Analysts continue to believe that the upward trend persists but admit a new fall.

Bitcoin rose slightly on December 11 and 12. However, this growth was so weak that it can not be counted. I still believe that the first wave of a new downward trend is completed and, if this is true, then the construction of a corrective wave 2 or b has begun and will continue at this time. However, the wave pattern will be analyzed a little lower. I just wanted to make it clear from the beginning of the article that a new increase in quotes is expected along the waves. But according to the news, a new decline in bitcoin is expected. This week, the results of the Fed meeting will be summed up and a decision will most likely be made to accelerate the abandonment of the economic stimulus program. Initially, the Fed announced the pace of $ 15 billion per month, but analysts agree that they will be raised in December to $ 20-30 billion. And everyone, as one, believes that this will hit the cryptocurrency market.

Bitcoin may come under pressure after the Fed meeting.

What could happen to the cryptocurrency market if the Fed announces a higher rate of withdrawal from stimulus? This will only mean that in the coming month, the American economy will receive not $ 95 billion, but $ 80-90 billion. Based on this, I believe that a new decline is possible, but it is unlikely to be strong or collapse. Most likely, the dynamics of a further decline in bitcoin (since the downward section of the trend has not yet been completed) will be quite moderate. Thus, nothing will prevent BTC from continuing to build a corrective wave this week. The meetings of the ECB and the Bank of England should not worry crypto investors at all, because no changes in the parameters of monetary policy are expected there.

The IMF warns that bitcoin could be a bubble.

At the same time, a report was published on the IMF website, which characterizes bitcoin. Analysts concluded that the capitalization of bitcoin, which has grown to 2.5 trillion, may indicate both technological innovation and an ordinary "bubble". IMF experts note that after the emergence of a new strain, investors began to invest more often in cryptocurrencies (although bitcoin was only declining at that time). The IMF believes that bitcoin is now overvalued, and its estimates are overestimated. The IMF also offers all cryptocurrencies for payment and investment, to control all companies and entities that deal with cryptocurrencies, as well as to entrust regulation to central banks and securities commissions.

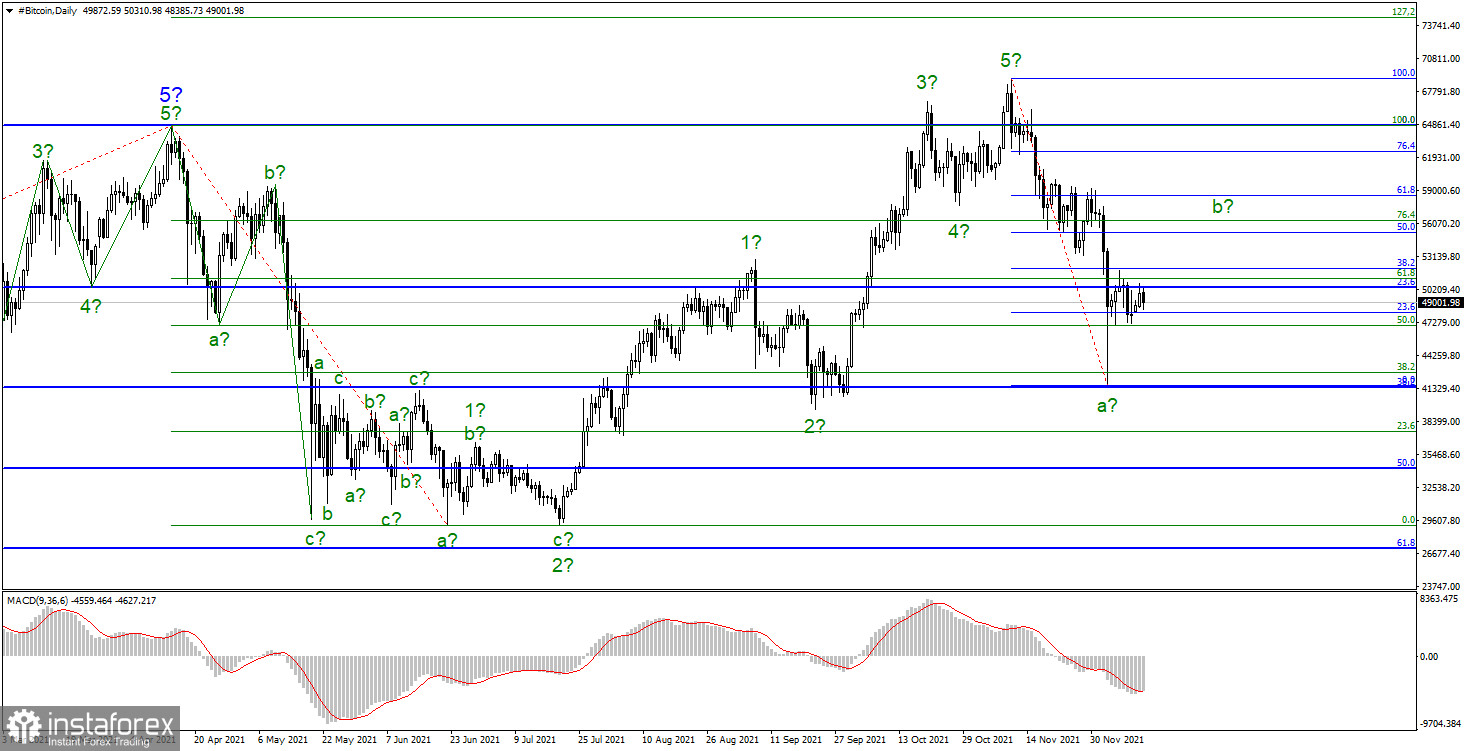

The current upward section of the trend still does not cause any doubts. The wave pattern was refined after the instrument made a successful attempt to break the maximum of the assumed wave 3. Now the whole picture looks like a completed five-wave impulse upward trend section, which began its construction on July 20. The departure of quotes over the past four weeks from the reached highs means the completion not only of the expected wave 5, which turned out to be shortened but also of the entire upward section of the trend. After a decline of $27,000, an increase in quotes would mean the construction of a corrective wave b. Therefore, at this time, the increase in bitcoin quotes may resume within this wave with targets located near the $ 52,077 and $ 55,295 marks, which corresponds to 38.2% and 50.0% Fibonacci from wave a. And after the completion of this wave, the construction of a new descending wave c will begin, the minimum of which should be much lower than the $ 41700 mark. And falling to this mark can change the upward trend to a downward trend.