US stock market futures edged up on Thursday morning following Wednesday's fall triggered by the first confirmed case of Omicron in the US. The Dow Jones Industrial Average futures gained 287 points or 0,71%, the S&P 500 grew by 0.72%, and the NASDAQ 100 added 0.4%.

US tightens travel restrictions

The Biden administration has tightened travel restrictions for both domestic and international flights. All inbound international passengers must have a negative test made in the 24 hours before arriving in the US, compared to 72 hours before. Mask requirements for all domestic flights and public transport are extended until March 18. These measures are a part of a wider plan to tackle the new strain, as the US government remains wary of the third wave of the pandemic.

US president Joe Biden said the US received about 50 million doses of the vaccine, but it is unclear how effective they would be against Omicron.

The WHO reported the discovery of the Omicron strain last week. 23 countries have reported confirmed cases of the new variant. The number is expected to rise in the coming days and weeks, the WHO said.

The new pre-departure testing protocols will apply to all inbound international travelers regardless of vaccination status and will begin as early as next week, CNBC reports, citing senior administration officials. Earlier, inbound travelers were required to have proof of a negative COVID-19 test within 72 hours of departure. Unvaccinated travelers had to have a negative Covid test within one day of departure. "Our doctors believe tightening testing requirements for pre-departure will help catch more cases, potential cases of people who may be positive and inside the country," a senior administration official told CNBC. Fines for violating these restrictions would remain doubled, starting at $500 for first-rime offenders, and going up to $3,000 for repeated offenders.

Yesterday, the Dow Jones fell by about 460 points or 1.34%, the S&P lost 1.18%, and the Nasdaq Composite declined by 1.83%

Investors remain concerned about the new strain and expect an accelerated bond-buying taper by the Federal Reserve, resulting in high volatility in the market and prolonging the downward correction. The high volatility in the stock market is likely to continue.

Today, the weekly jobless claims data is due, with 240,000 new claims expected. Yesterday's ADP's non-farm employment data beat forecasts - 534,000 new jobs were created in November, compared to a projected increase of 506,000.

On Thursday, Dollar General, Kroger and Signet Jewelers are set to release their Q3 earnings reports before the opening of the New York session. Q3 earnings reports by Ulta Beauty, Marvell Technology and Ollie's Bargain Outlet will be released after the closing.

At the beginning of the premarket, Boeing's stock rose by 3.6%. Shares of Royal Caribbean bounced back by 3.6%, and MGM Resorts International added 2.7%. A deteriorating COVID-19 situation would put serious pressure on these stocks.

Stocks of companies in the travel sector were badly affected by the recent slump, as new restrictions caused by Omicron would badly affect the industry. Stocks of cruise lines, airlines and hotel companies are likely to finish the week in negative territory due to declining market sentiment.

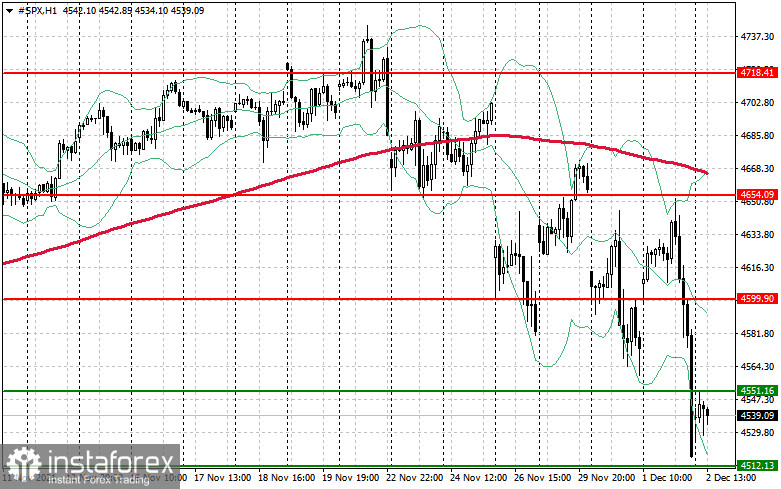

On the technical side, the S&P 500 has broken through the major support level of $4,551, which is likely to boost the downtrend. The lows at $4,512 and $4,470 are the new bearish targets. If the situation deteriorates and tomorrow's non-farm payroll report turns out to be strong, it would signal an imminent quick QE taper by the Fed, opening the way for $4,428 and $4,382. Due to a strong downward momentum, traders are not advised to open long positions. If bulls manage to reverse the price back towards $4,551, it could lead to a retracement towards the $4,599 area. Today's scheduled speeches by Fed officials would limit such an upward retracement - they are expected to focus on inflation and market risks, which could weigh down on the quote.