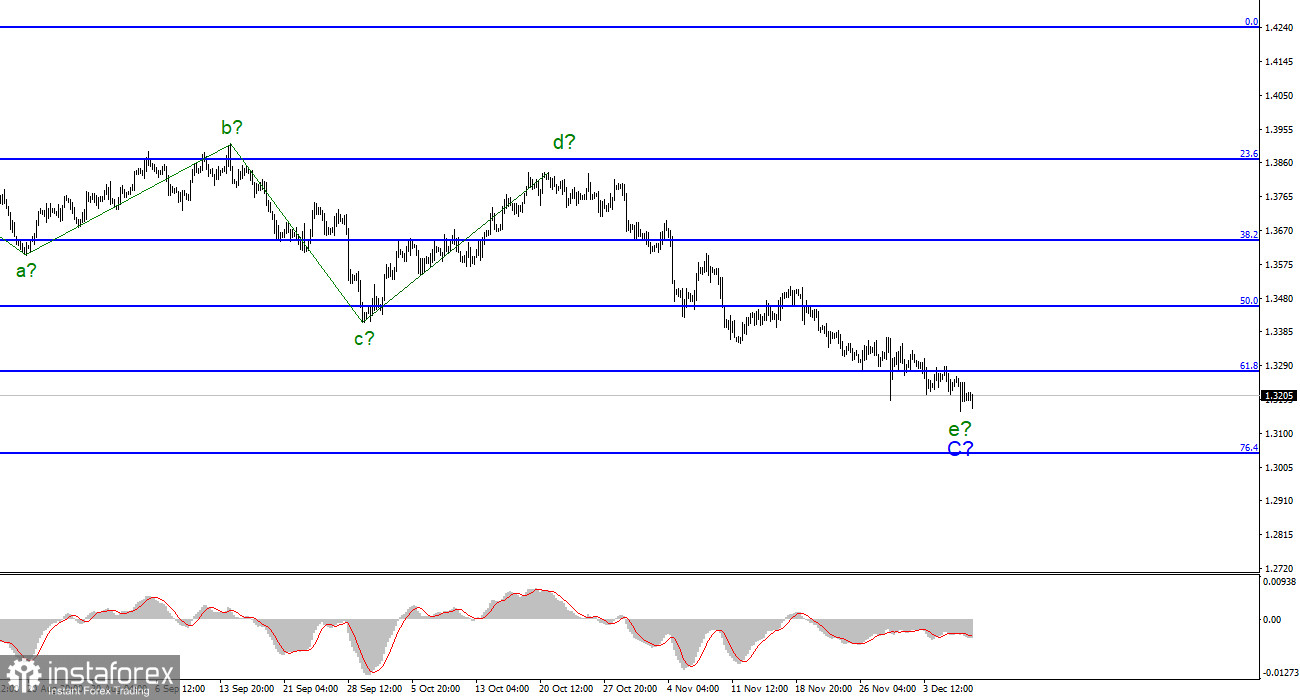

Wave pattern

The wave counting for the Pound/Dollar instrument continues to look quite complicated, but at the same time quite convincing. If the current wave pattern is correct, then the construction of the last wave in the composition of C is now continuing. The decline in the quotes of the British pound in recent days leads me to think that the wave e in C may take a longer form than I expected earlier, but at the same time, it is time for it to end.

Unfortunately, the news background is not on the side of the pound sterling right now. Thus, this factor can cause new sales of the instrument. The low of November 30 was broken yesterday, which led to the complication of wave e. I am waiting for the EUR/USD instrument to build another downward wave, so the GBP/USD instrument can continue building an elongated wave e at this time. It would be ideal if both instruments completed the construction of their downward trend sections at the same time.

News from the UK continues to sink the pound

The exchange rate of the Pound/Dollar instrument did not lose a single point on Thursday, but at the same time, the markets continue to look only in the direction of sales. As before, I cannot conclude that the construction of the descending wave is completed, since the instrument cannot move away from the reached minimums even by 100 basis points. And the news background continues to drown the pound.

A month earlier, the Bank of England surprised everyone when they cleared that it could raise the key rate without waiting for the end of the stimulus program. The markets believed in this even a few days before the last November meeting. The rate was not raised, so the probability of an interest rate increase in December immediately rose to almost 100%.

However, according to the latest information, the BoE will refuse to make this decision, as it does not know what the situation with the Omicron strain may turn out to be. Recall that U.K. Prime Minister Boris Johnson has introduced to tighten pandemic measures from next Monday to counter the spread of a dangerous strain. BoE policymaker Michael Saunders is already ready to change his mind about raising the rate to the opposite, as he fears that Omicron could cause new damage to the British economy.

Thus, analysts now agree that the Bank of England will not raise the rate in December, but will delay this decision for a month or two. And the British pound loses its next hope for support from the news background. If BoE raised the rate next week, the British pound could improve its position against the U.S. dollar (however, everything also depends on the Fed's decisions). Without this, it is very difficult to count on an increase in the tool. The only hope now is for the wave counting, which assumes the completion of the downward trend section.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. The supposed wave e resumed its construction. Thus, now I would advise you to wait for new "up" signals, which can be formed in case of an unsuccessful attempt to break through the 1.3046 mark, which corresponds to 76.4% Fibonacci, or in case of a successful attempt to break through the 1.3273 mark, which is equal to 61.8% Fibonacci.

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed), but there is no unambiguous confirmation of this yet. The entire downward section of the trend may lengthen more than once.