To open long positions on GBP/USD, you need:

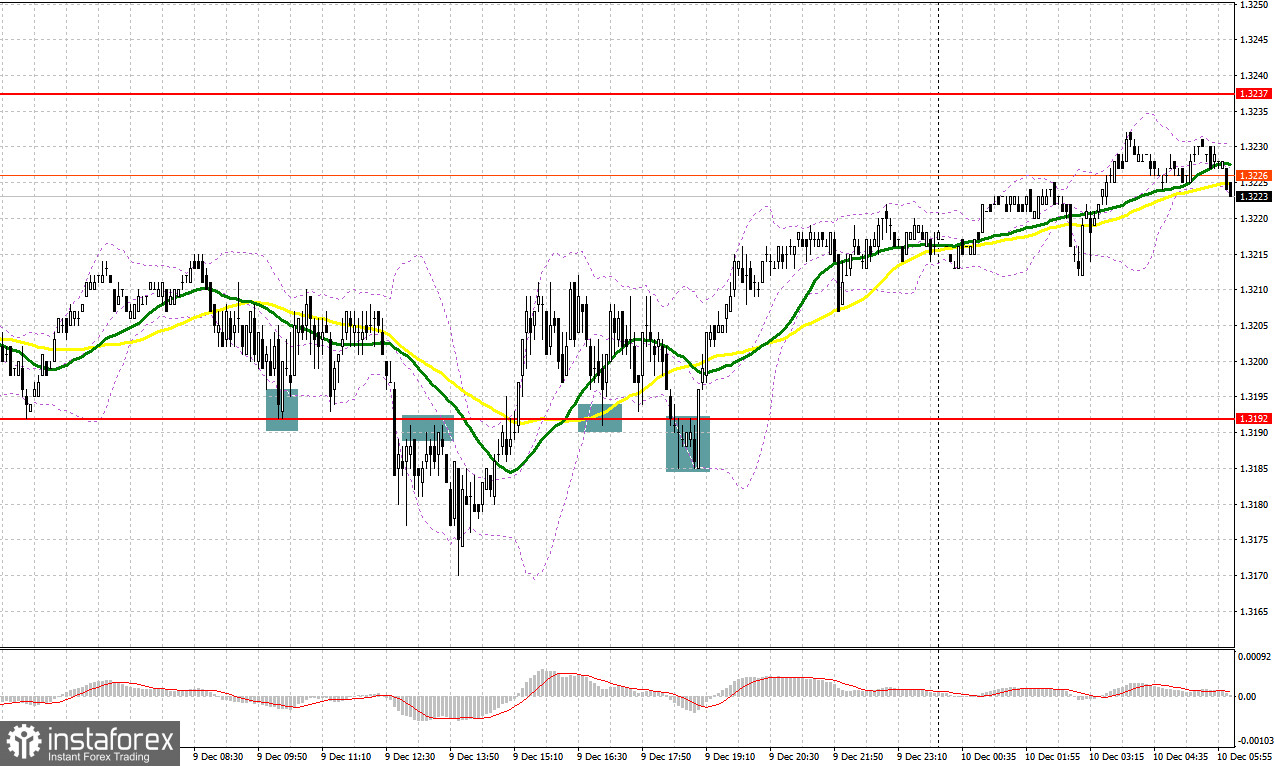

Yesterday we generated quite a lot of signals to enter the market. Let's take a look at the 5-minute chart and figure out the entry points. The volatility for the GBP/USD pair was extremely low in the first half of the day. An indistinct attempt by the bears to break below 1.3192 only led to a signal for the formation of long positions, but the matter did not turn into a sharp growth. The bears broke below 1.3192 and tested this area from the bottom up closer to the US session, which gave an entry point to short positions. The decline was about 20 points, after which the demand for the pound returned, and trading moved above 1.3192. Several false breakouts of this level during the US session led to good signals to buy the pound, which brought about 30 points of profit. What were the signals for EUR/USD yesterday?

