The euro currency was doing nothing but growing all day yesterday. And all this happened amid a completely empty macroeconomic calendar. Some data were published only in the evening. Moreover, the European Central Bank's representatives hinted at the continuation of the stimulus measures. In particular, Isabel Schnabel reassured everyone that this negative is offset by the action of the quantitative easing program although she noted the negative impact of zero interest rates on the profits of the banking sector during her speech. And from her words, it can be concluded that the European regulator still does not intend to take at least some steps towards tightening the parameters of monetary policy.

However, she mentioned these things only in passing, without focusing on them. Her speech itself was devoted to several other things. In particular, that each of the member countries of the monetary union has different conditions, and each of them needs to make efforts in different directions from the others. To some extent, this is also a hint at maintaining the current parameters of monetary policy. So, in general, the signals from the European Central Bank were rather negative for the single European currency. Nevertheless, it grew steadily.

The British currency behaved somewhat differently yesterday, as it was doing nothing but getting cheaper all day. At the same time, the information background on the pound was virtually absent. No macroeconomic statistics, no statements by representatives of the Bank of England, no worthless sayings of the wisest politicians. In general, nothing. And this is even more surprising, since the euro, which is somewhat in less comfortable conditions, was only doing what it was growing. The pound recovered only at the time of the publication of data on open vacancies in the United States. However, n the pound began to lose its position again. There is a feeling that investors simply do not believe in the pound and they do not need any reasons to sell.

As noted earlier, American statistics caused a small surge and growth of the pound, as the increase in the number of open vacancies from 10,602 thousand to 11,033 thousand was a completely unpleasant surprise. After all, this entirely contradicts the logic of a recent report by the United States Department of Labor. Here, the growth of open vacancies rather disoriented the market. And the most important thing is that this unpleasant fact has given rise to extremely uncomfortable questions, to which there are no answers yet. Investors do not like such situations and regard them as an increase in risk. So in general, the weakening of the US dollar is quite understandable.

Job Openings (United States):

The only thing that can be said with certainty is that the market is still reacting to the US statistics. Based on this, it is worth considering forecasts for applications for unemployment benefits, the publication of which will clearly affect investor sentiment. Perhaps, it will even remove some questions. So, the number of initial appeals should increase by 3 thousand, which can rather be called a statistical error, and therefore not worthy of attention. Unlike repeated requests, the number of which may be reduced by 76 thousand, which looks pretty good already. So if we proceed from these data, then the US dollar should grow at least from the moment of their publication.

The number of re-claims for unemployment benefits (United States):

The EUR/USD pair continues to follow the correction, where this time, the quote rushed towards the local high on November 30. So holding the price above the level of 1.1355 may well push buyers towards the 1.1400 level. Otherwise, stagnation is possible relative to the current values.

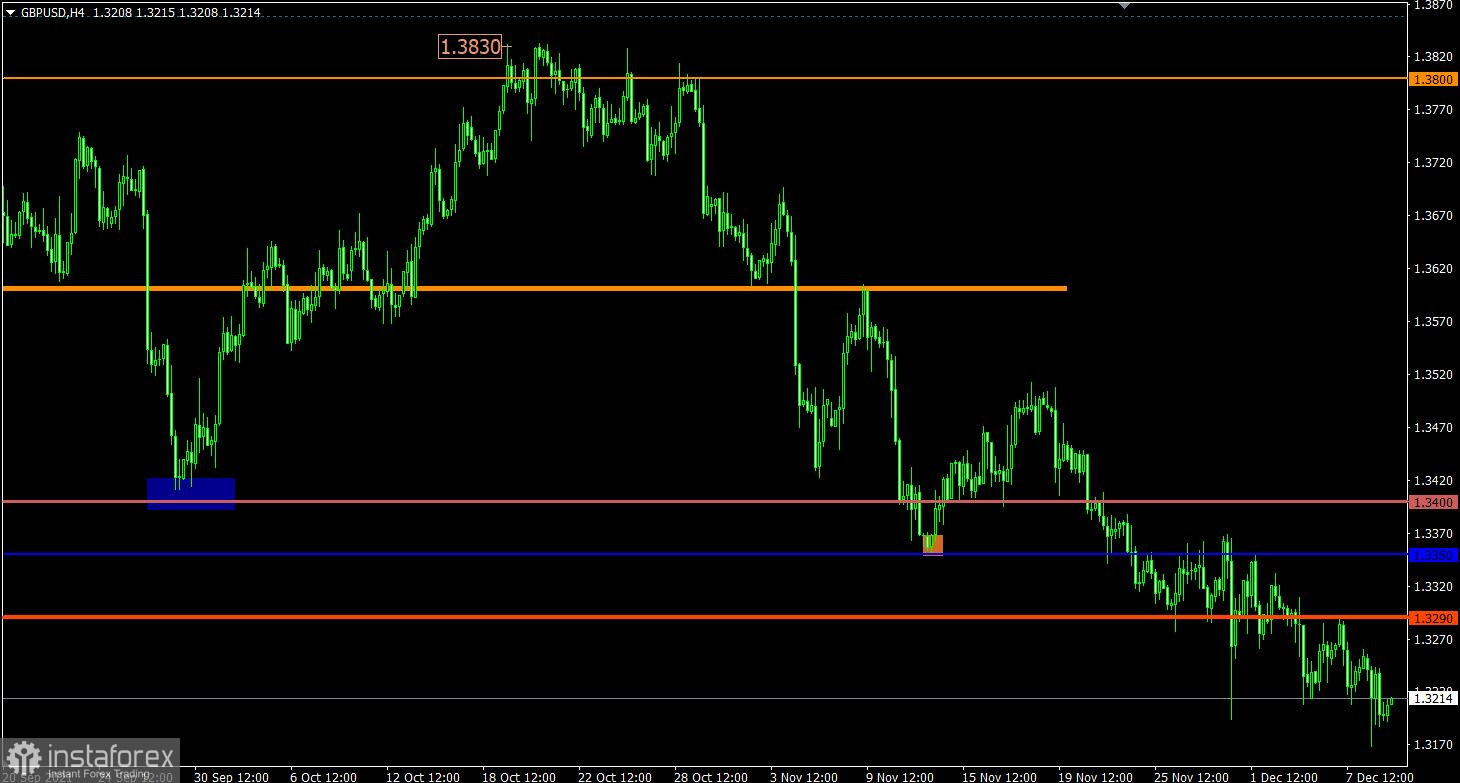

The GBP/USD pair has updated this year's local low again, but the quote failed to stay below the new values. As a result, a pullback to the side of the previously broken flat 1.3200/1.3290 appeared. So, a sell signal will come from the market when the price is holding below the level of 1.3180 in a four-hour period. Otherwise, the amplitude within the flat may resume.