All main events related to the reassessment of risks will take place later this week – the Fed on Wednesday, and the ECB, the Bank of England, and Norges Bank on Thursday. Accordingly, a pause begins in the markets, which will be reflected in low volatility in anticipation of new data. The UST yields slightly fell and dragged down yields in most other countries, but forecasts remain the same – the markets see the first rate hike by the US Federal Reserve in June 2022, and there are no changes relative to Friday.

On another note, the risks associated with Omicron have slightly increased – China has reported the first cases of infection. The UK Health Minister claims that Omicron accounts for more than 44% of new infections in London, and even the first fatal outcome has already been recorded, but there is no confirmation of this yet. The main risk factor is a sharp decrease in the effectiveness of vaccines, which are essentially useless against the new strain. The hopes are connected with the fact that Omicron still will not give severe consequences.

The risk also increases after gas prices in Europe and the UK showed a daily increase of 10% after Germany announced the impossibility of certification of Nord Stream 2. Accordingly, pressure on the European manufacturing sector will increase, which will lead to an increase in demand for protective assets.

NZD/USD

The New Zealand dollar has not found grounds for a reversal, and the upward correction is also in great doubt. More recently, the NZD seemed to be the most promising currency, because there was a strong consumer boom with inflation going through the roof, and the state of the labor market did not require continued incentives. But December has come, and everything has changed – the PMI index in the manufacturing sector is 50.6p with a forecast of 56.7p, the services sector is 46.7p, that is, it is in the compression phase. The forecast for GDP in the 3rd quarter is -4.5%, the data will be released on Wednesday.

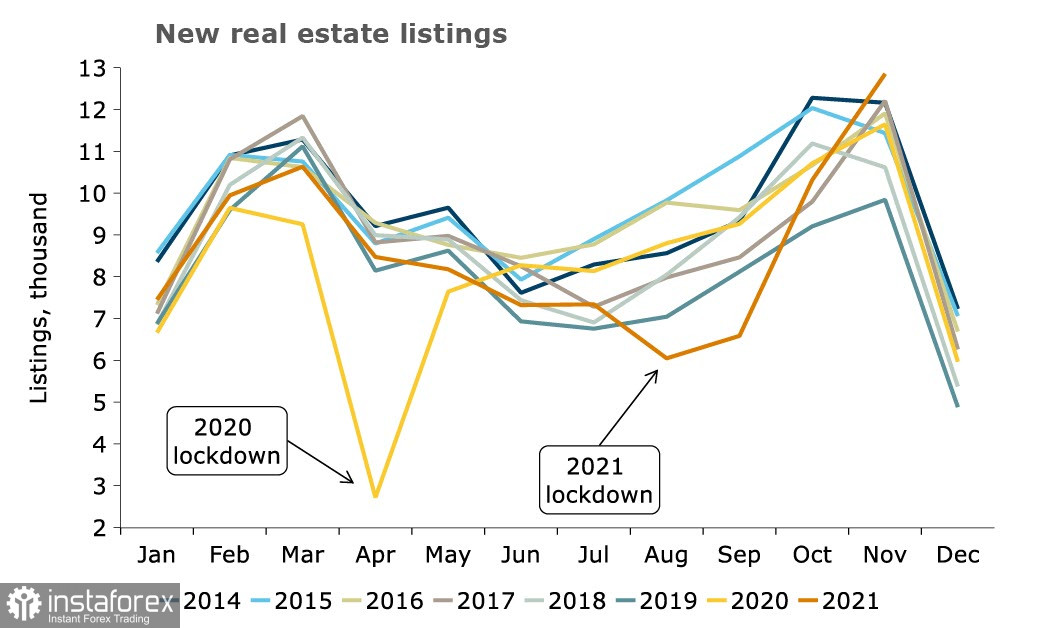

The main driver of inflation and the housing market is also under attack, as the government has introduced several regulations to cool the market. The RBNZ has tightened restrictions on mortgage loans. So far, the housing market in New Zealand looks better than in previous years, but taking into account seasonality and measures to curb growth, we can expect a strong contraction from December.

In fact, there is only one powerful factor left, focusing on which we can expect a further increase in the RBNZ rate - according to estimates, consumer inflation may exceed 7%. But considering the latest data, the RBNZ gets grounds to at least take a break and observe real estate prices. According to the combination of factors, expectations for NZD are rapidly declining.

