Bitcoin has collapsed to $42,000 and may continue to decline.

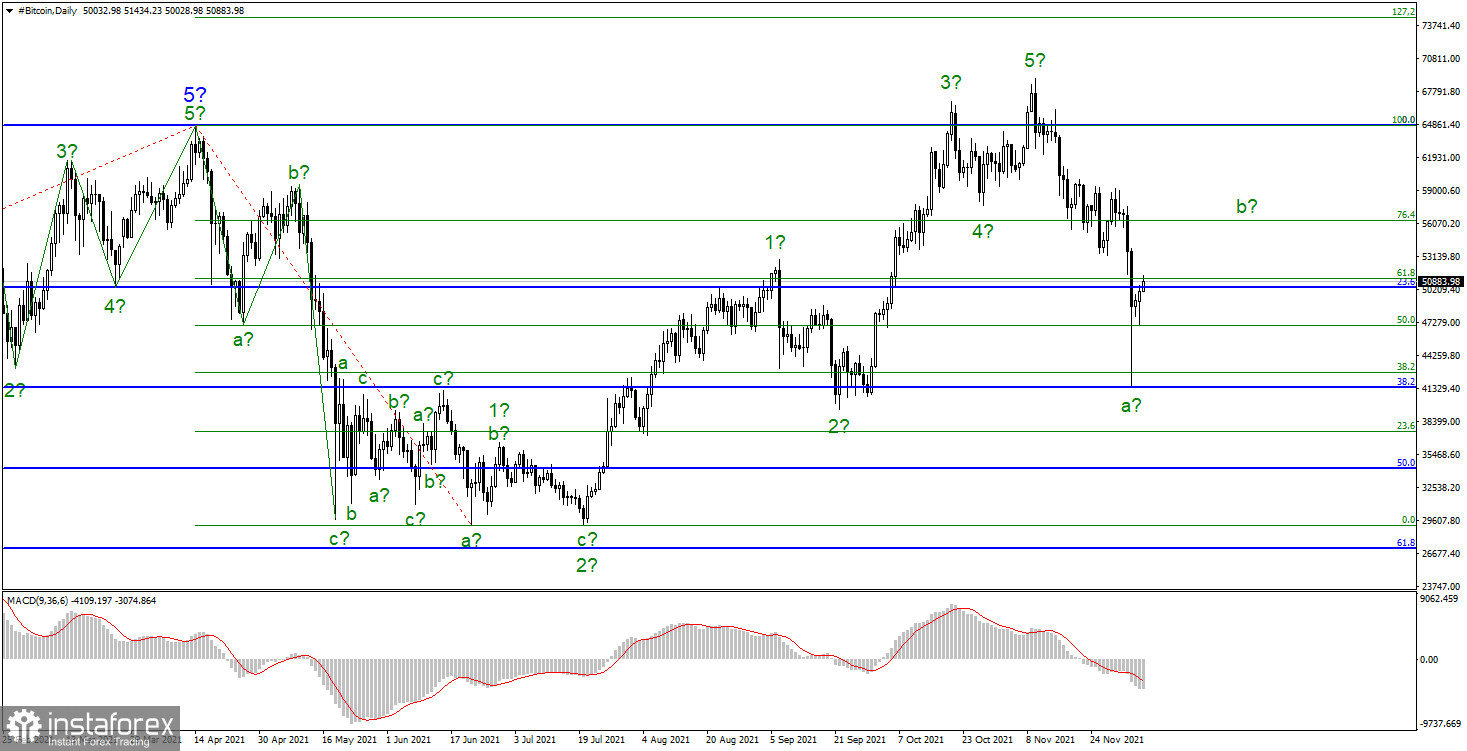

The weekend turned out to be really "black" for bitcoin. Within just a few hours on Saturday, the cryptocurrency quotes fell by $15,000. A little later, a recovery followed, which allowed the cryptocurrency to recover most of the losses. But only Saturday's losses. In just the last few weeks, bitcoin has sunk by $19,000, if you count the opening and closing levels. And, most importantly, all this movement can be considered one wave. Thus, after a slight pullback to the top, a new downward wave may follow, which may lead the cryptocurrency to the $ 30,000 mark, where it has been for a long time this summer. However, we will talk about the waves a little below. So far, I want to note that only an unsuccessful attempt to break through the $ 41,368 and $ 42,674 marks, which corresponds to 38.2% and 38.2% by Fibonacci, stopped the decline of the instrument. At the same time, two days have passed since this fall and the markets are clearly in no hurry to buy bitcoin "at an attractive price." Perhaps they are waiting for a new, stronger decline and, from my point of view, they are waiting correctly.

The bankruptcy of a Chinese developer led to the flight of investors from risky assets.

On Saturday, there was only one event that could lead to such a strong decline in the entire cryptocurrency market, since not only bitcoin fell in price. The Chinese developer Evergrande, who has been walking on the edge of the abyss of bankruptcy for several months in a row, announced that he would not be able to guarantee the fulfillment of financial obligations and the payment of interest on bonds for $ 260 million. By and large, this is called a technical default. The company has certain assets, but if investors refuse to restructure its debt, the company must be declared bankrupt. To tell the truth, many have already given up on it. Its debt is too great. But what will be the consequences after this is officially announced? At times when a large company fails and can no longer fulfill its obligations, it affects all markets. A vivid example of this is the collapse of Lehman Brothers in 2008. Investors in a panic get rid of the riskiest assets, as they are the first to fall in price. And on Saturday, investors could not sell stocks or bonds, since stock markets were closed. Therefore, only the cryptocurrency market suffered. It should also be noted that at the moment the total debt of the company exceeds its value by $ 100 billion, and the Chinese government refused to lend a helping hand to the company. According to many analysts, the official collapse of Evergrande could trigger a new global financial crisis.

The current upward section of the trend still does not cause any doubts. The wave pattern was refined after the instrument made a successful attempt to break the maximum of the assumed wave 3. Now the whole picture looks like a completed five-wave impulse upward trend section, which began its construction on July 20. The departure of quotes over the past three weeks from the reached highs may mean the end of the expected wave 5, which in this case turned out to be shortened. At the moment, I'm leaning towards this option. There is no alternative option at this time since the instrument does not even try to start a new upward wave. Thus, now I expect either a further collapse in the quotes of the instrument (if the news background matches or the market starts to panic) or the construction of an upward corrective wave b, after which the decline will also resume with targets located below the low wave a. That is, below the $ 41,469 mark. As you can see, there is no smell of $100,000 in 2021.