To open long positions on GBP/USD, you need:

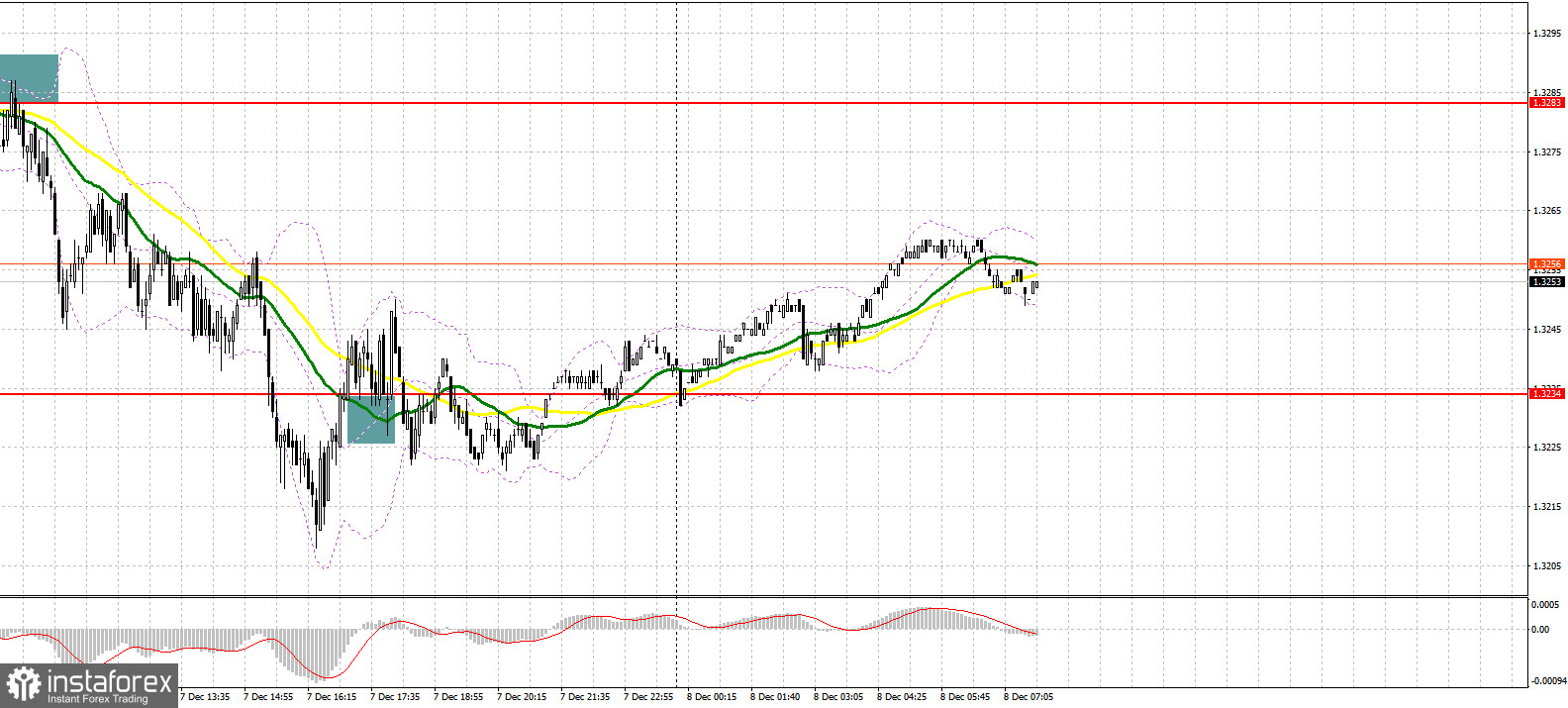

Yesterday there were several signals to enter the market. Let's take a look at the 5-minute chart and figure it out. In my morning forecast, I paid special attention to the 1.3283 level and advised you to make decisions on entering the market. It could be seen how bulls tried with all their might to take control of the resistance at 1.3283, but failed each time. After three such attempts, the bears started to be more active, which led to the formation of a false breakout and an excellent signal to sell GBP/USD. As a result, the pair first fell by 40 points, and then even reached the target support of 1.3234 and failed. In the second half of the day, which I drew attention to in my forecast for the US session, the bulls achieved a return to the level of 1.3234. Its reverse test gave an entry point for long positions, causing the pound to correct about 20 points up.

