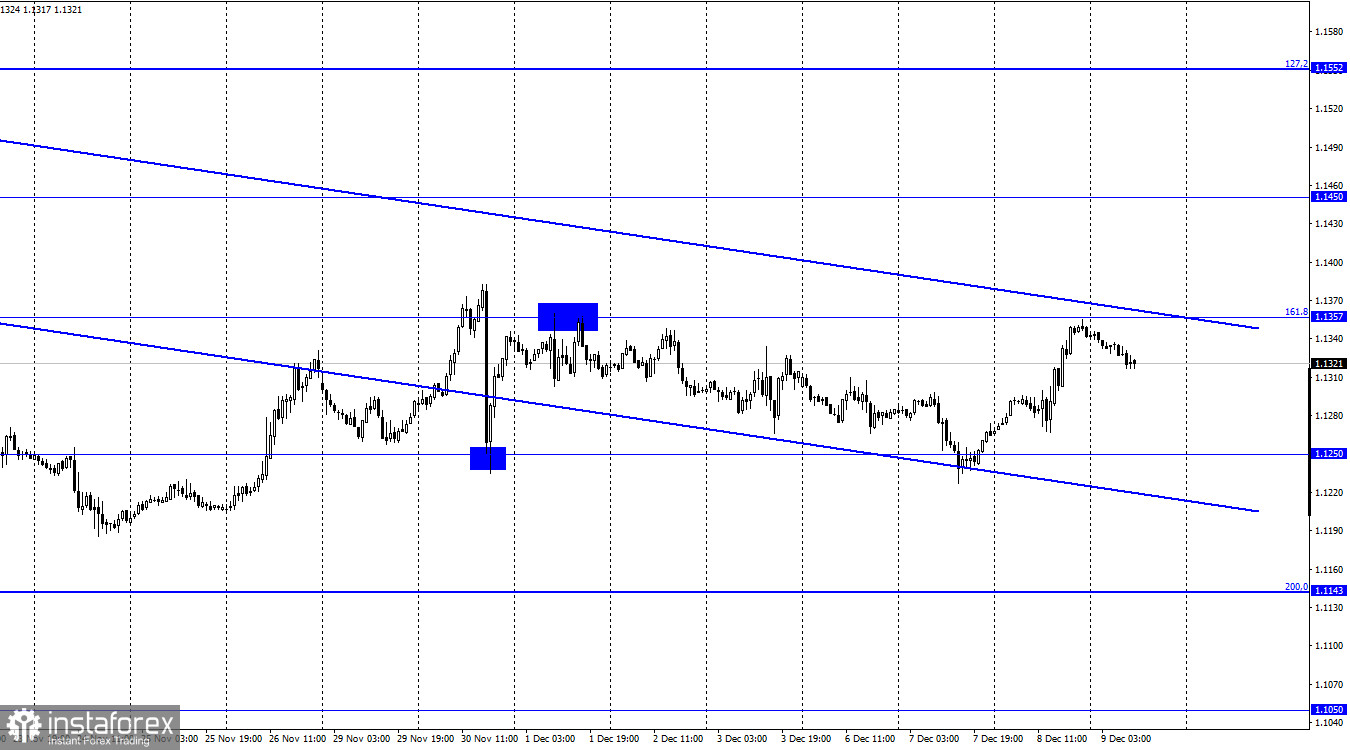

EUR/USD – 1H.

The EUR/USD rallied to the retracement level of 161.8% (1.1357) on Wednesday and stopped just a few points away from that level. Nevertheless, we can consider that there was a breakaway from this level, a reversal in favour of the US currency and a fall towards 1.1250 is underway. Also, the pair remains inside a downtrend corridor, which continues to characterize the mood of traders as bearish. Therefore, a fall in the European currency is still more likely than a rise. Meanwhile, there are no important events in the EU and the US. However, this has not stopped traders from trading quite actively in the last two days. Yesterday, only the ECB president Christine Lagarde's speech was due to take place. However, the rise of the European currency started much later than this event, so I can't relate them to each other. There will be no interesting data today in the US and the EU. Traders this week can only study the inflation report, which will be released tomorrow in the USA. And if it turns out that the consumer price index rose in November, it could lead to another strong rise in the US currency.

