Bitcoin and Ethereum have stabilized after a major sell-off at the end of last week. Ethereum is even gaining strength and is likely to make a new all-time high by the end of this year.

Recently, the Bank for International Settlements said it was concerned about the "illusion of decentralization" in DeFi. Notably, DeFi is a fast-growing part of the crypto market that provides traditional financial products without intermediaries, such as banks. Against this background, regulators in many countries are increasingly concerned about the emergence of new platforms offering DeFi services that may not be as 'decentralized' as advertised.

The Bank for International Settlements noted that the decentralized aspect tends to be illusory. "There are some incentive issues related to the fact that, through this decentralization, at some point, you end up with some agents that play an important role, and not necessarily for the best [interests] of users of financial services," general manager the bank said. However, what exactly was talked about was not fully stated. The BIS said DeFi needs to be "properly regulated" to protect investors and increase market confidence.

Meanwhile, the cryptocurrency community has reacted to such allegations, noting that DeFi has its problems, but that significant progress is also being made. Many platforms in the field are already addressing some of the systemic issues highlighted in the BIS report. The expert said that DeFi could indeed benefit from working within the new regulatory framework set up to protect investors and maintain access to markets. It is worth noting that many DeFi services are now based on Ethereum. According to research firm The Block, DeFi's Ethereum-based protocols currently account for more than $100 billion. The biggest platforms are Maker, Curve, and Compound. DeFi websites attract investors with promises of huge profits on their deposits. But many people become victims of hackers and scammers. According to analyst firm Elliptic, more than $10 billion was lost to DeFi fraud and theft in 2021.

The BIS also noted that the risks associated with DeFi are currently limited to the cryptocurrency markets. However, if this industry develops in the future, the growth of DeFi will create problems for financial stability and the economy as a whole.

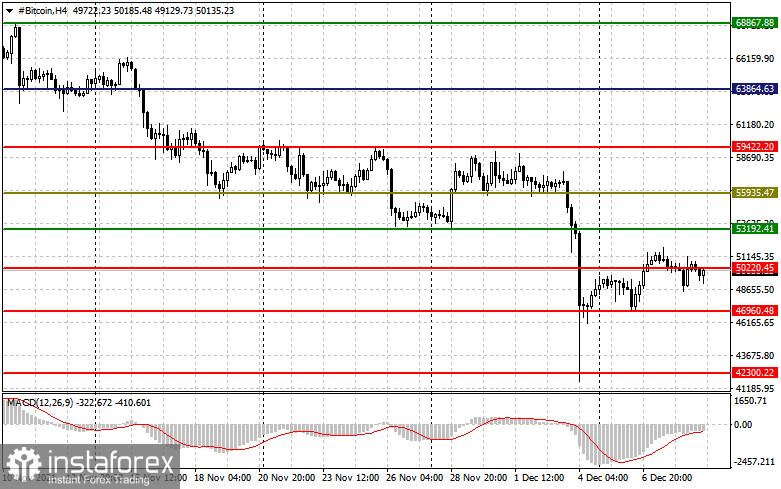

Bitcoin's technical picture

A return to $50,220 gives hope for the first cryptocurrency to continue rising at the end of the year. The main goal for the buyers is now the growth to the level of $53,190 and its breakthrough. Breaking beyond it will ensure a good recovery to $55,930, and then it will be easy to reach $59,400, which will end the fall of the cryptocurrency on December 3. The pressure on BTC will resume after it breaks through $46,900, which will lead prices to $42,300.

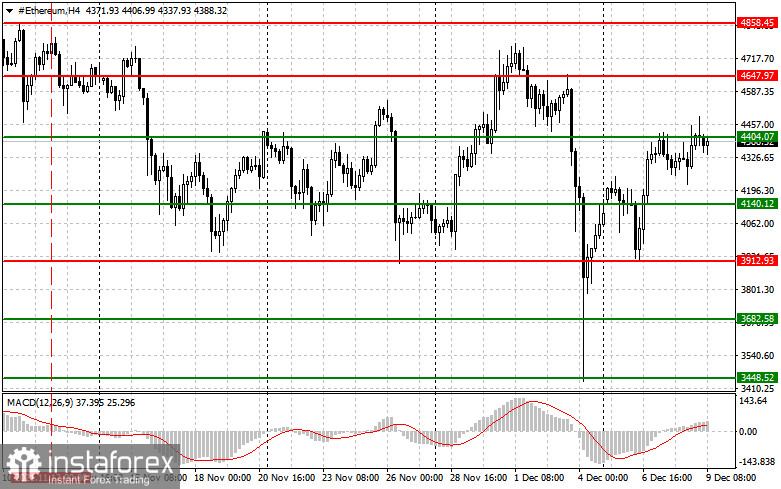

Ethereum's technical picture

The bulls are trying to reach the level of $4,404, the break-up of which will push the interest of the buyers towards $4,647, and there will be a historical high of $4,860. A good support and area where large buyers will show themselves is $4,140 level. It is the one I recommend to rely on. A break-up of this area will obviously create problems for the traders, which will push Ethereum to $3,912 and quite possibly increase pressure all the way up to a test of $3,680. It is a bad signal for the end of this year.