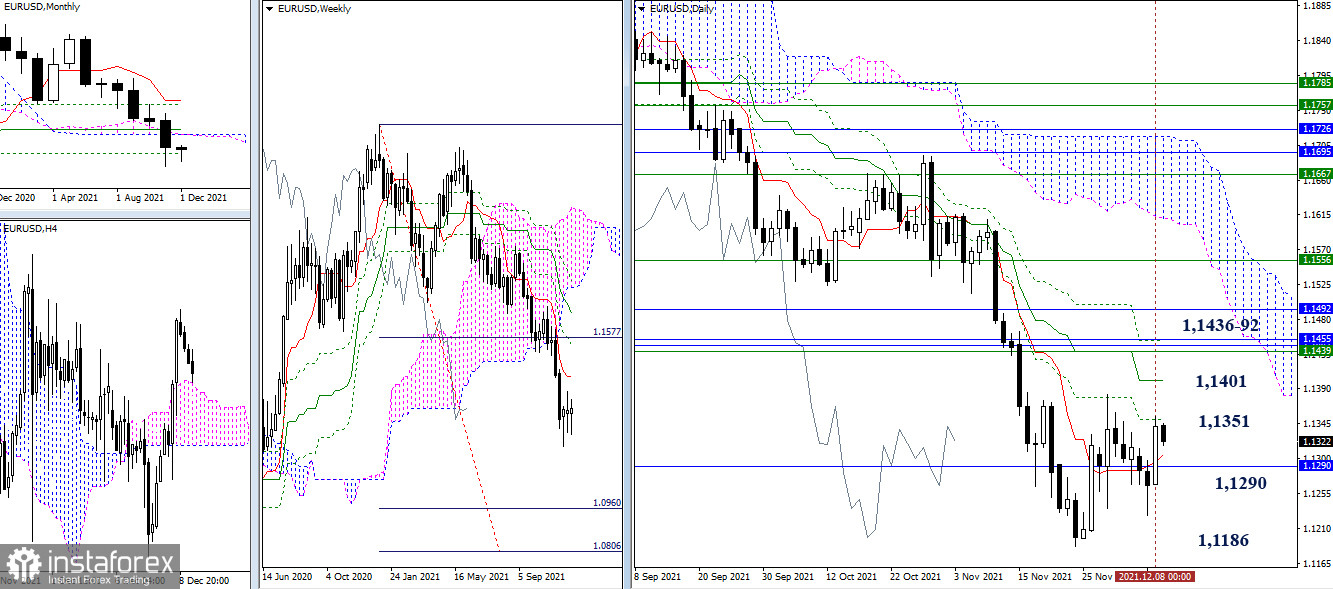

EUR/USD

The euro is currently within the reached results of the last trading week. None of the market participants have so far been able to identify obvious changes and achieve an advantage. Nevertheless, the activity belonged to the bulls yesterday. They managed to increase to the daily resistance of 1.3151, where they indicated some deceleration. Further, they are expected to have a daily medium-term trend at the turn of 1.1401. A consolidation above will allow us to consider testing the strong resistance zone, which consists of several levels of the most higher timeframes (1.1439-92) at once.

In the current situation, the main attraction and influence zone is still 1.1290 - 1.1305 (daily Tenkan + monthly Fibo Kijun), and the prospects of the bears can be considered only after going beyond the November low (1.1186).

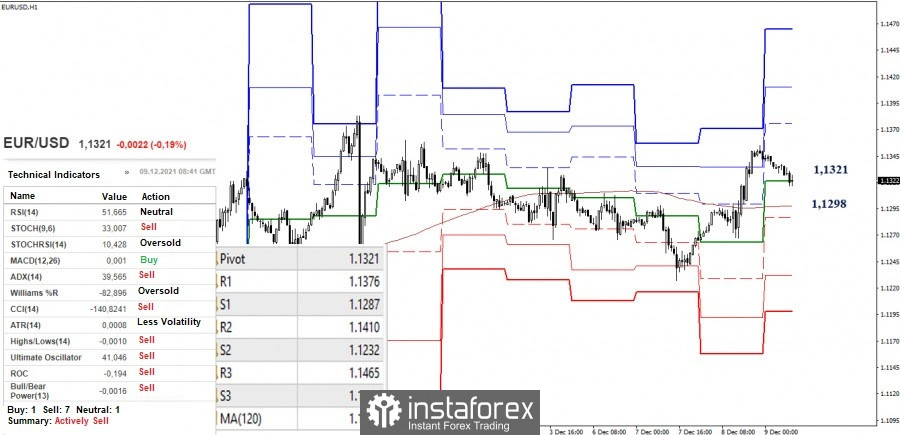

Yesterday, the bulls were able to break through the resistance of the weekly long-term trend. As a result, we can say that the advantage in the smaller timeframes now belongs to the bulls. At the moment, such an advantage will be provided by the key support levels, which are currently located at 1.1321 (the central pivot level) and 1.1298 (the weekly long-term trend). In the case of bullish activity and the continuation of the rise, the classic pivot levels serve as upward pivot points (1.1376 - 1.1410 - 1.1465 ). On the contrary, the return of the bearish strategy will make the update of the nearest low (1.1227) and the further breakdown of the minimum extreme of the higher timeframes (1.1186) to be the bears' first task.