Therefore, if the quotes do not leave the downward corridor by tomorrow, the pair is likely to resume falling towards the 1.1250 level. Inflation would have to be weaker than forecast in order for the US dollar to continue falling this week. It should also be noted that in spite of a quite strong rise of EUR yesterday, the currency could not yet even close above its previous peaks, which were formed on November 30. I should also point out that the pair has so far managed to move up by only 150-160 points from its annual lows. Therefore, completion of the fall in quotations is unlikely. If the Fed announces an acceleration of QE cuts next week, this could also have a favourable effect on the US dollar. Therefore, I believe that the dollar will rise against the Euro currency. The euro, on the other hand, has no chance. Perhaps something will change after the ECB meeting. Perhaps Christine Lagarde will also announce a significant reduction in stimulus. But at the moment there are no signs.

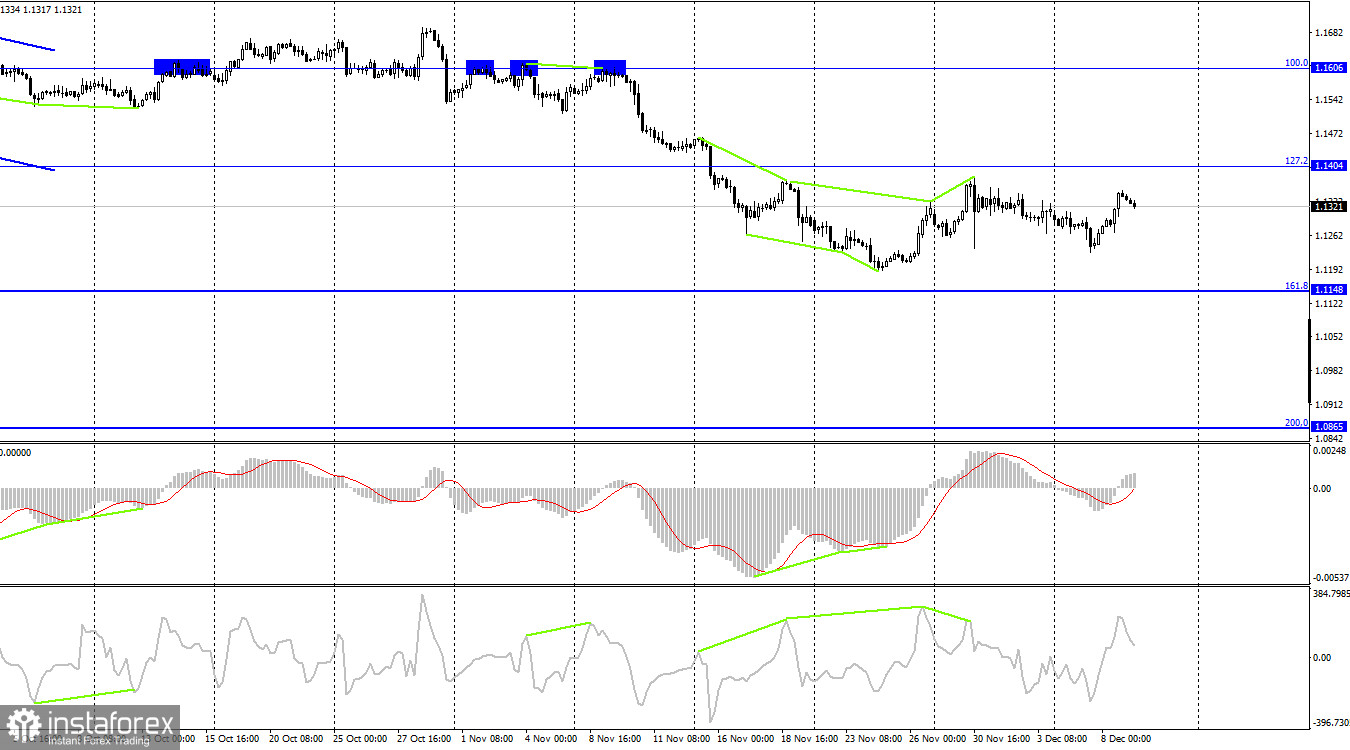

EUR/USD – 4H

On the 4-hour chart, the pair performed a reversal in favor of the EU currency and started the process of growth towards the correctional level of 127.2% (1.1404). A rebound from this level will work in favor of the US currency and resume falling towards the retracement level of 161.8% (1.1148). There are no emerging divergences in any indicator today. A close above the 127.2% Fibonacci level would increase the chances of a further rally towards the next retracement level of 100.0% (1.1606).

News calendar for US and EU:

US - Number of initial jobless claims (13-30 UTC).

On December 9 there will be no important economic events in the EU. There will only be one report in the USA, which is unlikely to affect the mood of traders during the day. Therefore, the information backdrop today will be extremely weak.

