same 65%. A price drop below the Nov 30 low of 112.54 would raise this probability to 75%.

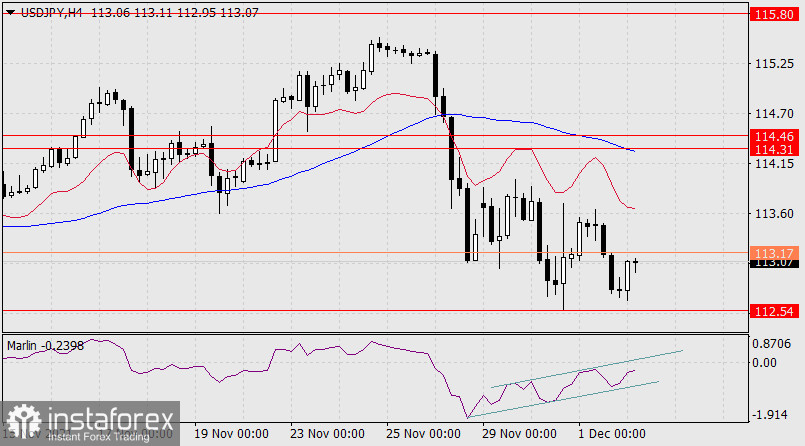

The price divergence with the Marlin Oscillator still persists on the 4-hour chart. Here lies the risk - underneath the convergence, there may be a banal growing channel, from which the price exit to the downside is statistically higher than an exit to the upside. Therefore, from a practical point of view, the strategy of waiting for a signal to open a sell position is more profitable, and the signal will be when the price breaks the level of 112.54.

For a potential price growth (114.31/46), it needs to settle above the price channel and MACD line of the daily scale, that is, above the level of 113.16. This will take at least a day. We are waiting for the development of events.