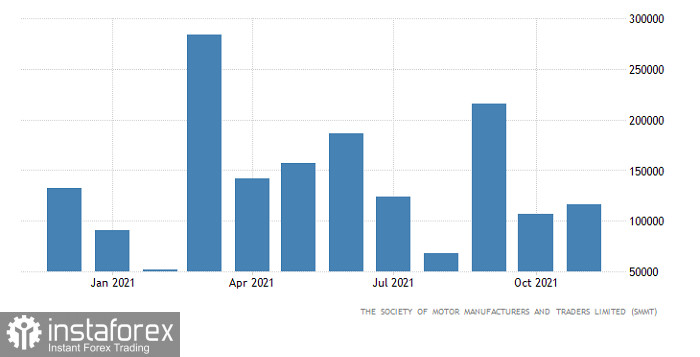

The pound was supposed to behave exactly the same as the single European currency, then stand still. However, it was able to demonstrate, albeit moderate, but still growth. And it's not about the index of business activity in the construction sector, which increased from 54.6 points to 55.5 points. Although it was expected to decrease to 54.2 points. The point is in the sales of new cars, the rate of decline of which was supposed to slow down from -24.6% to -12.0%. Instead, they showed an increase of 1.7%. And this is in annual terms. In other words, the data really presented an unexpected surprise. And it was quite pleasant. And most importantly, they showed a clear increase in consumer activity, which is the engine of economic growth. This was the reason for the pound's growth.

New Car Sales (UK):

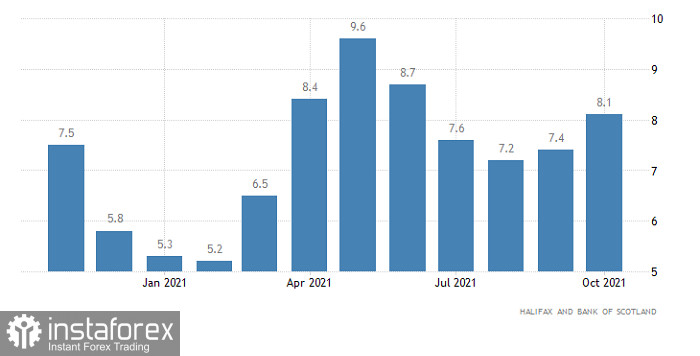

Today, it will be possible to move the pound from its place only if the Halifax data on housing prices will differ too much from forecasts. And their growth rates are expected to slow down from 8.1% to 7.8%. In principle, the data are rather negative, since the housing market is of great importance to the British economy, due to the fact that construction and real estate transactions account for at least a fifth of the entire economy of the United Kingdom. However, Halifax data cover only a part of the housing market, and it is difficult to call them so representative. They don't reflect the big picture. And the changes are not expected to be so large-scale as to move the market from its place.

Halifax House Price Index (UK):

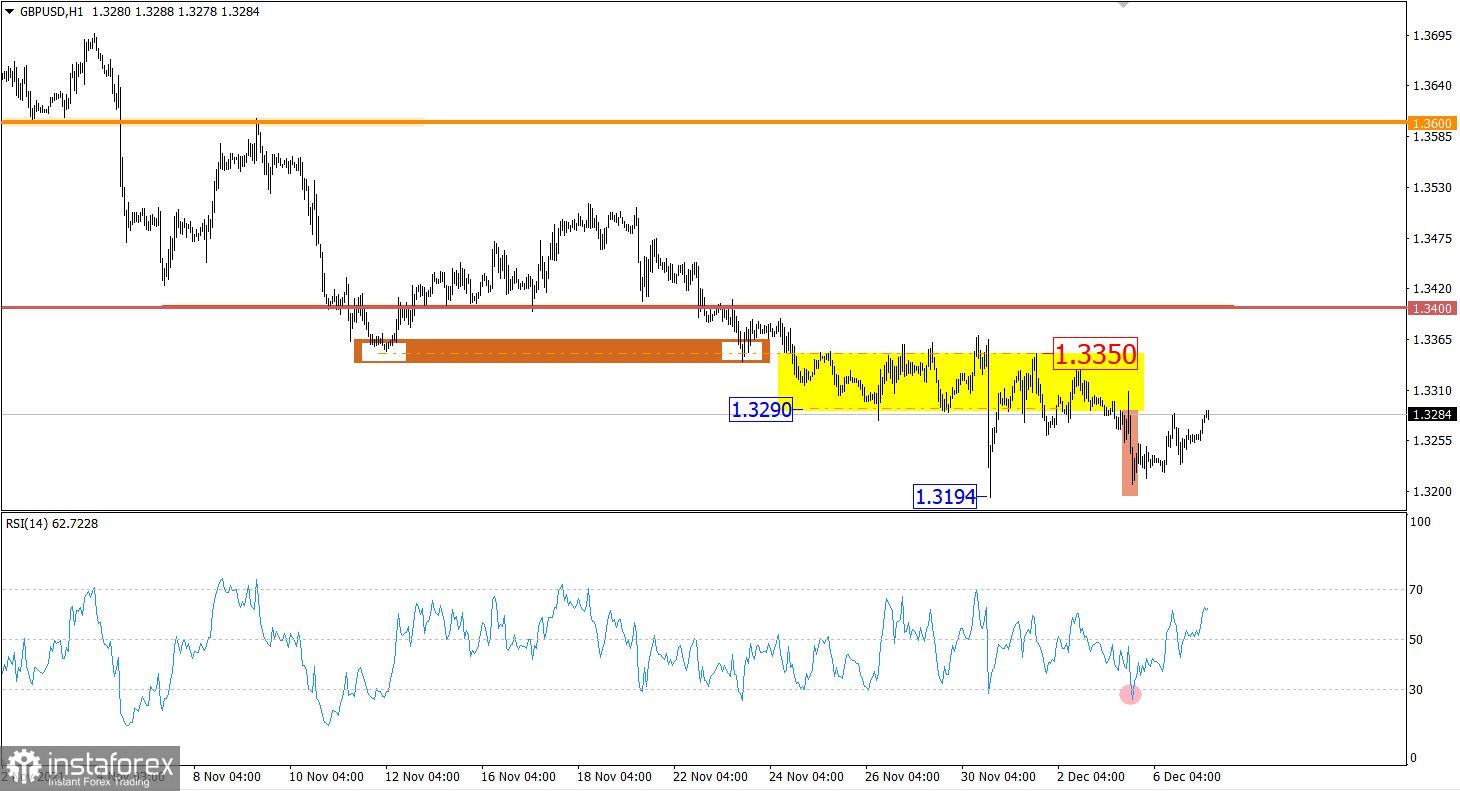

The GBPUSD currency pair completed the construction of the horizontal range of 1.3290/1.3350 with a downward momentum. This led to a decrease in the value of the pound in the direction of the local low of November 30 - 1.3194, where a natural price rebound occurred.

The technical instrument RSI in the hourly period confirms the signal to rebound by crossing the 30 line. The indicator in the four-hour period is still moving in the lower 30/50 area, this signals a high interest in short positions.

On the daily chart, the quote is on the verge of updating the local low of 2021. This is a positive signal for a downward trend that could lead to a subsequent recovery from the upward trend.

Expectations and prospects:

In this situation, a slowdown in the retracement within the 1.3290 level is considered. This can lead to a reduction in the volume of long positions and, as a result, primary stagnation. After that, it is worth considering another attempt to update the local low of 2021.

Comprehensive indicator analysis provides a buy signal based on short-term and intraday periods due to a rebound.