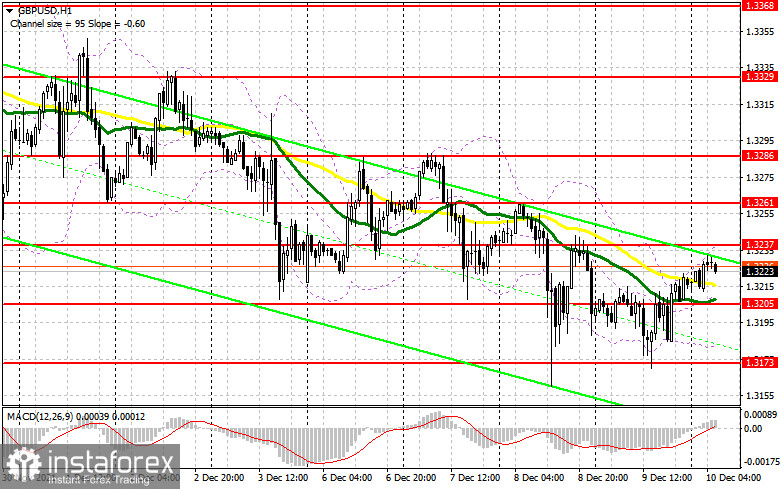

A fairly large number of important statistics for the UK will be released today, which can indirectly affect the pair's direction. The October data is no longer of much concern to traders, although serious discrepancies with forecasts may lead to a surge in volatility. You can pay attention to the change in the volume of UK GDP, where less active growth is predicted than in September, as well as data on the change in the volume of industrial production, which declined in September. Slight growth is expected of the indicator. The fact that the pound slightly recovered yesterday, and bulls did not allow the next local low to be updated - all this plays on the bulls' side. Today they will have to try very hard to keep the initiative, and they will be able to do this only if a false breakout is formed in the 1.3205 area. The pound will rise and resistance at 1.3237 can be tested only in this case, which is quite important from a technical point of view. Strong data can help push the pair above this range, so the 1.3237 update from top to bottom will provide an additional entry point for buying GBP/USD with the prospect of a breakthrough of 1.3261 closer to the afternoon. A breakdown of this range will open the possibility of renewing the 1.3286 high, where I recommend taking profits. The next target is the resistance at 1.3329, but it will be possible to reach it only in case of a sharp slowdown in inflationary pressure in the US. In case the pound falls during the European session and traders are not active at 1.3205, then bulls will have problems again. I advise you to take your time with long positions for this reason. Only the formation of a false breakout near the next low of 1.3173, which was formed at the end of yesterday, will provide an entry point for long positions. It is possible to buy GBP/USD immediately on a rebound in the area of 1.3144, or even lower - from 1.3111, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears will heavily rely on inflation in the US and its big rise at the end of the year. All the bears need now is to protect the 1.3237 level, on which a lot depends in the short term. Forming a false breakout there can create a new entry point into short positions, followed by a decline to the 1.3205 area - a kind of middle of a new horizontal channel. It is also very important for the bears to update local lows, which will preserve the downward trend. Weak data on the UK economy may increase the pressure on the pair, so the breakdown of 1.3205 will create new problems for bulls and keep the pair in the downward trend channel. A reverse test of this range from the bottom up will provide an excellent entry point, which will push GBP/USD to new lows: 1.3173 and 1.3144, where I recommend taking profits. The next target will be support at 1.3111, but we will fail to achieve it in case of strong data on inflation in the US. In case the pair grows during the European session and the bears are not active at 1.3237, it is best to postpone selling until the larger resistance 1.3261. I also recommend opening short positions there only in case of a false breakout. Selling GBP/USD immediately on a rebound is possible only from a large resistance at 1.3286, or even higher - from a new high in the 1.3329 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for November 30 revealed that both short positions and long positions increased. However, there were more of the latter, which led to an increase in the negative delta. Last week there was very little fundamental statistics on the UK economy, and all the speeches of Bank of England Governor Andrew Bailey were dovish, which did not give traders confidence in the future of the British pound. And if the representatives of the BoE preferred to take a more wait-and-see attitude, then the speeches of Federal Reserve Chairman Jerome Powell, on the contrary, were of a hawkish character. In his comments, he spoke quite a lot about the expected changes in monetary policy towards tightening. The reason for this is rather high inflation, which has grown from "temporary" to permanent, which creates many problems for the central bank. An equally serious problem for the UK is the new Omicron coronavirus strain, which could lead to another lockdown and the country's quarantine. So far, the authorities have to closely monitor the development of the situation with the new strain, which negatively affects the economy at the end of this year. Let me remind you that the Fed will hold a meeting next week, at which a decision on the bond purchase program will be made, so demand for the US dollar is expected to remain in the shorter term. The COT report indicated that long non-commercial positions rose from 50,122 to 52,099, while short non-commercials increased from 84,701 to 90,998. This led to an increase in the negative non-commercial net position: delta was -38,899 against -34,579 a week earlier. The weekly closing price dropped from 1.3397 to 1.3314.

Indicator signals:

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market before the release of important statistics.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3237 will lead to a new wave of growth of the pound. A breakout of the lower border of the indicator around 1.3190 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.