OPEC and its allies adhere to the established policy of increasing oil production on a monthly basis, despite concerns about a reduction in demand after the new Omicron option and the White House's commitment to release strategic oil reserves, and despite all the obstacles that could create serious problems for the industry in the coming months.

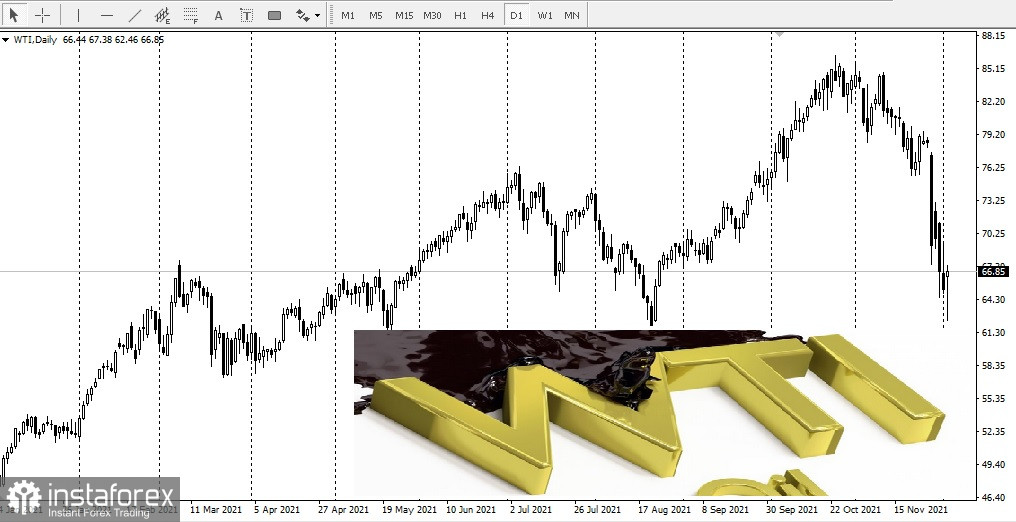

After last Friday's sharp decline of 13 and 11%, WTI and Brent, respectively, remain at a price below $ 70 per barrel.

The risk of a potential oversupply is growing. OPEC is worried about this, especially since internal reports by March suggest a potential oversupply of 3.8 million barrels.

The Organization is also cautious about escalating tensions with the United States, which previously called on OPEC+ to increase supplies from January in excess of current commitments of 400,000 barrels per day.

US President Joe Biden has joined forces with China, the United Kingdom, South Korea, Japan, and India to free up strategic reserves to prevent future oil price increases.

The American head is struggling to cope with a sharp rise in gasoline prices, while his falling popularity rating puts him under pressure ahead of crucial midterm elections next year.

A little earlier this week, Deutsche Bank published a bearish forecast for oil, claiming that the price of WTI could fall below $ 60 per barrel next month.

Michael Xue, a commodity research specialist, argues that there will be a huge oversupply in the oil market next year.

This implied a delay in the increase in OPEC production, which is now continuing. This increases the likelihood of serious problems in the industry next year.