The US consumer price index rose in November by 6.8% yoy, which is the highest level since the energy crisis of 1979/1982. So, the scenario that inflation will exceed 7% in Q1 2022 becomes dominant.

The FOMC meeting, which will take place on Wednesday, will bring a lot of new information about how the regulator intends to build monetary policy in the coming months. Hawkish rhetoric is expected to grow, which is equivalent to an increase in demand for the US dollar.

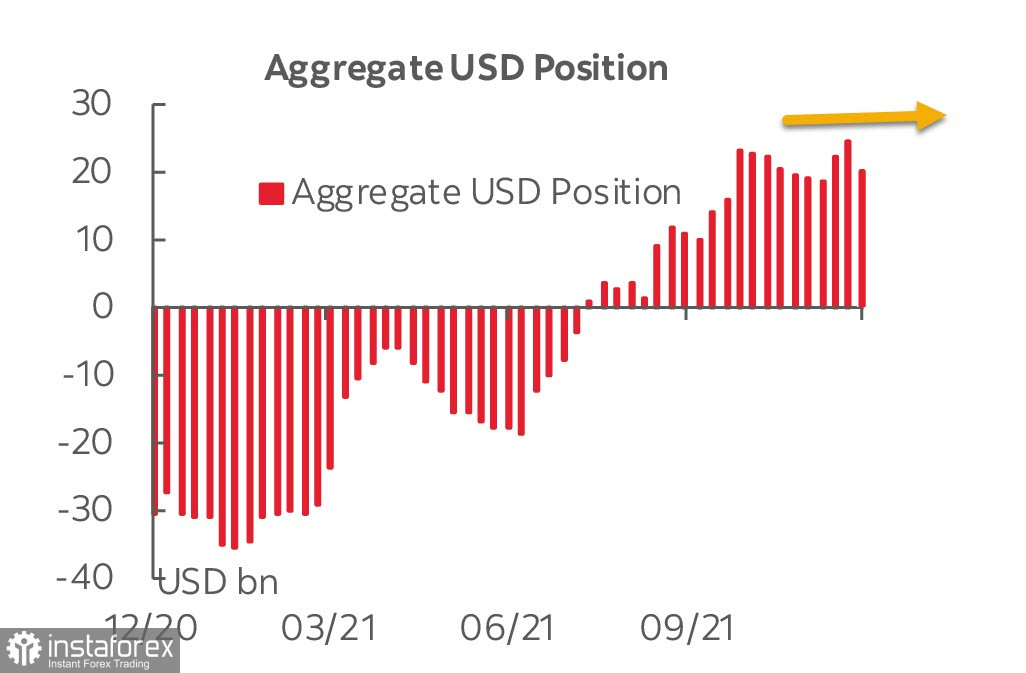

The CFTC report published on Friday showed that investors are not yet ready to continue expanding the long positioning for the US dollar. There was a fairly significant reduction in the long position of USD during the reporting week by 4.4 billion against major currencies. At the same time, the cumulative long position remains at the level of 20.3 billion, which allows us to maintain an optimistic attitude towards this currency.

The main trend that can be seen in the report is a noticeable reduction in short positions on the euro and the yen, which most likely reflects an outbreak of panic due to the beginning of the spread of Omicron. Both of these currencies are most correlated with the VIX volatility index, that is, the growth in demand for them is equivalent to the growth in demand for protective assets.

EUR/USD

This week's main event s the ECB meeting on Thursday, December 16. Despite the fact that the eurozone lags behind the pace of recovery in the US and the ECB in a number of key indicators, there is no need to get ahead of the Fed. Hawkish notes will still be heard at the end of the meeting. It is expected that purchases under PEPP will be completed in March 2022, but the ECB will not escalate tensions with the possible development of a liquidity crisis and may raise purchases under the APP program to stabilize the markets. Accordingly, the decision on the APP can be made either on Thursday or postponed for Q1 2022.

In any case, a strong increase in volatility is possible by the end of Thursday. Central Banks, the Fed, and the ECB will demonstrate a hawkish attitude, but it is unclear in what proportion they will share this attitude among themselves. Perhaps, the markets will not pay attention to the ECB at all if the Fed manages to surprise them a lot or the Fed issues the results of the meeting in exact accordance with expectations.

