According to Davidson analyst Chris Brendler, the recent string of declines provides investors "a buying opportunity as Omicron only strengthens the case for Bitcoin and the miners offer a better risk/reward."

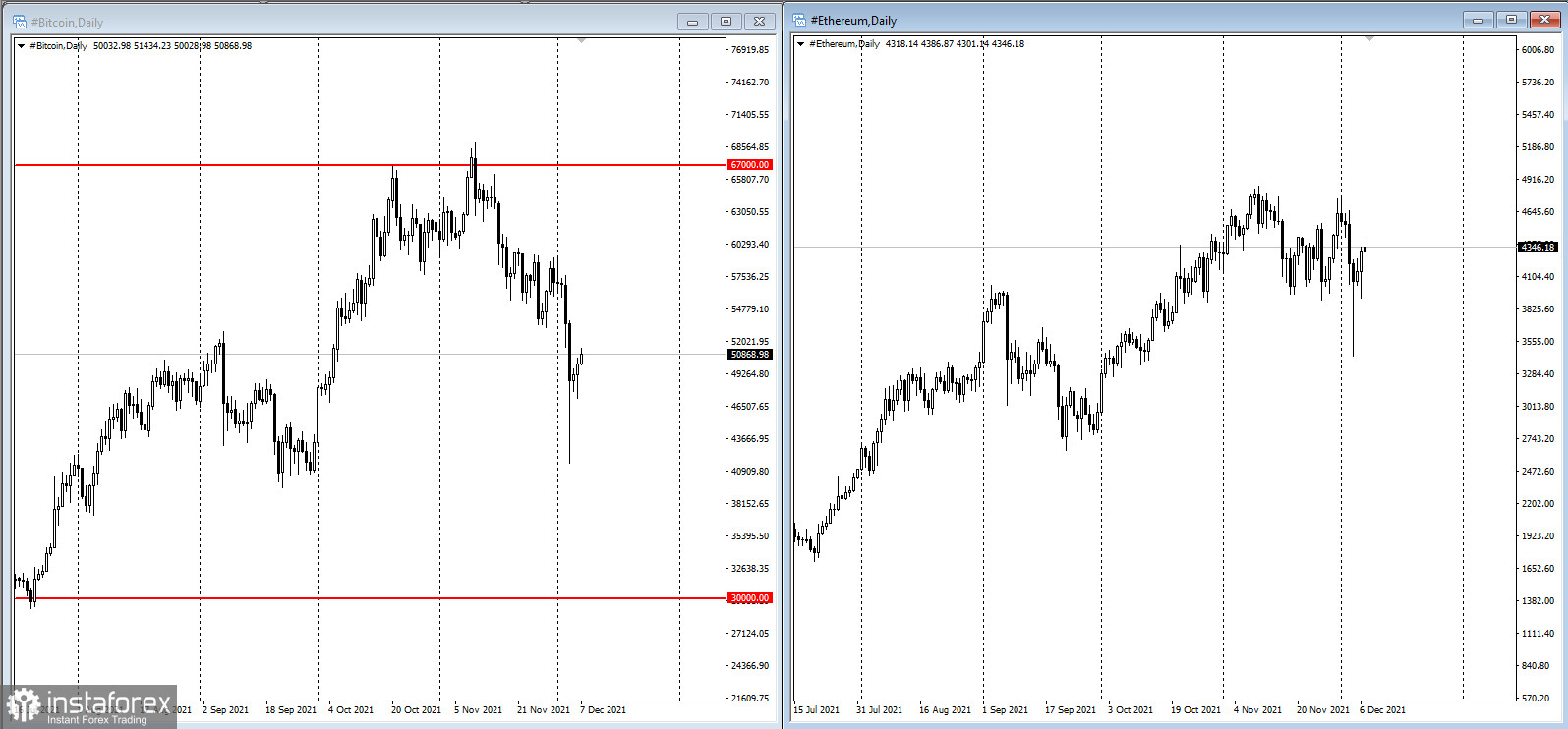

Bitcoin's latest selloff hit a fever pitch on Saturday, as the world's largest digital token dropped as much as 35% before paring its losses to just over 10%. The choppy trading spread to other digital tokens including Ether and Litecoin, both of which saw declines this morning. Meanwhile, the recently launched ProShares Bitcoin Strategy exchange-traded fund fell 7.6%, putting it on track to close at a fresh record low.

As of today, bitcoin rose after Saturday's collapse. Ethereum is also trading higher than on Black Saturday.

