EUR/USD

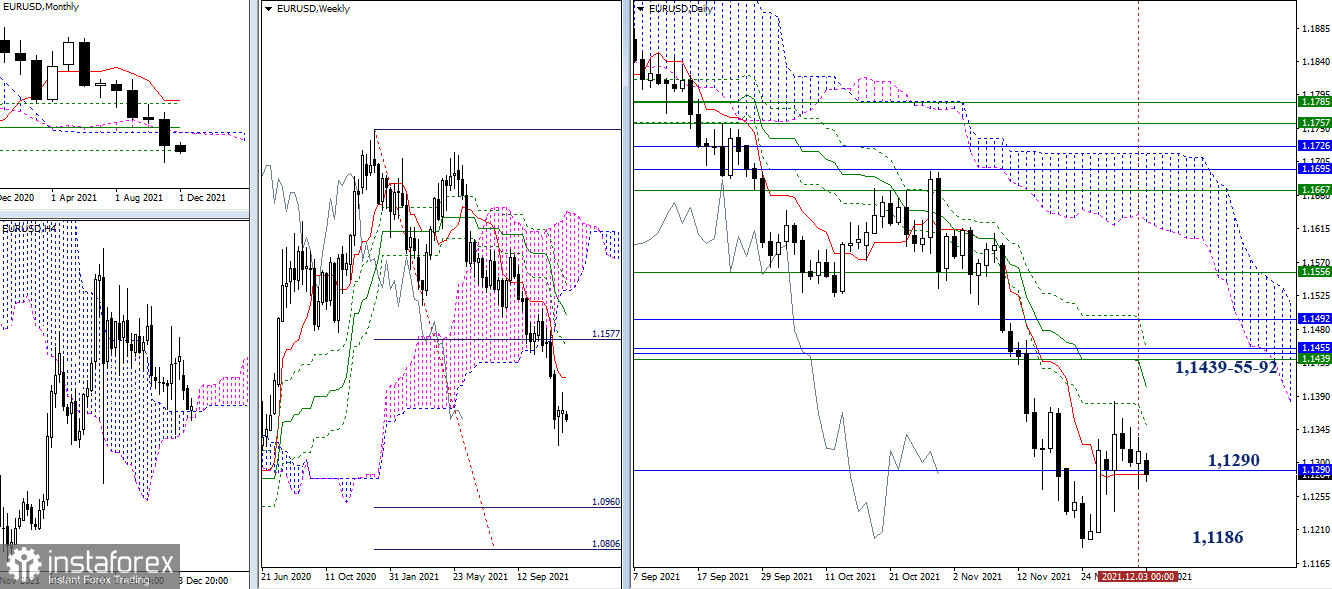

Last week was closed with a candle of uncertainty. The euro remained in the attraction and influence zone of the monthly Fibo Kijun (1.1290). The daily short-term trend (1.1284) was also held here all last week, whose horizontal position supports the current uncertainty. The absence of changes made it possible to maintain the main nearest pivot points in their former places. For the bears, their task is still to update the low (1.1186) and recover the trend, which will return the relevance of the decline to the downward weekly target for the breakdown of the cloud (1.0960 - 1.0806).

Meanwhile, a return to bullish activity, the breakdown of the nearest daily resistance levels of 1.1351 (Fibo Kijun) and 1.1401 (Kijun), will focus the interests of the bulls on testing and breaking through the levels of 1.1439-55-92, where the weekly short-term trend and monthly levels (cloud + medium-term trend) combined their efforts.

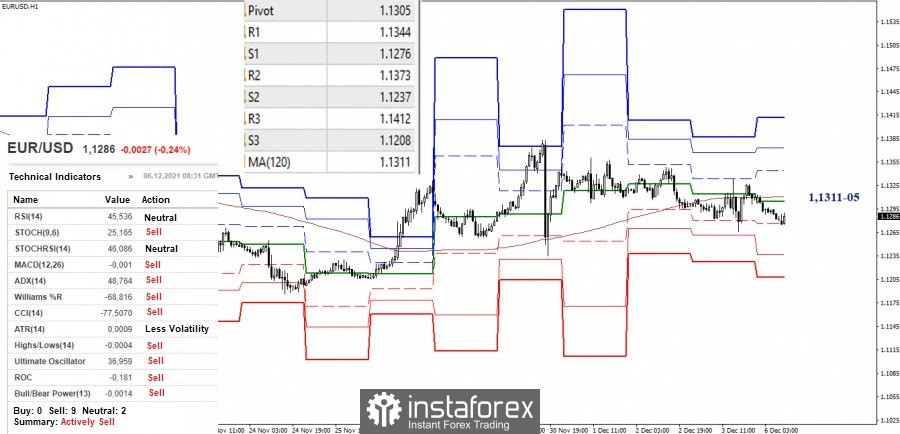

The prolonged uncertainty has led to the fact that the key levels in the smaller timeframes, which determine the distribution of the balance of power, have united in the attraction and influence zone of the higher timeframes. They are currently located in the area of 1.1311-05 (central pivot level + weekly long-term trend). A movement above the levels gives preference to the bulls, whose pivot points will be the resistance of the classic pivot levels (1.1344 - 1.1373 - 1.1412). In turn, finding a pair below key levels provides a bearish advantage. The supports of the classic pivot levels are set at 1.1276 - 1.1237 - 1.1208 today.