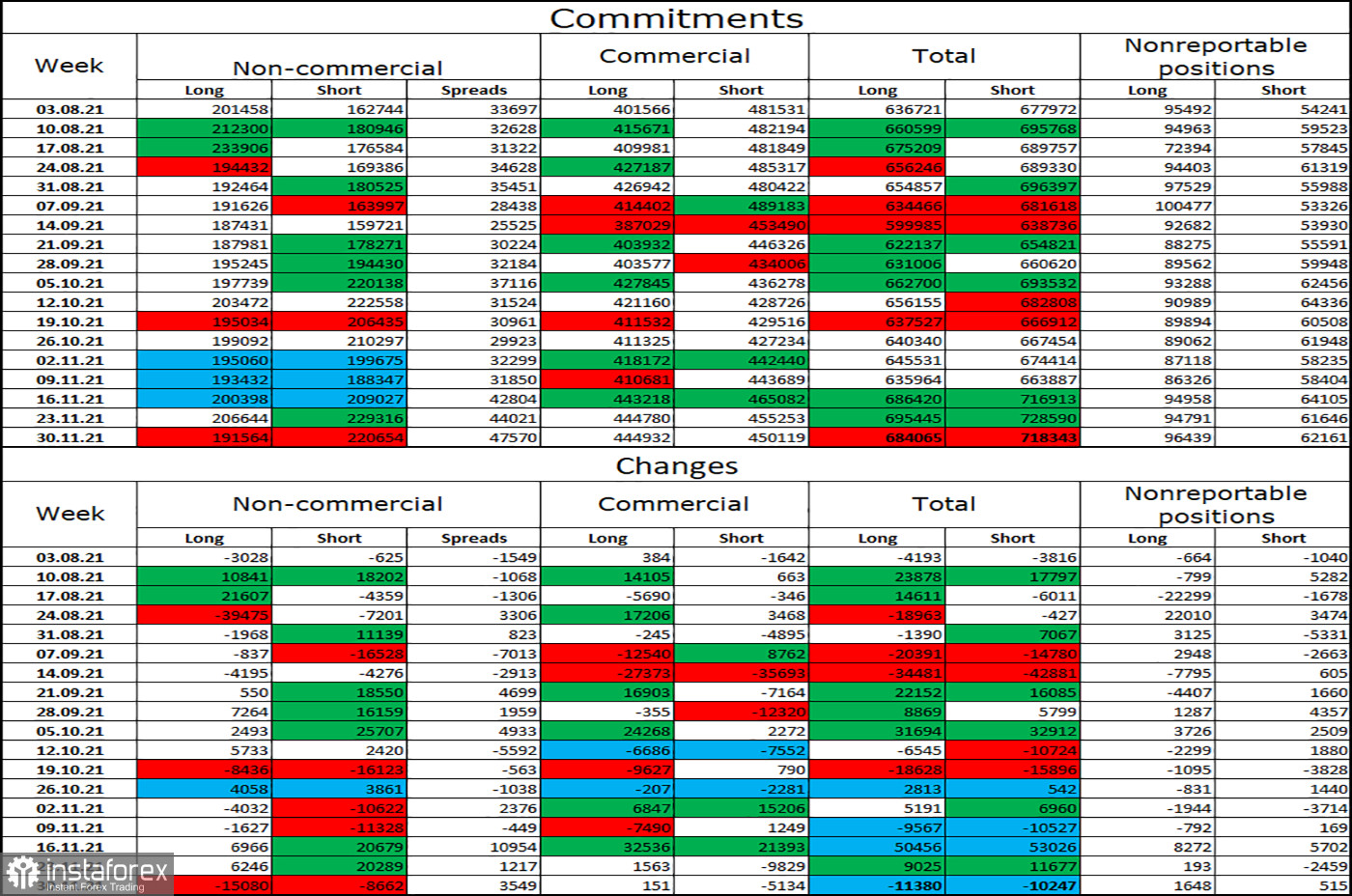

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became much more "bearish" again. However, this time speculators did not increase shorts but closed about the category of contracts. But longs and large volumes. In total, 15080 long contracts on the euro currency and 8662 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 191 thousand, and the total number of short contracts – to 220 thousand. Thus, the "bearish" mood among the most important category of traders continues to strengthen. Consequently, the European currency may resume falling in the near future. According to COT reports, there are no signs of possible long-term growth of the euro yet.

EUR/USD outlook and tips for traders:

Sales of the pair could be opened at the rebound from the 1.1357 level on the hourly chart with a target of 1.1250. I recommend new purchases of the Euro at a close above the corridor on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.