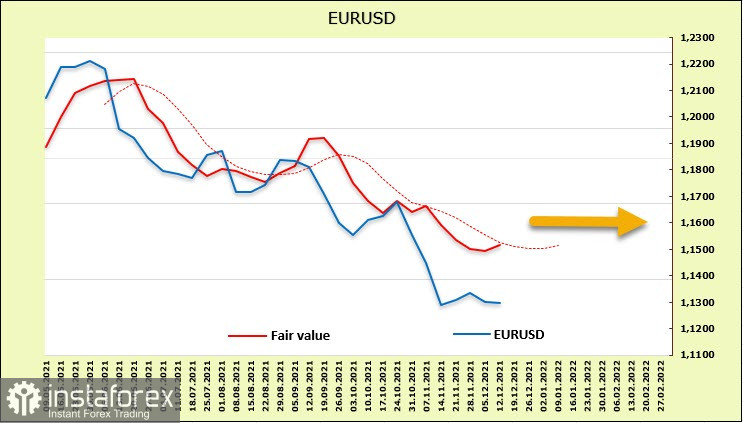

The euro's net short position immediately fell by 2.125 billion, to -1.169 billion. We can say that the trend for a further sale of the euro has lost all momentum and there is currently no strong direction. The estimated price is still below the long-term average, but it is clearly trying to turn up.

An attempt to update the low is possible while the euro is almost in the middle of the descending channel, and further movement will largely be determined by the outcome of the FOMC meeting on Wednesday. In this case, it is possible to establish a new low in the zone of 1.1050/70 after the breakdown of the support level of 1.1187. If the FOMC decision is not hawkish enough, then a strong upward correction is possible. Here, the upper limit of channel 1.1450/80 will be the nearest target. The next resistance is 1.5020.

GBP/USD

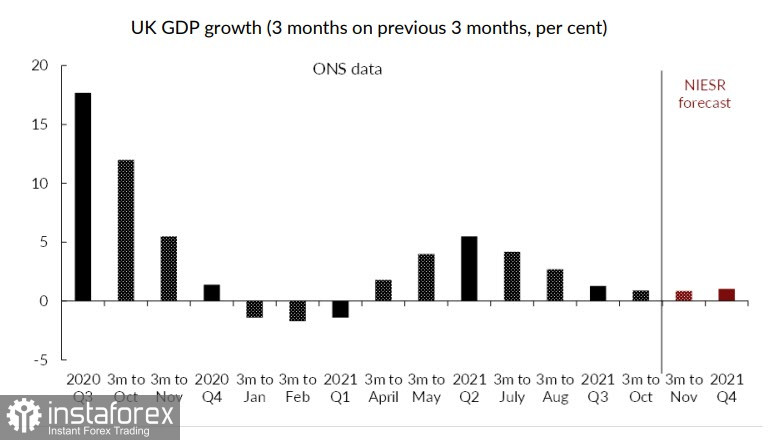

The extensive package of macroeconomic data for the UK published on Friday was disappointing. GDP growth as of October was only 0.1% with a forecast of +0.4%. Industrial production in October fell by 0.6%, while e annual rates fell from 2.9% to 1.4%. NIESR forecasts GDP growth in November by 0.6%, with a forecast of 1% for the entire fourth quarter growth. This is noticeably lower than in the US.

In general, we can say that the UK economy did not grow after Brexit, which, apparently, was the calculation. Despite a moderate increase in average wages, the next few months will be characterized by a slowdown in growth, inflation, and increased income inequality.

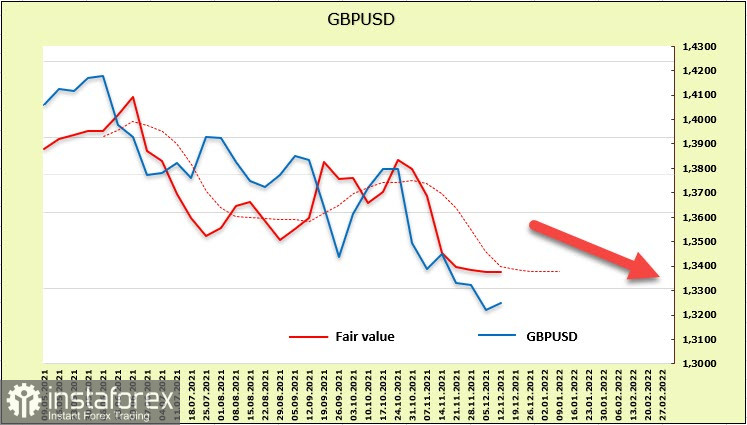

The change in positioning for GBP over the week is insignificant. The net-short position is -3.168 billion, the estimated price is lower than the long-term average, and there is no bullish reversal.

The pound is expected to continue to decline. The key support level of 1.3160 will most likely be broken. The long-term target is 1.2830, but it is too early to speak about the achievability of this goal until the results of the Fed meeting are summed up.