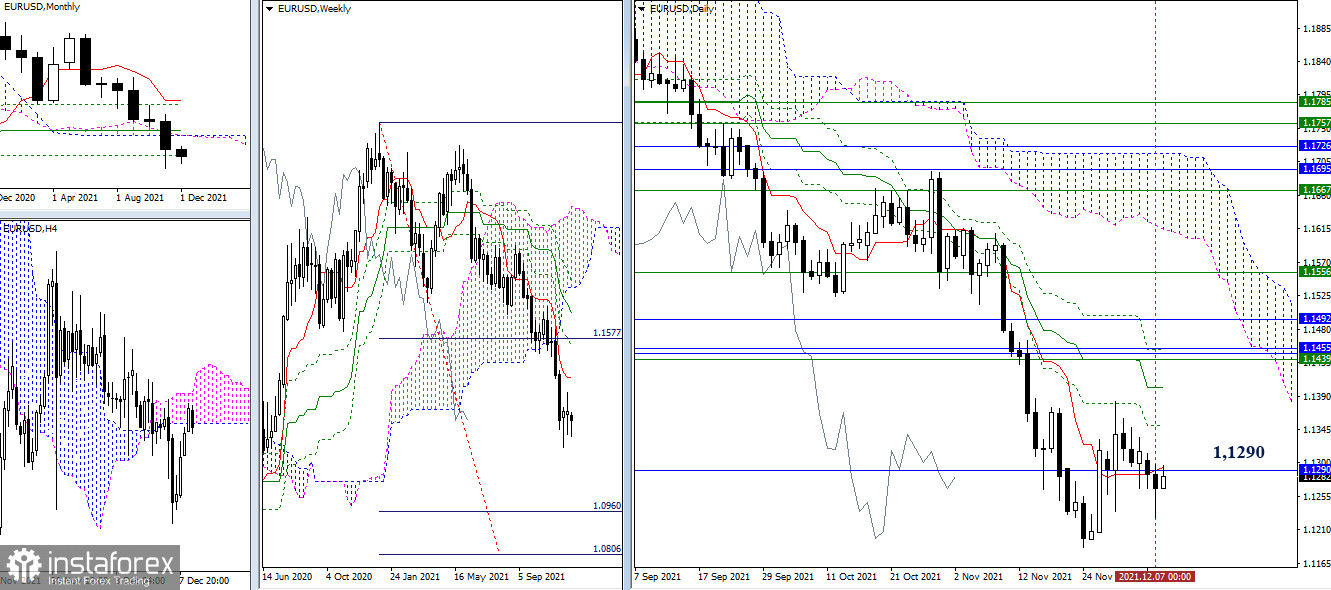

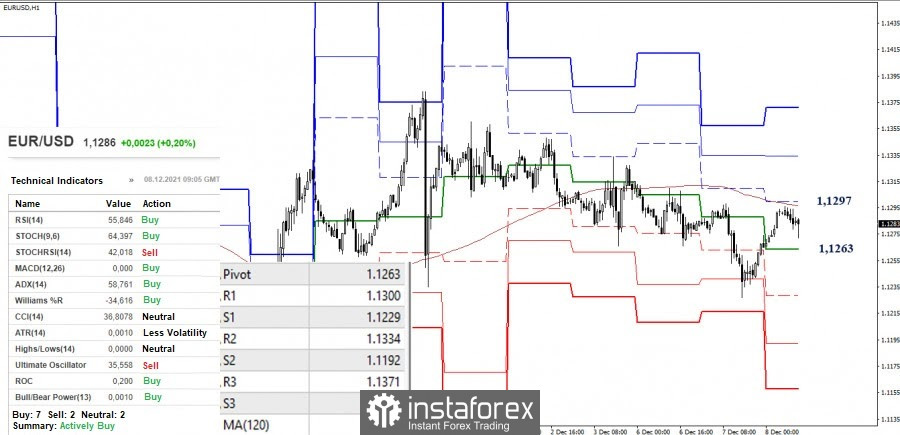

EUR/USD

The attempt of the bears to leave the attraction zone of 1.1290, where the daily short-term trend and the final level of the monthly Ichimoku cross are now joining forces, failed. At the moment, the euro is still interacting with the level of 1.1290 and is in the influence zone of this border. Here, the nearest pivot point remains in place and retain their significance. Further, the minimum extremum (1.1186) is important for the bears. As for the bears, the next interest is directed at the daily resistance levels of 1.1351 (Fibo Kijun) and 1.1401 (Kijun).

The bulls in the smaller timeframes managed to develop a fairly high corrective growth, indicating a slowdown below the key level – a weekly long-term trend (1.1297). This level has an increase in the higher timeframes, so the breakdown of this level is important not only for smaller ones. The next upward pivot points will be R2 (1.1334) and R3 (1.1371). If the key levels (1.1297 weekly long-term trend + 1.1263 central pivot level) remain on the bearish side, then bearish interests will be directed towards the breakdown of the support levels of 1.1229 - 1.1192 - 1.1158 (classic pivot levels ).

