Weekly pivot point has already placed at the price of 1.1127. The Pound pair is at an all-time lowest against the dollar around the spot of 1.0345, but the trend rebounded to reach the top of 1.1494. The GBP/USD pair is inside in downward channel. For three weeks GBP/USD pair decreased within a down channel, for that GBP/USD pair hits new lowest 1.1055 and 1.0989. Consequently, the first support is set at the level of 1.0918. Hence, the market is likely to show signs of a bullish trend around the area of 1.0918 and 1.0900. If the GBP/USD pair fails to break through the support prices of 1.0918 and 1.0900. today, the market will rise further to 1.1000 so as to try to break it. The GBP/USD pair is one the best overall investment this week. However, if you want to try to improve the growth of the GBP/USD pair, thus it seems great to buy above the last bearish waves of $1.0918 and 1.0900. Buy orders are recommended above the major's support rates of (1.0918 and 1.0900) with the first target at the level of 1.1055. Furthermore, if the trend is able to breakout through the first resistance level of 1.1055. Furthermore, if the trend is able to breakout through the first resistance level of 1.1055 (1.1055 - to test the 61.8% of Fibonacci retracement levels). We should see the pair climbing towards the next target of 1.1241. We should see the pair climbing towards the next target of 1.1241 (to test the 78% of Fibonacci retracement levels). The pair will move upwards continuing the development of the bullish trend to the level 1.1055 - golden ratio 61.8%. It might be noted that the level of 1.1241 is a good place to take profit because it will form a new double top in coming hours.

End of week :

