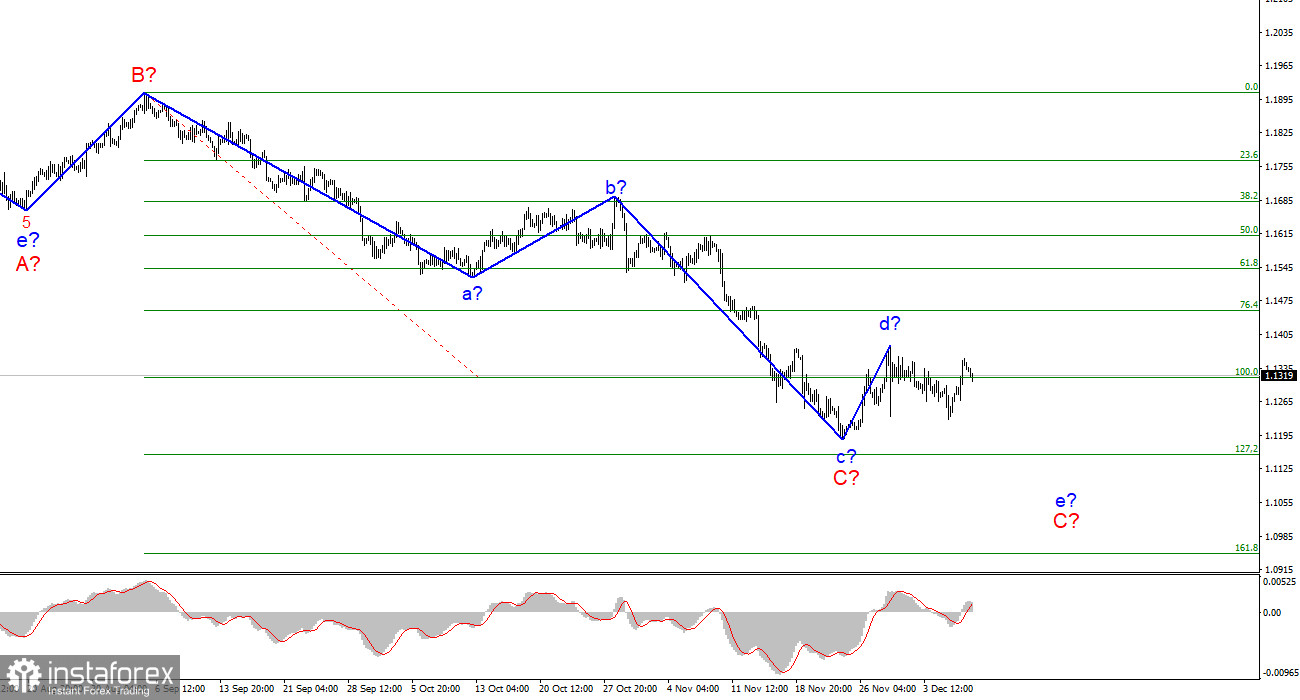

Wave pattern

The wave layout for EUR/USD on the 4-hour chart remains complete and does not require any changes. The a-b-c-d-e section of the trend, which was formed at the very beginning of the year, should be interpreted as a wave A, and the subsequent rise in the instrument is seen as a wave B. Thus, the formation of the assumed wave C continues and can take a very extended form. At the same time, we can assume that the formation of the new ascending wave has been completed, presumably, the wave d in C. If the current layout is correct, an internal wave e in C is being built. A successful attempt to break through the 100.0% Fibonacci level will indicate that the market is ready to go short on the instrument. So, the pair may continue to fall throughout the week towards the estimated target of 1.1152 which corresponds to the 127.2% Fibonacci retracement where the entire trend section can complete its formation. I also would like to highlight that the C wave is still taking on a corrective form. So, the entire descending section of the trend, which originated in January 2021, may take a five-wave form of A-B-C-D-E instead of a three-wave structure. It will be possible to give a more precise forecast when the C wave completes its formation.

