On Tuesday, US stock markets rose in the biggest rally since March. Leading indexes gained at least 2% on optimism that Omicron would not undermine global recovery.

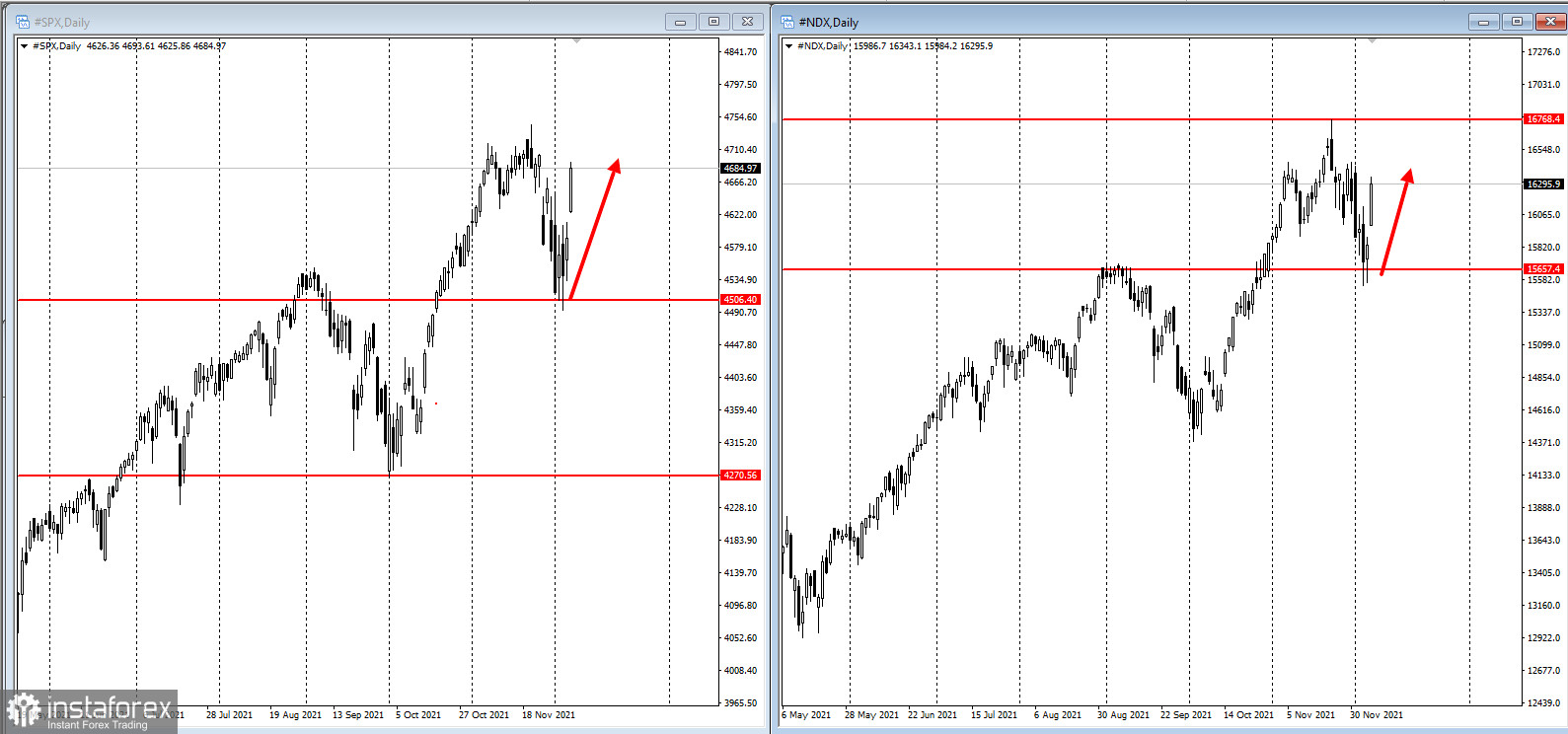

Tech stocks that caused last week's slump extended their recovery. The NASDAQ 100 rose by 3%, while the S&P 500 fully recouped the losses it had sustained after Jerome Powell's hawkish tilt last week, when Omicron rocked the markets.

Risk assets are recovering this week after preliminary reports suggested the rise in Omicron cases has not overwhelmed hospitals. Furthermore, China has moved in to support its economy, relieving volatile markets. A Goldman Sachs Group Inc. basket of nonprofitable tech firms increased by almost 7% on Thursday, recouping almost half of last week's losses.

"This morning's rally is being fueled by the belief that the Omicron variant will not create many problems for the global economy and that China has pledged measures to support economic growth," said Matt Maley, chief market strategist for Miller Tabak & Co. "If those were the reasons why the market has seen such a big increase in volatility since Thanksgiving, we'd agree the worst is likely over and that investors should jump back into the market with both feet," he added.

US trade deficit is on the decline, while productivity in the third quarter fell.

Latest research indicated that a COVID-19 vaccine by GlaxoSmithKline Plc and Canada's Medicago Inc. is effective against several variants of the coronavirus.

Fiona Cincotta, senior financial markets analyst at City Index commented, "The market mood has been notably more upbeat this week after several health experts across the globe, including the U.S.' Dr. Anthony Fauci, have said Omicron symptoms appear milder, so far. Whilst it is still early days, the encouraging news sparked bargain hunters into action. Who would want to miss out on the possibility that a milder variant could accelerate natural immunity to COVID?"

Stock markets could still remain turbulent due to new measures enacted to limit the spread of Omicron, as well as the resumption of geopolitical tensions. US Treasury Secretary Janet Yellen stated that US dependence on foreign supply chains has proved to be a vulnerability, boosting policies that may be considered protectionist.

Let us have a look at this week's key events:

Wednesday - the Reserve Bank of India sets the interest rate.

Wednesday - Olaf Schultz becomes Germany's chancellor, replacing Angela Merkel.

Wednesday - ECB president Christine Lagarde gives a speech at a conference of the European Systemic Risk Board (ESRB).

Thursday - Fed Reserve Bank of Minneapolis president Neel Kashkari gives a speech.

Thursday: China economic data: CPI, PPI, monetary supply, new yuan loans, total social financing.

Friday: US economic data: CPI.