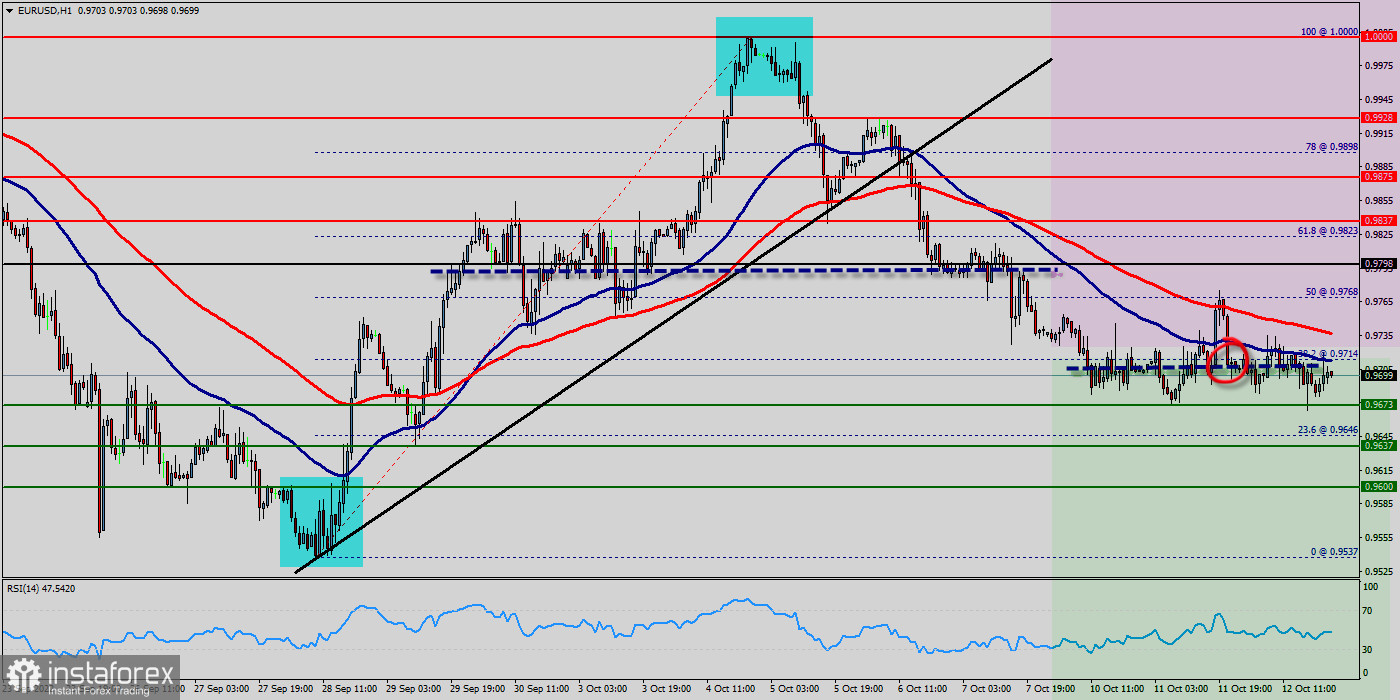

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 0.9673 and 0.9798, so it is recommended to be careful while making deals in these levels because the prices of 0.9798 and 0.9673 are representing the resistance and support respectively. Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market.

The EUR/USD pair hit the weekly pivot point and resistance 1, because of the series of relatively equal highs and equal lows. But the pair has dropped down in order to bottom at the point of 0.9673. Hence, the major support was already set at the level of 0.9635. Moreover, the double bottom is also coinciding with the major support this week. Additionally, the RSI (The Relative Strength Index) is still calling for a strong bullish market as well as the current price is also above the moving average 100.

The EUR/USD pair has faced strong resistances at the levels of 0.9798 because support had become resistance last week. So, the strong resistance has been already formed at the level of 0.9798 and the pair is likely to try to approach it in order to test it again.

However, if the pair fails to pass through the level of 0.9798, the market will indicate a bearish opportunity below the new strong resistance level of 0.9798 (the level of 0.9768 coincides with a ratio of 50% Fibonacci).

Additionally, the price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend. From this point, the EUR/USD pair is continuing in a bearish trend from the new resistance of 0.9798. Thereupon, the price spot of 0.9798/0.9800 remains a significant resistance zone. Therefore, a possibility that the EUR/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective.

In other words, sell deals are recommended below the price of 0.9768 with the first target at the level of 0.9673. From this point, the pair is likely to begin a descending movement to the price of 0.9637 with a view to test the daily support at 0.9600.

On the other hand, if the EUR/USD pair fails to break through the support level of 0.9673 today, the market will rise further to 0.9798. The pair is expected to climb higher towards at least 0.9875 with a view to test the weekly support 2. Also, it should be noted that the weekly support 2 will act as major resistance today.

Forecast :

Bearish outlook :

If the pair fails to pass through the level of 0.9798, the market will indicate a bearish opportunity below the strong resistance level of 0.9798. In this regard, sell deals are recommended lower than the 0.9798 level with the first target at 0.9637. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 0.9637. Third objective will be located at 0.9600. Nevertheless, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1 USD (notice that the major resistance today has set at 0.9798).