The GBP/USD pair was trading at 1.1208 at the time of writing. In the short term, it rebounded as the Dollar Index crashed. Fundamentally, Retail Sales registered only a 0.0% growth versus the 0.2% expected, while Core Retail Sales reported a 0.1% growth compared to the 0.1% drop forecasted. The greenback depreciated a little after mixed retail sales.

The USD took the lead again after the Prelim UoM Consumer Sentiment came in at 59.8 points above the 58.7 points expected and compared to 58.6 points in the previous reporting period.

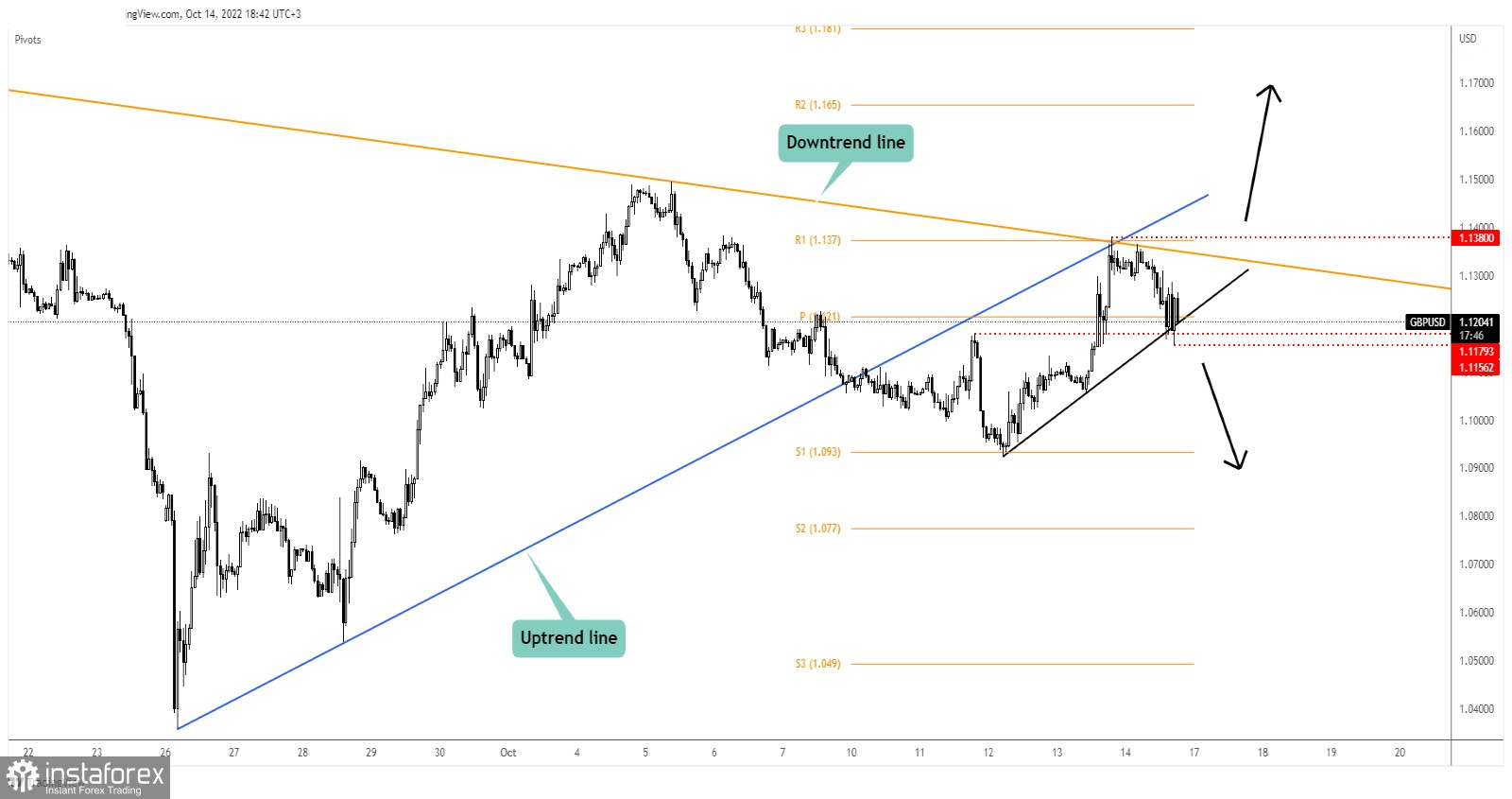

GBP/USD Rejected By The Downtrend Line!

As you can see on the h1 chart, the rate retested the downtrend line and now it has turned to the downside again. It challenges the minor black uptrend line and the 1.1179 static support. 1.1156 stands as a support as well.

After dropping below the uptrend line, the GBP/USD pair was somehow expected to register a strong drop, but the rate failed to take out the weekly S1 (1.0930) static downside obstacle. It has rebound in the short term and it has retested the downtrend line and the broken uptrend line.

GBP/USD Forecast!

As long as it stays under the downtrend line, the bias remains bearish. A valid breakdown below the minor uptrend line and below 1.1156 activates more declines and offer us a new chance to go short with a first potential target at S1 (1.0930).