The EUR/USD pair was trading flat, within a narrow price range, during today's Asian session. Yesterday, buyers could not consolidate in the area of 1.13, after which took control. However, they could not pull the price below the lower limit of the established range of 1.1260-1.1360. As a result, the pair closed the trading day again on the border of 12 and 13 figures. This price fluctuation has been going on for almost a week, since last Wednesday. "The top can't, the and bottom don't want to" – this is about how you can characterize the current situation.

Traders' indecision is quite justified. Tomorrow, we will know the results of the Fed's December meeting, while the day after tomorrow, the results of the last meeting of ECB members this year will be announced. These events will determine the vector of EUR/USD movement in the medium and (possibly) long term. Given the high degree of uncertainty, none of the investors dare to open large positions either in favor of the dollar or against it. Therefore, EUR/USD traders are forced to hang out in the flat, starting from the borders of the price level.

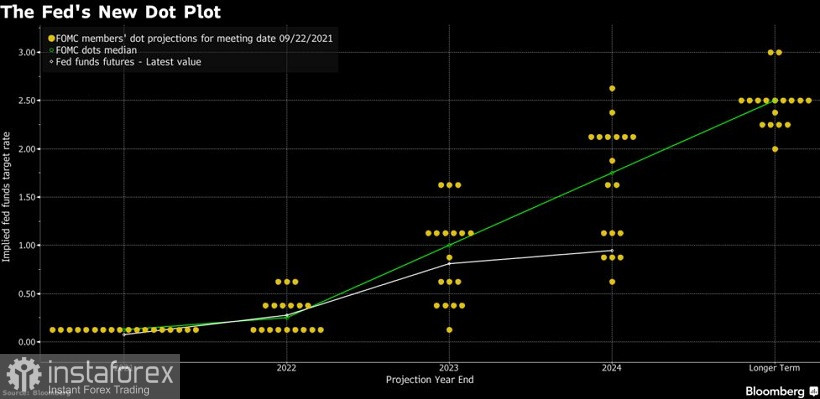

As already known, the Fed will publish an updated forecast of interest rate increases until 2024 tomorrow. The regulator publishes the median forecast once a quarter – it was last updated at the September meeting. And then, the dot plot of forecasts ("dot plot") showed that 9 out of 18 members of the Committee expect an increase in the base rate in 2022. Moreover, three of them suggested that the rate will be increased twice next year. A rate increase in 2023 was expected by 17 of the 18 Fed members, and in 2024, all 18. In addition, Fed Chairman Jerome Powell then announced that the Central Bank would begin curtailing QE earlier than expected – in November, not in December.

The results of the September meeting laid the foundation for strengthening the US currency for several weeks ahead. All subsequent events that took place after the September meeting was viewed by the market through the prism of prospects for tightening monetary policy. For comparison, it can be noted that if the EUR/USD pair was trading in the range of 1.1700-1.1890 before the meeting in September, then after it the US dollar began to systematically strengthen its positions, putting pressure on the pair. Looking at the monthly chart: in September, the downward trend resumed, dragging the pair to the lows of the year 1.1164.

Now, EUR/USD traders are waiting for the next information impulse. The focus is on the fate of QE and the dot chart again. And if the market has virtually no doubt that the Fed will complete the curtailment of the stimulus program earlier than expected (presumably in March), then the question of further prospects for tightening monetary policy is debatable. Preliminary forecasts promise success for the US dollar, although such forecasts should be treated with a certain degree of skepticism. So, according to most experts, the dot chart will reflect a rate increase of 50 basis points in 2022. At the same time, some analysts (in particular, Goldman Sachs bank) say that the regulator should include three rounds of rate increases in the forecast.

As it can be seen, market expectations are inflated, and this fact can do a "disservice" to the US dollar. For example, few experts before the September meeting assumed that the nine members of the Fed would indicate their "hawkish" position, predicting the first rate hike next year. Therefore, the spot forecast produced such an impressive effect: the EUR/USD pair dropped by 200 points in just two weeks after the September meeting.

At the moment, the situation is mirrored. The very fact of curtailing QE and the forecast for one rate hike in 2022 will not satisfy dollar bulls. For the "second coming" of the US dollar, more hawkish signals are needed, which suggest at least a double rate hike next year.

On the one hand, we can say that dollar bulls have trapped themselves in inflated expectations, due to US inflation, which has already updated a 39-year record. On the other hand, if the Fed members really demonstrate an aggressive attitude tomorrow, then they will give a surprise. The announced signals will give the US dollar the necessary impetus for further long-term growth, including paired with the euro.

The European Central Bank is unlikely to be able to reverse the trend if the US currency strengthens its positions throughout the market. Given the previous rumors, it can be concluded that the ECB will not become an ally of the Euro currency. In particular, Rabobank's currency strategists said that the European regulator will increase the size of the APP program to 40 billion per month, continuing to insist that the increase in inflation in the eurozone is temporary.

Therefore, given the general uncertainty and continuing intrigue regarding the outcome of the Fed meeting, it can be assumed that the pair will continue to trade in the range of 1.1260-1.1360 before the announcement of the results of the December meeting. The further behavior of the price will depend on the degree of aggressiveness of the members of the American regulator.