GBP/USD

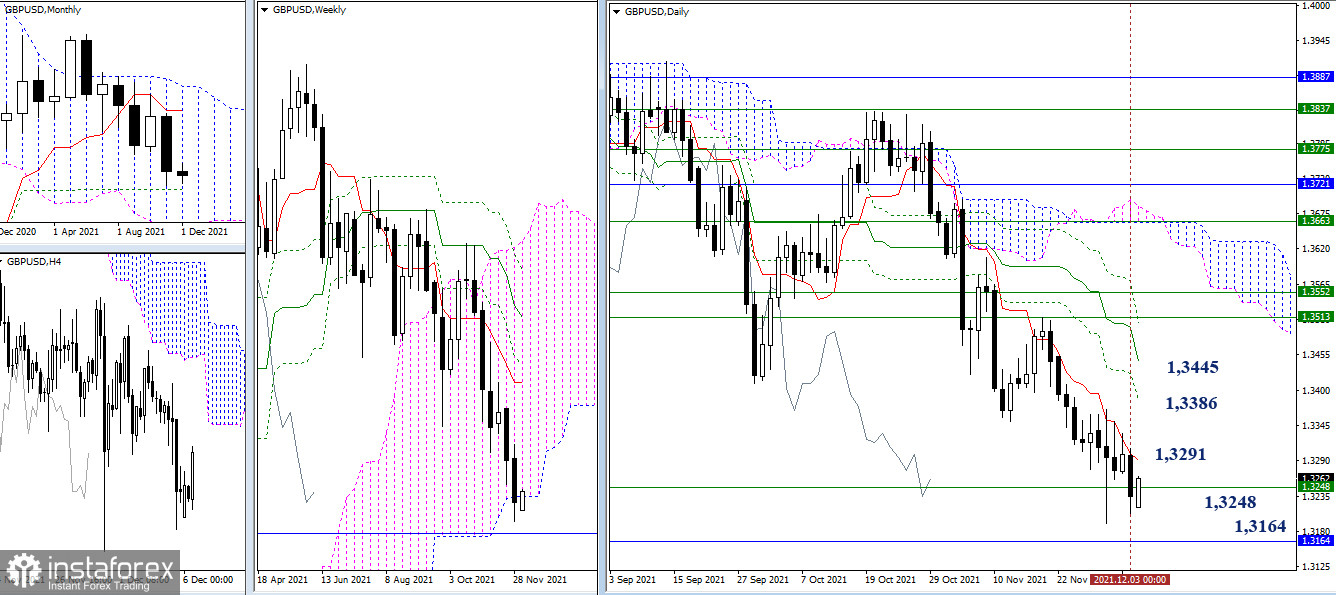

The bears expressed their weekly advantage by closing Friday's trading below the lower border of the weekly cloud (1.3248). Due to this, their attention and efforts will now be directed to the monthly support (1.3164) if the decline continues. If an upward correction occurs, the first task will be to break through the daily short-term trend (1.3291) and further rise to the resistances of the daily cross, which are currently at 1.3386 (Fibo Kijun) and 1.3445 (Kijun).

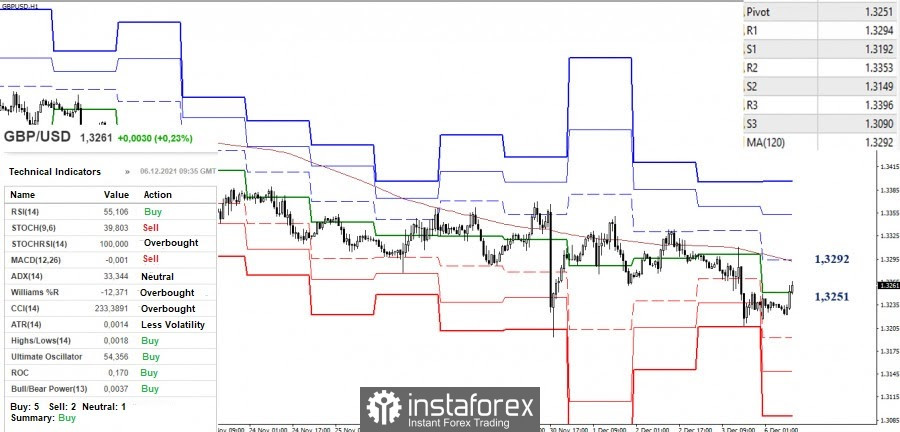

The pound in the smaller timeframes has been in the correction zone for a long time. It now makes an attempt to make an upward correction, and as a result, the central pivot-level (1.3251) is being tested. The next key resistance is located at 1.3292 (weekly long-term trend). A consolidation above and a reversal of moving averages can change the current balance of power here in favor of bullish traders. On the contrary, the formation of the rebound and the restoration of the downward trend will return the relevance to the downward pivot points, which are the support of the classic pivot levels (1.3192 - 1.3149 - 1.3090).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.