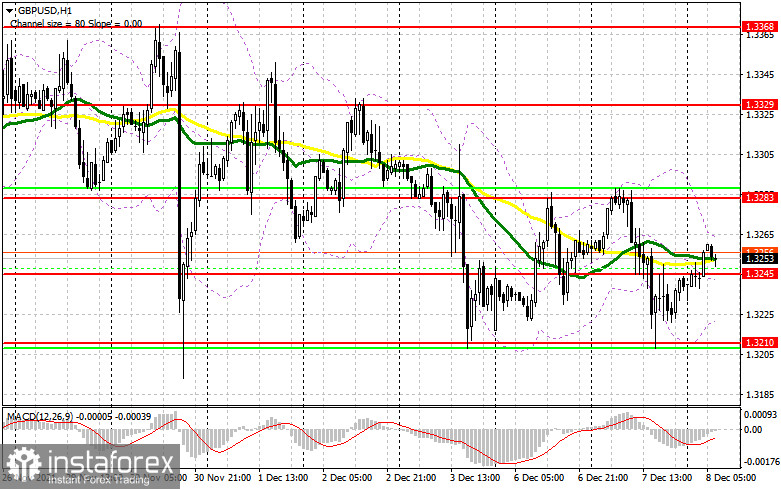

Today there are no important statistics on the UK and most likely the pound will continue to trade in a narrow horizontal channel and with the prospect of further decline along the trend. Bulls need to try very hard to keep the initiative, and this will only be possible if a false breakout is formed in the area of the middle of the 1.3245 horizontal channel, where the moving averages are also passing. The pound will rise to the upper border of 1.3283 only in this case, beyond which it will determine the further short-term direction of the pair in the second half of the day. A downward test of this level will lead to the formation of a buy signal with the prospect of stopping the bearish momentum and rebuilding the GBP/USD to the 1.3329 area. A breakthrough of this range will open the possibility of renewing the 1.3368 high, where I recommend taking profits. The next target is the resistance at 1.3407, but it will be quite difficult to reach it without good news. In case the pound falls during the European session and lack of activity at 1.3245, I advise you not to rush to buy. Only the formation of a false breakout at the lower border of the horizontal channel at 1.3210 will lead to forming a buy signal. I advise you to open long positions in GBP/USD immediately for a rebound from the next low of 1.3154, or even lower - around 1.3111, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The fact that the bears are not letting the pair rise above the resistance level of 1.3283 indicates continued bearish momentum. All that is required now is to protect resistance at 1.3283. The next formation of a false breakout there will lead to creating a new entry point to short positions with a subsequent decline to the 1.3245 area, and then to the lower border of the horizontal channel at 1.3210, which is very important from a technical point of view. Considering that today there are no serious statistics for either the UK or the United States, the breakdown of 1.3210 will create real problems for bulls and keep the pair in a downward trend. A reverse test of this range from the bottom up will provide an excellent entry point, which will push GBP/USD to new lows: 1.3154 and 1.3111, where I recommend taking profits. The next target will be support at 1.3070, but we will fail to reach it if the situation in the UK worsens due to the number of infections with a new strain of coronavirus. In case the pair grows during the European session and the bears are not active at 1.3283, it is best to postpone selling until the larger resistance 1.3329. I also recommend opening short positions there only in case of a false breakout. Selling GBP/USD immediately on a rebound is possible only from a large resistance at 1.3368, or even higher - from a new high in the 1.3407 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for November 30 revealed that both short positions and long positions increased. However, there were more of the latter, which led to an increase in the negative delta. Last week there was very little fundamental statistics on the UK economy, and all the speeches of Bank of England Governor Andrew Bailey were dovish, which did not give traders confidence in the future of the British pound. And if the representatives of the BoE preferred to take a more wait-and-see attitude, then the speeches of Federal Reserve Chairman Jerome Powell, on the contrary, were of a hawkish character. In his comments, he spoke quite a lot about the expected changes in monetary policy towards tightening. The reason for this is rather high inflation, which has grown from "temporary" to permanent, which creates many problems for the central bank. An equally serious problem for the UK is the new Omicron coronavirus strain, which could lead to another lockdown and the country's quarantine. So far, the authorities have to closely monitor the development of the situation with the new strain, which negatively affects the economy at the end of this year. Let me remind you that the Fed will hold a meeting next week, at which a decision on the bond purchase program will be made, so demand for the US dollar is expected to remain in the shorter term. The COT report indicated that long non-commercial positions rose from 50,122 to 52,099, while short non-commercials increased from 84,701 to 90,998. This led to an increase in the negative non-commercial net position: delta was -38,899 against -34,579 a week earlier. The weekly closing price dropped from 1.3397 to 1.3314.

Indicator signals:

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market in the short term.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3260 will lead to a new wave of growth of the pound. A breakout of the lower border of the indicator around 1.3220 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.