Today, we will analyze both the released and the upcoming macroeconomic reports that may affect the EUR/USD pair and will sum up the results of this weekly session. So, in the morning, the consumer price index was published in Germany. In annual and monthly terms, the growth of consumer prices in Europe's leading economy came fully in line with the forecast. In yearly terms, consumer prices increased by 5.2%, while in monthly terms, they turned negative and declined to - 0.2%. At 16:30 Moscow time, the United States will report on changes in the consumer price index. The indicator is expected to grow by 0.7% in November while its base value should go up by 0.5%. US CPI is projected to rise by 6.8% year-on-year and its base value - by 6.9%, excluding prices for energy and food.

In general, almost all emerging economies have faced surging inflation. This was caused by the COVID-19 pandemic which led to disruption in the supply chain and an imbalance between supply and demand. This factor forces the world's leading central banks to revise their monetary policies towards tightening. First of all, this concerns the tapering of stimulus programs. Everyone is talking about this both in the US and the EU. However, if the US Federal Reserve has admitted that inflation may not be temporary, the European Central Bank (ECB) still thinks that soaring inflation will not last long. Thus, the Fed's position is more hawkish than that of its European counterpart. The US regulator is expected to completely cut back on its quantitative easing program next year and start the process of raising interest rates. Today's data on changes in consumer prices in the US can be considered the most important event of the current week, and next week it will certainly be the Fed meeting.

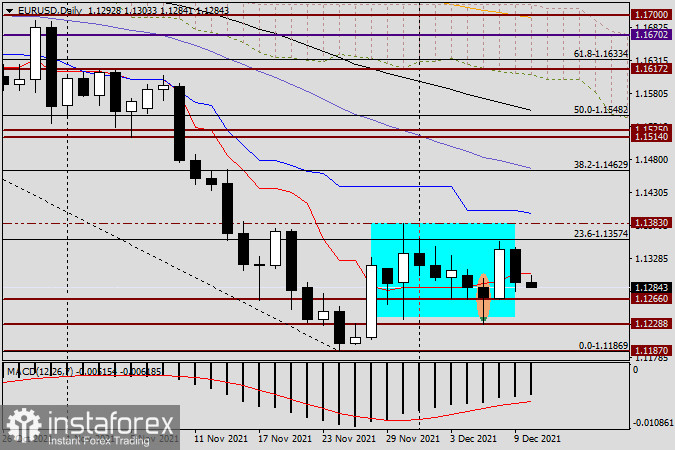

Daily chart

As you can clearly see on the daily EUR/USD chart, the pair developed a proper uptrend upon the formation of the highlighted candlestick which was a reversal bullish pattern. However, it did not continue for long. Having met strong resistance in the key zone of 1.1350-1.1360, bears regained control of the pair yesterday. As a result, the price closed the session on December 9 below the red line of the Tenkan Ichimoku indicator, as well as below the strong and important technical level of 1.1300. For today, buyers will need to close the session above the Tenkan line and the level of 1.1300. It would be even better if they updated yesterday's highs at 1.1355. As for euro/usd bears, they will have to break through the support at 1.1266, where the lows were posted on December 8, and then storm the next level of 1.122 which is the low of December 7.

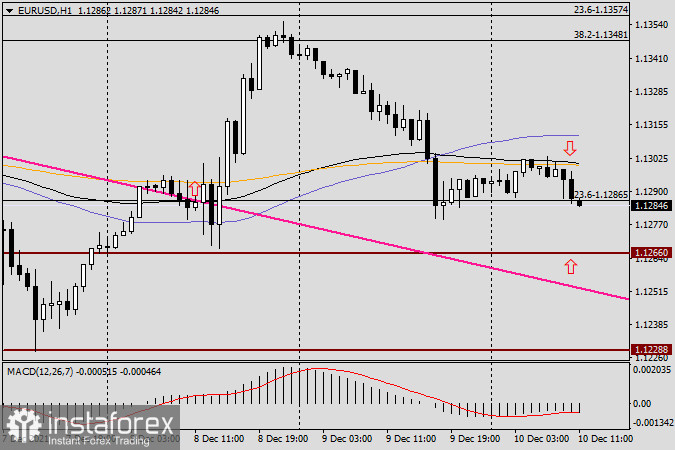

H1 chart

If you consider opening new positions, I advise you to buy the pair on a rollback to the 1.1275-1.1255 area. Firstly, this is where the support level of 1.1266 and the pink resistance line are located. Besides, the price hasn't yet made a clear pullback from this line. I suggest going short on the pair in case the price rises to the key level of 1.1300 and fails to break through it. This important level is reinforced by the 50 SMA at 1.1311. On Monday, we will consider a new trading plan based on the actual close of weekly trades.

Good luck!