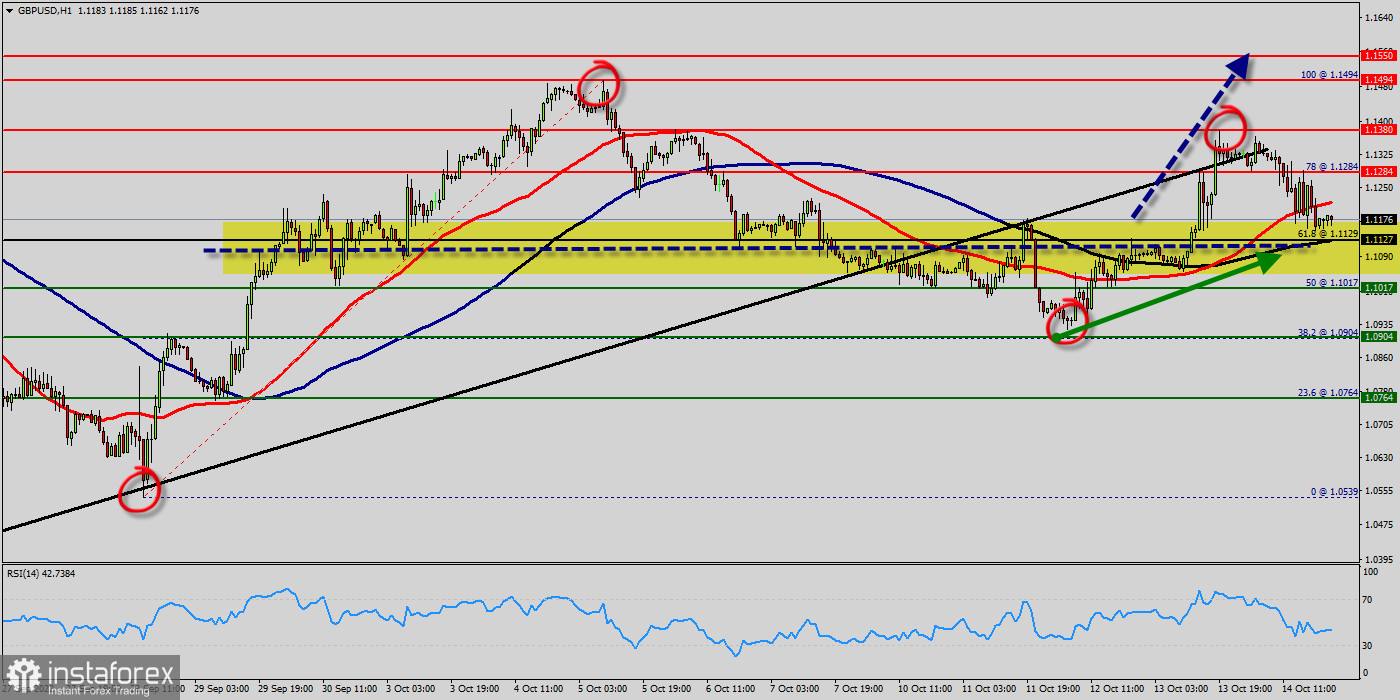

The GBP/USD pair is at highest against the dollar around the spot of 1.1284 - 1.1205 for three weeks. The GBP/USD pair is inside in upward channel. This week, the GBP/USD pair decreased within an up channel, for that Bitcoin its new highest 1.1284. But the trend rebounded from the resistance 1.1284 to close at 1.1205 on the hourly chart. Consequently, the first support is set at the level of $ 1.1127. Hence, the market is likely to show signs of a bullish trend around the area of 1.1127 and 1.1205. The GBP/USD pair reverses from 1.1284 and drops to multi-day lows near 1.1205 - this price formed a bottom this morning in the hourly chart. Right now, the GBP/USD pair dropped further and bottomed at 1.1127. It then trimmed losses, rising to from 1.1127. The move lower took place amid a stronger US dollar across the board. Probably, the main scenario is continued decline towards 1.1127 (sentiment level). The level of 1.1127 coincides with the golden ratio (61.8% of Fibonacci retracement) which is acting as major support today. Another thought: the Relative Strength Index (RSI) is considered overbought because it is above 60. The GBP/USD pair price could be awaiting a major upswing if the digital savings manages to slice above a fatal line of the first resistance that sets at the price of 1.1127 (Horizontal black line). The prevailing chart pattern suggests that if the leading the trend could be expecting to rebound from the levels of 1.1127 and 1.1205. Moreover, if the GBP/USD pair fails to break through the support prices of 1.1127 today, the market will rise further to 1.1284 so as to try to break it. The GBP/USD pair is one the best overall investment for in coming weeks. However, if you want to try to improve the growth of Pound, thus it seems great to buy above the last bearish waves of 1.1127. The pair will move upwards continuing the development of the bullish trend to the level 1.1127 - golden ratio 61.8%. Buy orders are recommended above the major's support rates of (1.1127) with the first target at the level of 1.1284. Furthermore, if the trend is able to breakout through the first resistance level of1.1284 (1.1284 - to test the 78% of Fibonacci retracement levels). We should see the pair climbing towards the next target of 1.1300. It might be noted that the level of 1.1380 is a good place to take profit because it will form a new double top in coming hours. Overall, we still prefer the bullish scenario. Consequently, there is a possibility that the GBP/USD pair will move downside. The structure of a rise does not look corrective. In order to indicate a bullish opportunity above 1.1200, buy above 1.1200 with the first target at 1.1284. Besides, the weekly resistance 2 is seen at the level of 1.1300. The market will climb further to 1.1380. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.1380 in order to test the third support (1.1380) in coming hours. However, traders should watch for any sign of a bullish rejection that occurs around 1.1129.

Conclusion :

An uptrend will start as soon, as the market rises above support level 1.0918, which will be followed by moving up to resistance level 1.1055. Further close above the high end may cause a rally towards 1.1115 and 1.1241. Nonetheless, the weekly resistance level and zone should be considered at 1.1241. The breakdown of 1.0918 will allow the pair to go further down to the prices of 1.0784 and 1.0714.

Next week forecast:

- Trend : uptrend.

- Range : 1.1000 - 1.1380

- Targets : 1.1284 and 1.1380