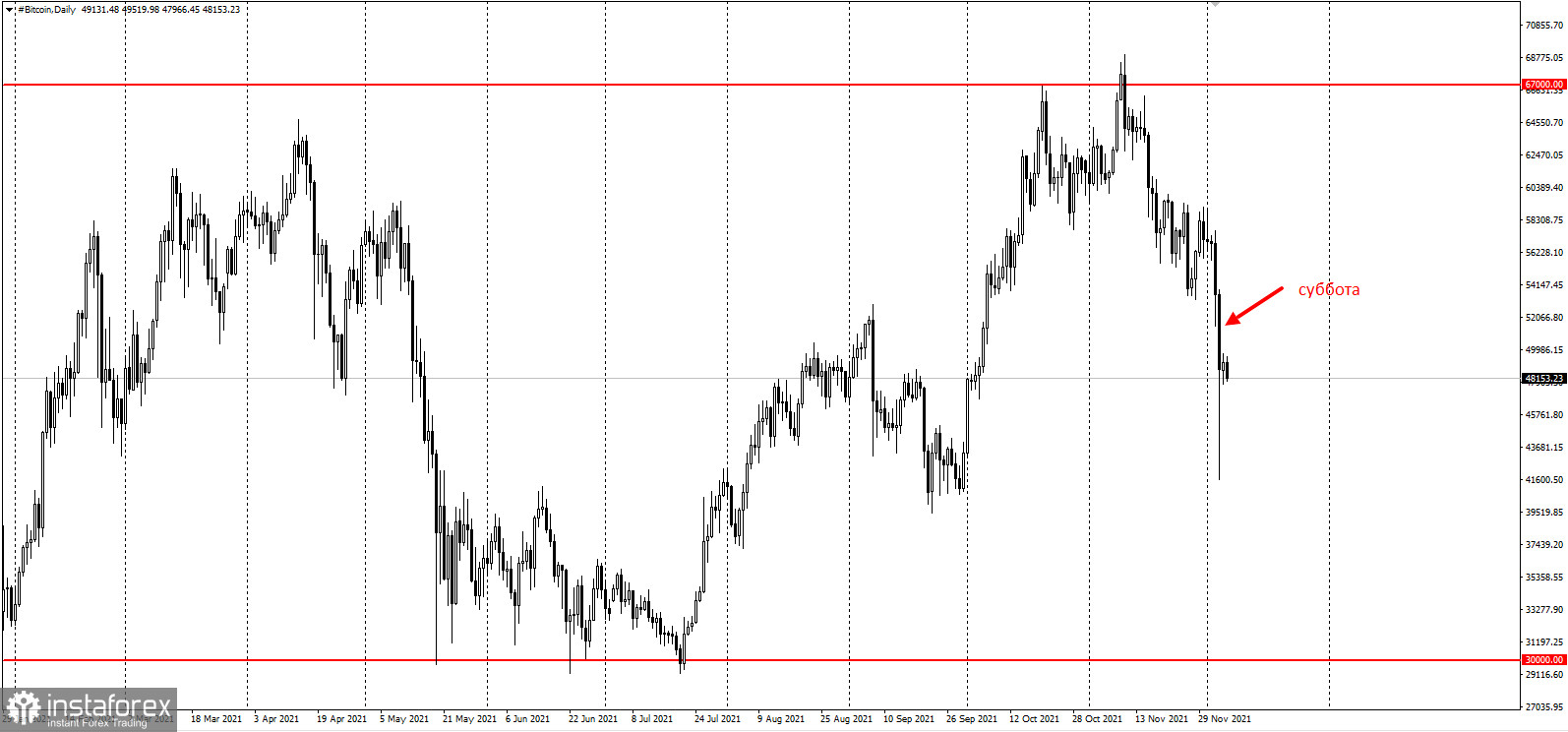

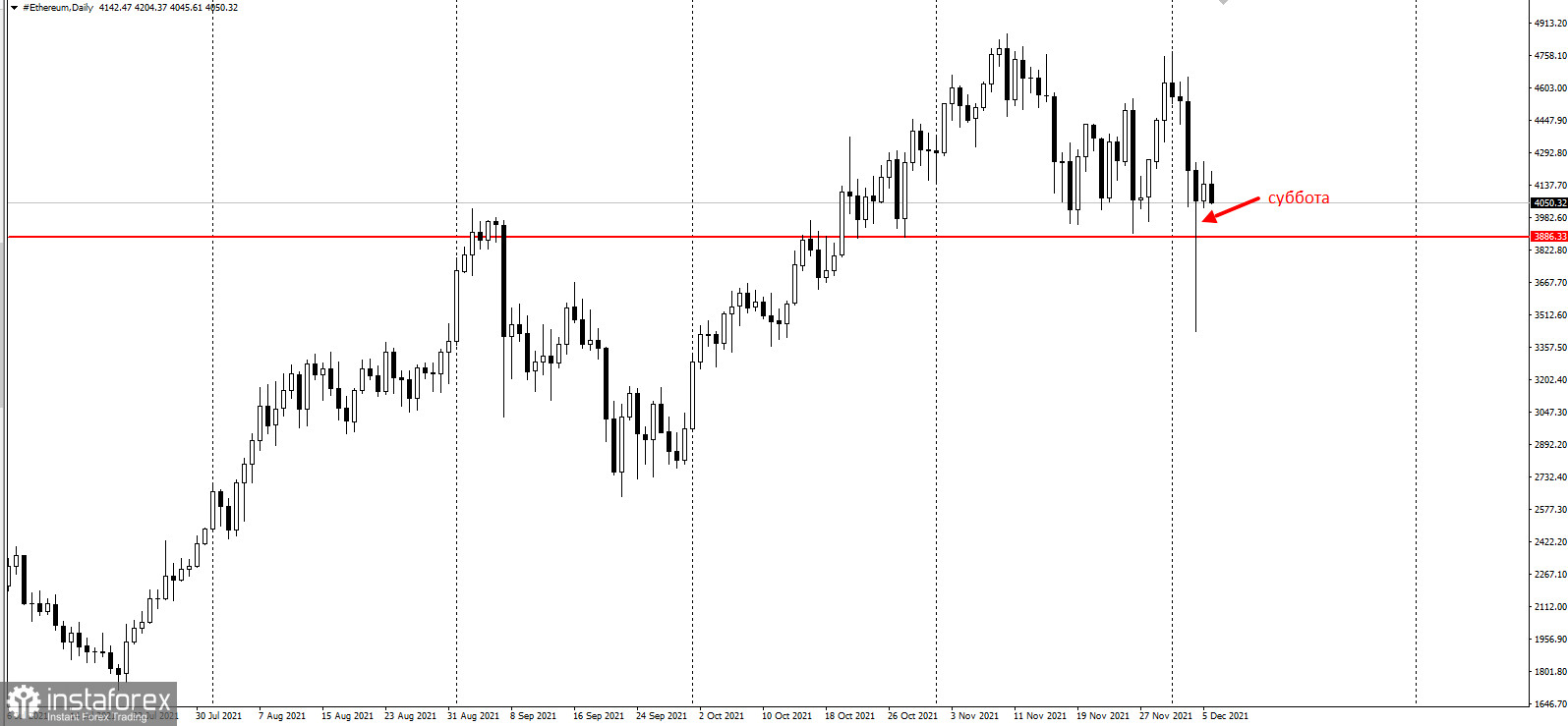

On Saturday, bitcoin decreases considerably as well as other cryptocurrencies. It signals risk aversion in markets. Therefore, BTC declined by almost 35% to $42,700 per coin. Ether, the second-largest token, fell by almost 30% to $3,550 per coin.

According to CoinGecko, the crypto market has lost about a fifth of its value, dropping to $2.2 trillion.

Such fluctuations in cryptocurrencies are associated with headwinds in financial markets and a sharp rise in inflation. Central banks are mulling over monetary policy tightening which may reduce the liquidity of many digital assets. The omicron variant has also fueled risk aversion due to concerns over the global economy. Global stock indices also declined by about 4% compared to a sharp drop logged in November, while safe-haven assets and Treasury bonds won luster with investors. "Some leveraged buyers of Bitcoin were flushed out in Saturday's crash" Vijay Ayyar, the head of Asia Pacific with crypto exchange Luno in Singapore, said. "Markets have also been jittery with all the uncertainty around omicron, with cases now appearing in many countries," he said. "It's hard to say what that means for economies and markets and hence the uncertainty," he added.

Notably, about $2.4 billion of crypto in both long and short positions was liquidated on Saturday, the most since September 7, Coinglass.com stressed. Bitcoin, known for its volatility, has lost about $21,000 since hitting a record level on November 10th. This year, it has risen by more than 60%, a return that surpasses many other assets. El Salvador's President Nayib Bukele said that the country had acquired an additional 150 bitcoins after the digital currency's value slumped again. Earlier, the country adopted bitcoin as a legal tender. "As usual, since crypto traders deploy leverage it results in cascading sell orders and liquidations," Antoni Trenchev, the co-founder of crypto lender Nexo, said. BTC may face the support level around $40,000 - $42,000. After that, it is likely to rebound to develop a rally at the end of the year. If this scenario does not come true, the BTC price may decline to the July lows of $30,000 to $35,000.

Ether also decreased on Saturday but it almost recouped its losses later.

Doge tumbled the most, reaching its yearly low.