The gold market has always been full of paradoxes. December is no exception. Investors are awaiting the release of U.S. inflation data, the acceleration of which should push the Fed to aggressive monetary restrictions, which will strengthen the U.S. dollar and weaken the precious metal. But XAUUSD quotes are growing. Increasingly, Omicron is presented in the news as a virus harmless to Humanity, which should reduce the demand for safe-haven assets, but gold is growing. The precious metal baffles investors, although they continue to pick up the keys to it.

According to Metals Focus, the main drivers of the decline in XAUUSD in 2022 will be expectations of an increase in the federal funds rate and a rally in the nominal yield of U.S. Treasury bonds. While low real rates on U.S. debt, new strains of COVID-19, and fears of stagflation will keep gold afloat. According to SaxoBank, the precious metal now looks like a dead in the water metal - and it cannot come to life, that is, rewrite record highs, and does not go to the bottom.

Historically, at this stage of the economic cycle, the recovery stage, gold felt out of place. Central banks abandoned the previously introduced monetary incentives, investors were looking for more attractive assets, XAUUSD quotes were falling. The speed of normalization of monetary policy was of great importance. The fear of the Fed's inaction, despite high inflation, was a favorable environment for the precious metal. On the contrary, the aggressively-minded Federal Reserve made it throw the white flag. That is, it was not inflation that determined the dynamics of XAUUSD, which is proved by their correlation, but the way the U.S. Central Bank viewed inflation.

Dynamics of inflation in the USA and gold

In this regard, U.S. President Joe Biden's focus on combating high consumer prices and the Fed's willingness to help the president speak of only one thing: hard times will soon come for gold. The year 2021 may be the first of the last three years that it closes in the red zone. But these are just flowers, we will see berries in 2022. Two or three increases in the federal funds rate will be a guilty verdict for the bulls on XAUUSD. And already on December 14-15, after the FOMC forecasts were raised, they will feel the full power of the strong dollar and the growing yields of U.S. Treasury bonds.

All the more surprising are the first positive inflows to precious metal-oriented ETFs in November since July. According to the World Gold Council (WGC), investors have increased their stocks of specialized exchange-traded funds on a net basis by 13.6 tonnes. Strange, not uncritical. To be honest, it's a drop in the bucket for expecting a serious pullback in XAUUSD.

In my opinion, the best times for precious metals are in the past. Fed Chair Jerome Powell and his colleagues intend to resolutely fight inflation, which will lead to higher Treasury yields and the strengthening of the U.S. dollar. And in such an environment, the analyzed asset, as a rule, does not feel at ease.

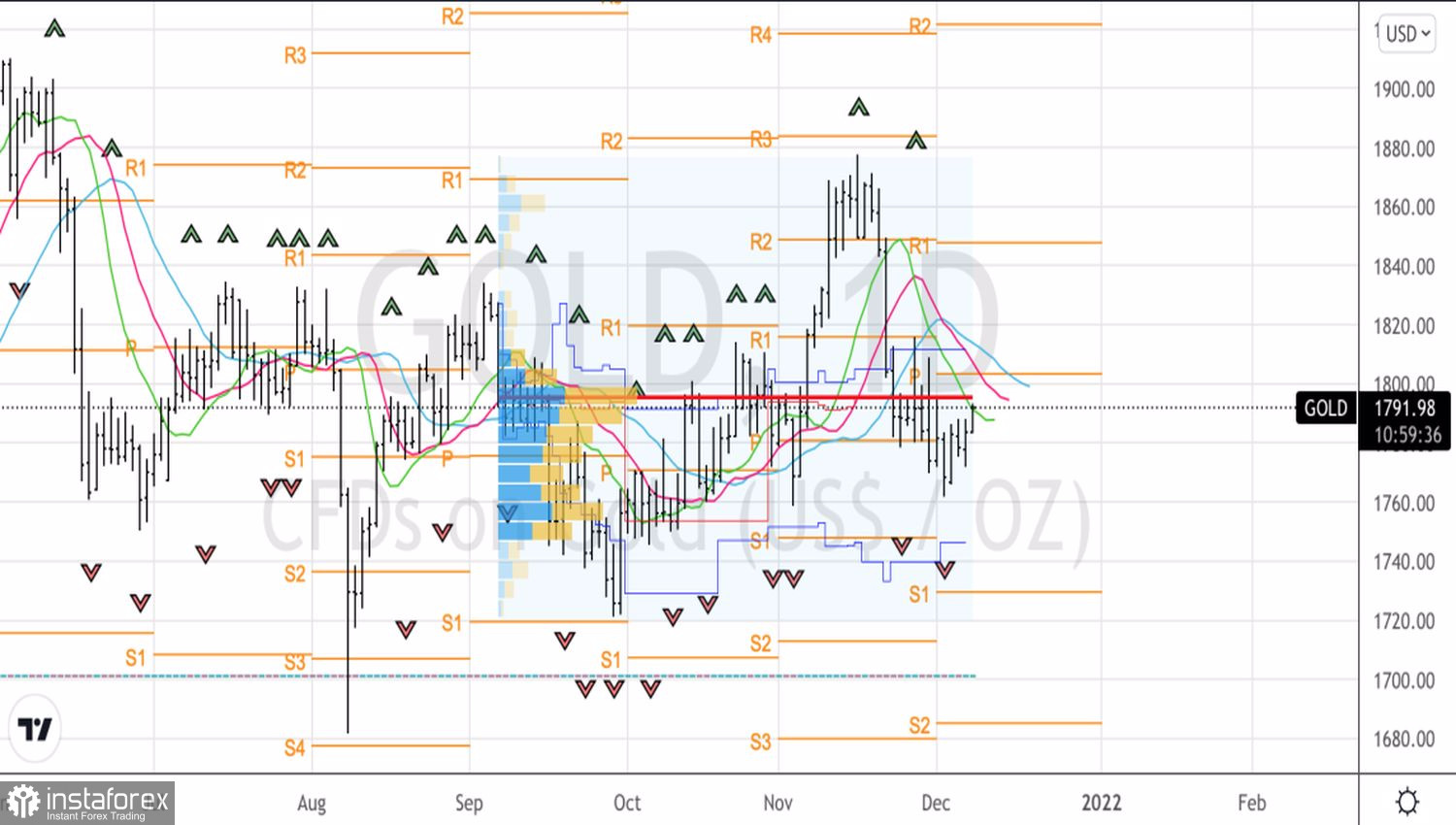

A technically unsuccessful test of the fair value at $1,795, as well as dynamic resistances in the form of moving averages near $1,805 and $1,812 per ounce, should be used for selling.

Gold, Daily chart