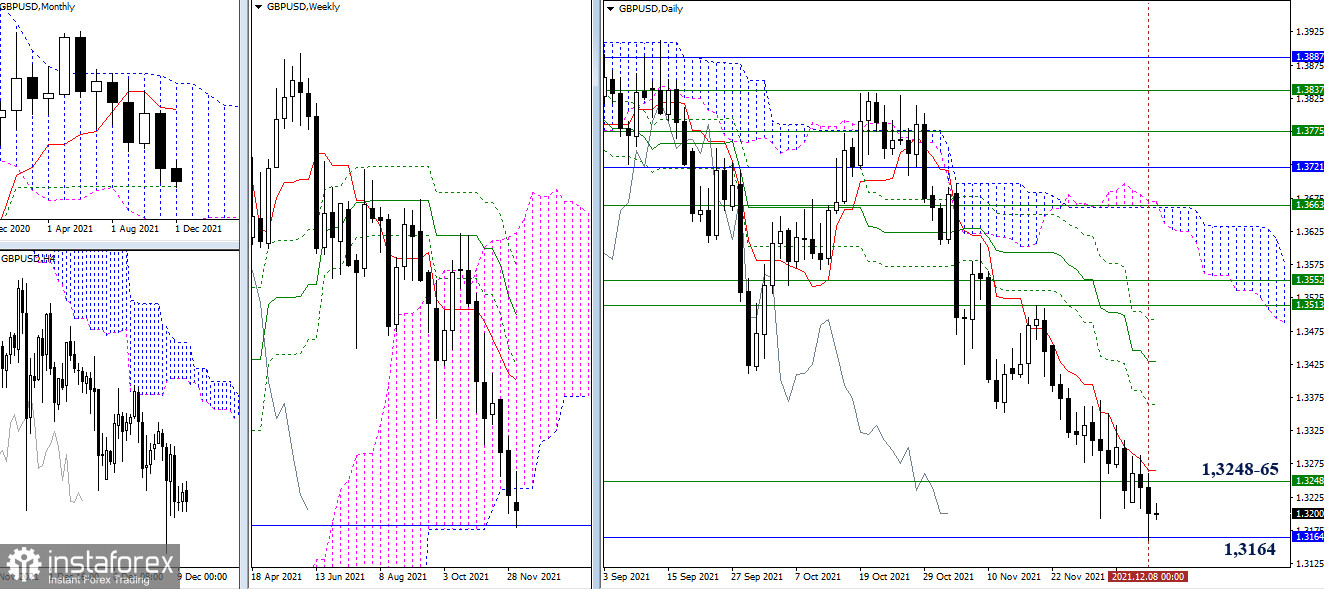

GBP/USD

The bears managed to update the last month's low yesterday and test the support for the monthly Kijun Fibo (1.3164), which is an important achievement. For short-term traders, it is desirable to indicate the minimum length of the lower shadow at the close of the week. In this situation, the best option is to close below the level of 1.3164. If the pound returns to the levels of 1.3248-65 (the lower border of the weekly level + daily short-term trend) soon, then the close of the week within these limits or above the levels will serve as the beginning of the formation of a rebound from the encountered monthly support of 1.3164.

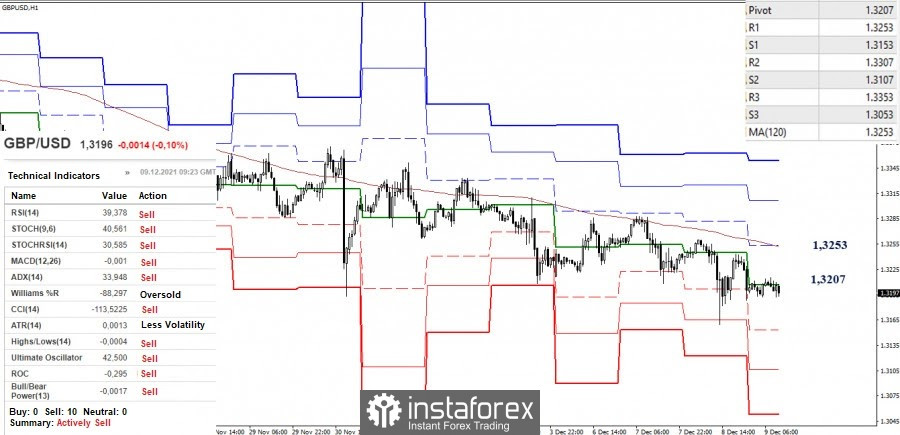

The bearish traders continued their decline yesterday, but they indicated a slowdown after meeting the monthly support. Now, a correction is developing in the smaller intervals, which is currently testing the first important resistance level (1.3207). The next key level responsible for the current balance of power is set at 1.3253 (weekly long-term trend) today. Further, R2 (1.3307) and R3 (1.3353) can act as upward pivot points. But if the decline resumes, the relevance will return to the supports of the classic pivot levels (1.3153 - 1.3107 - 1.3053).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.