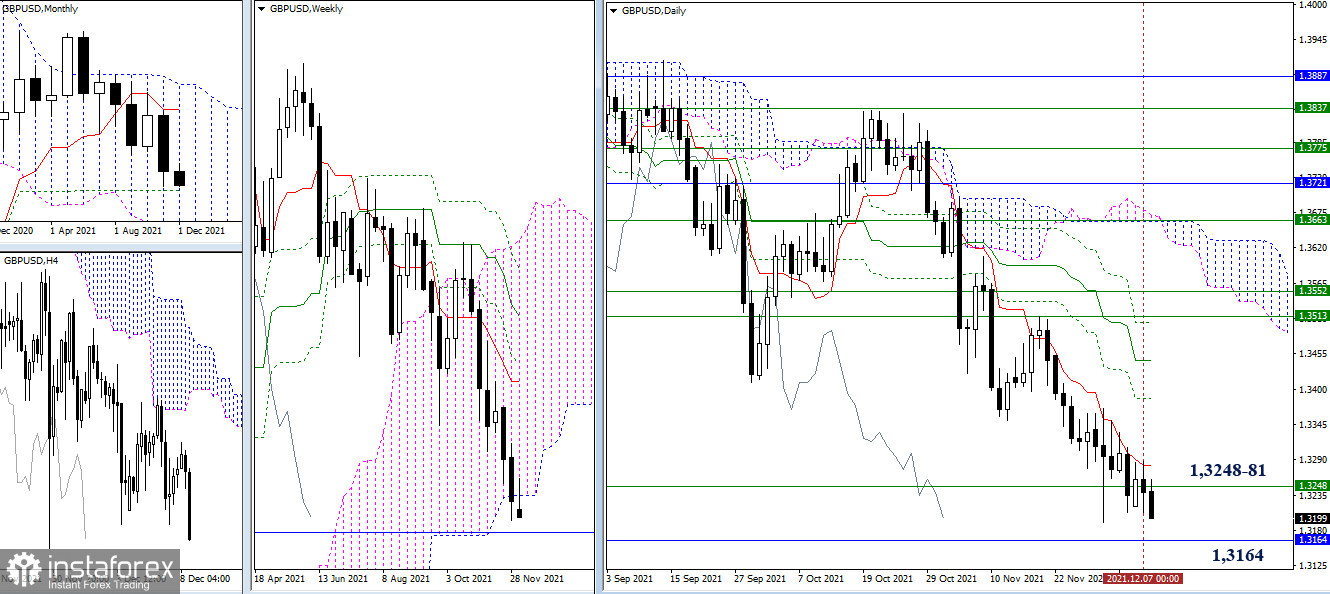

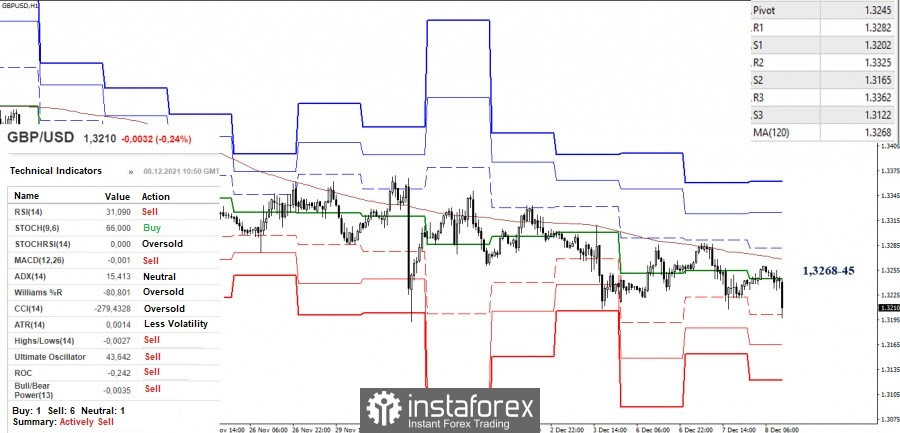

GBP/USD

The struggle for the lower limit of the weekly cloud (1.3248) continues. The attraction and force of this level continue to influence the nature of the movement. For the emergence of new prospects, the bears now need to break through not only the level of 1.3248 (weekly Senkou Span B) but also 1.3164 (monthly Fibo Kijun) located next. However, if new opportunities for the bulls appear, it is important for them to consolidate above the level of 1.3248, as well as to regain the daily short-term trend (1.3281).

The advantage in the smaller periods currently belongs to the bears. All analyzed technical instruments are set to continue the decline. A meeting with the support of S1 (1.3202) may contribute to the deceleration now. Further, the bears' attention can be directed to S2 (1.3165) and S3 (1.3122). A consolidation above 1.3268-45 (central pivot level + weekly long-term trend) will contribute to a change of priorities and the emergence of opportunities to strengthen the bullish mood.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.