Upcoming ECB and Fed meetings unlikely to change market sentiment

There was no news background for the EUR/USD pair on Thursday. Throughout the day, no major news was published either in the US or in the EU. Only one report on the number of jobless claims in the US could possibly influence the market sentiment. But even this report was not able to move the markets. At the moment, investors are fully focused on three important events: the report on inflation in the US, the Fed meeting, and the ECB meeting. The situation around inflation is more or less clear. This report will be released tomorrow. A higher inflation rate will mean that demand for the US dollar will also rise. Central bank meetings are a little more complicated, but the core idea remains the same. The Fed is likely to announce that it is going to speed up the process of cutting the QE stimulus program, which may further support the US currency. Besides, Jerome Powell's speech at the press conference is expected to be hawkish. Recently, the Fed Chair told the Congress that the current high inflation should no longer be called a "temporary phenomenon." Thus, everyone now expects Powell to take active steps to combat soaring prices. As for the ECB, markets do not expect much from it. There is very little information about measures that the European regulator may take in the near future. Christine Lagarde has stated on several occasions that a rate hike is unlikely to happen next year, and the future of the PEPP program is also vague. It is due to end in March next year, but another APP incentive program could be expanded instead.

Conclusion

Based on the analysis above, I can conclude that the formation of the descending wave C is likely to be completed. However, the internal structure of the assumed wave d suggests that another descending wave e may start to form soon. Thus, I advise selling the pair with the targets around 1.1152 for every sell signal of the MACD indicator.

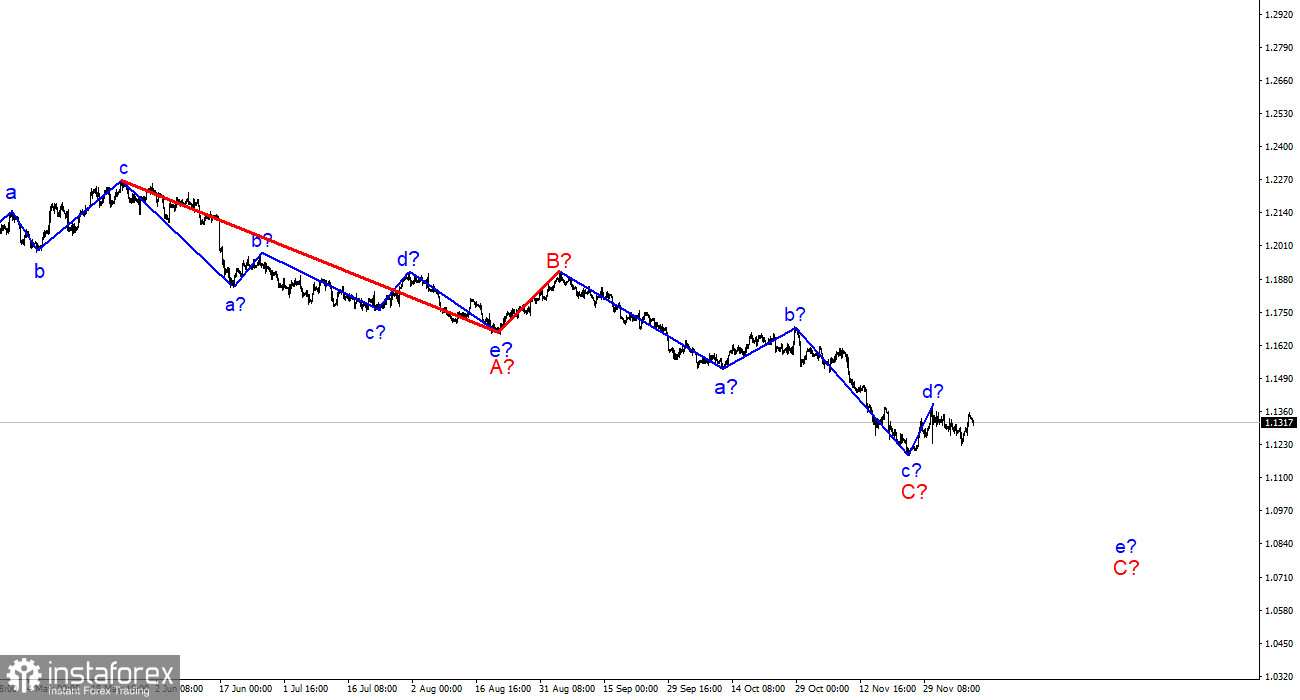

Higher time frame

The wave layout on the higher time frame looks quite convincing. The quotes continue to move lower. The descending section of the trend that was initiated on May 25 takes the form of a three-wave correctional pattern A-B-C. This means that the downtrend may continue for several more weeks until the C wave is fully formed. It should take a five-wave structure in this case.