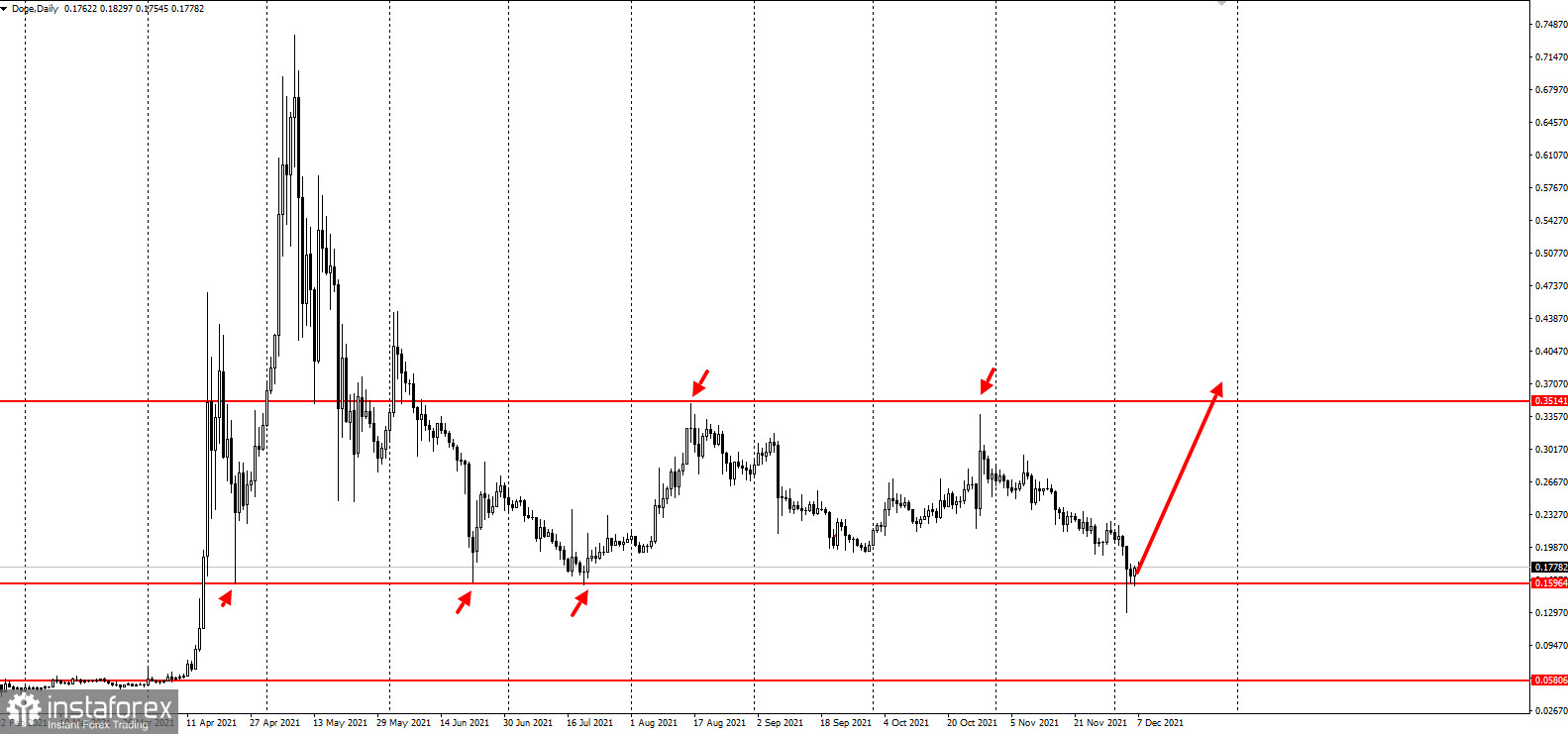

Dogecoin is by far the laggard, but at the same time, it has the biggest growth benchmark.

Monday's volatile trading session for crypto-linked stocks follows what was a painful four-day stretch last week as global markets experienced a broader shift away from riskier asset classes. The Amplify Transformational Data Sharing ETF, which holds a range of shares linked to the cryptocurrency space, dropped by nearly 9%, its biggest weekly loss since July. The fund was down as much as 6.2% early this morning and is currently lower by about 1%.

"Crypto coins and tokens have been propelled higher in this era of ultra cheap money and as speculation swirls about just when central banks will start further tightening mass bond buying programs and start raising interest rates, they are likely to continue to be highly volatile," Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said.