Gold is trading at 1,668 at the time of writing. It has moved sideways also because the Dollar Index seems undecided ahead of the FOMC Meeting Minutes high-impact event. The yellow metal maintains a bearish bias, so more declines are in cards if the USD dominates the currency market.

As you already know, the PPI came in better than expected, while Core PPI came in line with expectations. The FOMC Meeting Minutes could force XAU/USD to register sharp movements, that's why you have to be careful. Tomorrow, the US inflation data could really shake the markets and could move the price. Higher US inflation could force the yellow metal to drop.

XAU/USD Distribution!

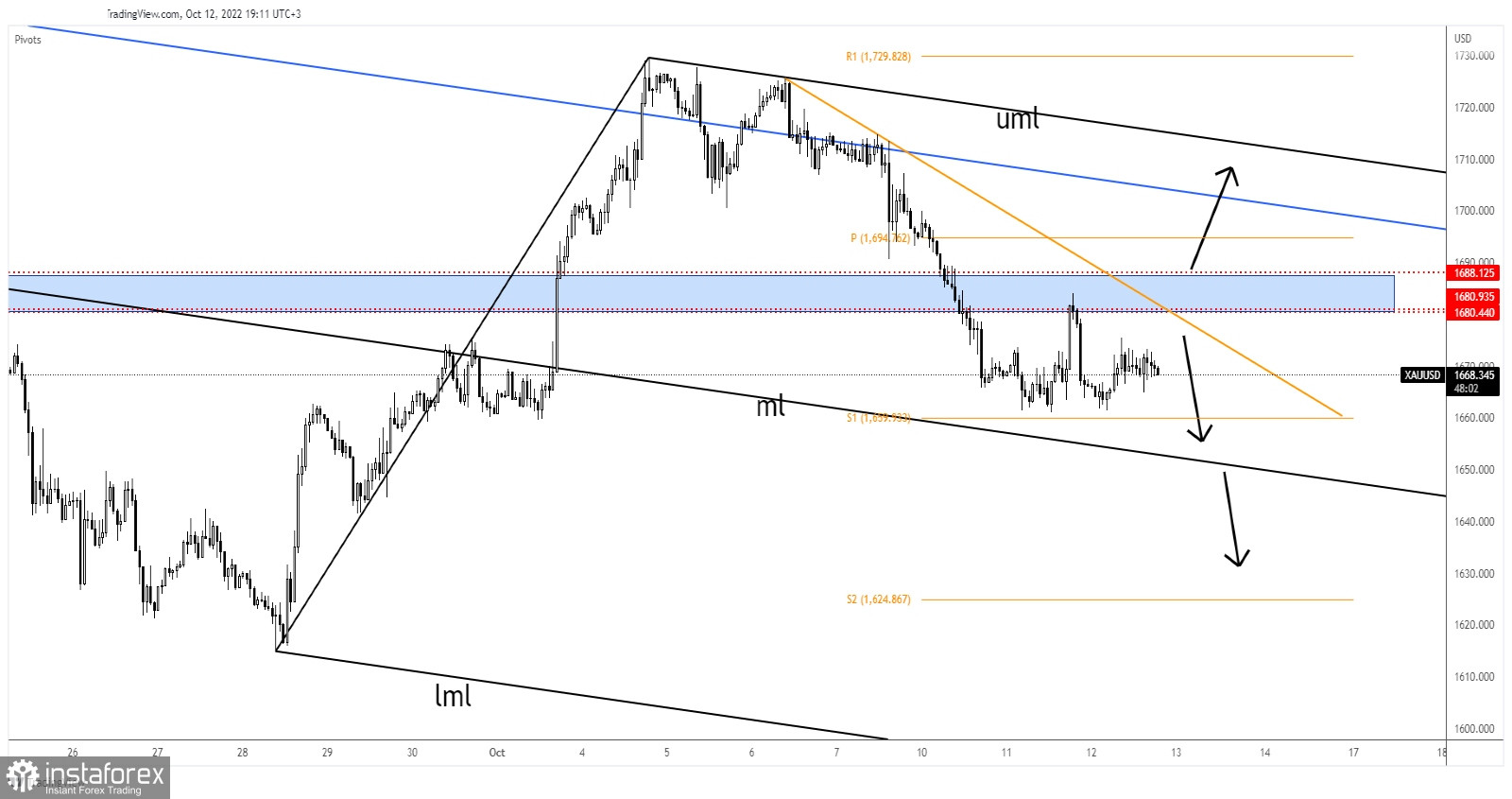

From the technical point of view, the bias remains bearish as long as it stays under the downtrend line. As you can see on the H1 chart, the rate retested the 1,680 key resistance and now it has turned to the downside again.

The S1 (1,659) stands as potential static support. Still, as long as it stays under the downtrend line, the yellow metal could still be attracted by the median line (ml) of the descending pitchfork.

XAU/USD Forecast!

Testing and retesting the downtrend line, registering only false breakouts may announce a new sell-off and could bring short opportunities. A new lower low may signal more declines. A great short opportunity could appear if the rate drops and stabilize below the median line (ml).