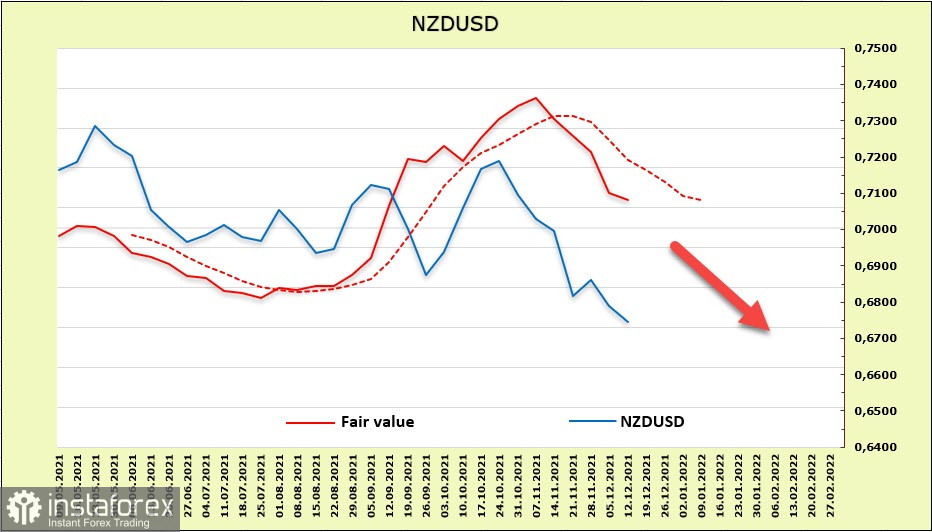

In the futures market, the NZD positions are almost unchanged. It still maintains bullish positioning against the US dollar (+727 million), but other factors, primarily the yield of T-bills, pull the NZD down. The estimated price is clearly bearish on Tuesday morning.

The New Zealand dollar continues to trade near the 12-month low. We expect a confident test of support at 0.6695, then to the lower border of the 0.6650/60 channel. The long-term target is 0.6450.

AUD/USD

The business activity review from NAB did not provide new information on AUD prospects. Some indicators have improved, in particular the employment index, business activity, a noticeable improvement in retail trade, but at the same time, there is a strong decline in construction.

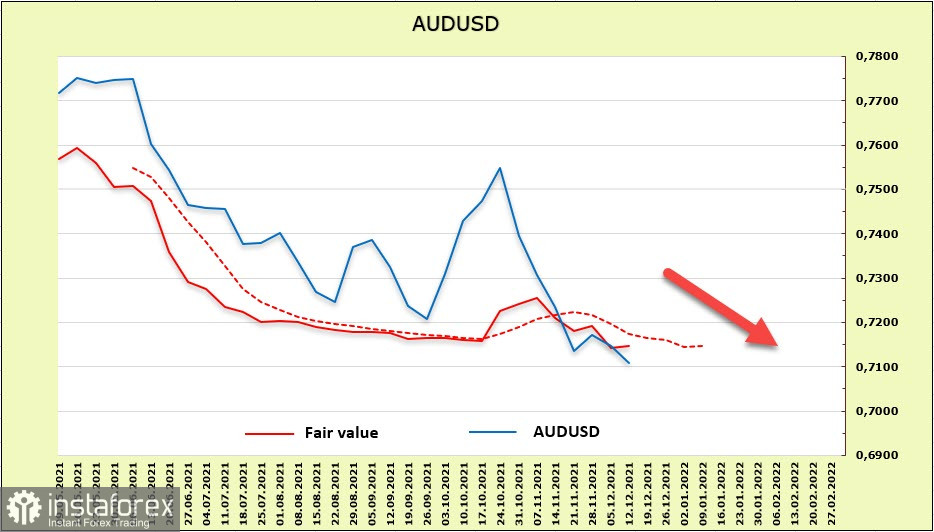

The Australian dollar's net short is up slightly (108m to -5.823bn), but the bearish edge remains strong. The target price is below long-term average, and chances of reversal are still minimal.

As expected, a small technical pullback from the low of 0.6990 turned out to be shallow. The most likely scenario right now is a resumption of the decline, that is, consolidation below the level of 0.6990 with a target of 0.6760. Since the estimated price makes an attempt to turn up, it is also possible to go into the side range, but this period will not last for a long time.