EUR/USD has no potential for growth and is unwilling to decline

Hello, dear colleagues!

It is Tuesday today. Despite this fact, it is better to start the analysis of the main currency pair of the forex market with the results of the last trading week. Not to mention the fundamental analysis and focus on the technical analysis, I will briefly outline the main macroeconomic events of the day. At 13:00 (Moscow time) the eurozone will publish industrial production data on a monthly and yearly basis. As for the US statistics, I recommend focusing on the PPI, including its core value. These reports will be released at 16:30 (Moscow time).

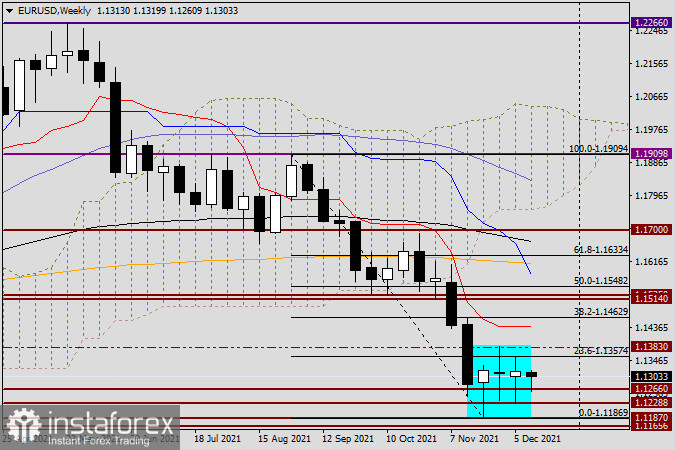

Weekly

It has no potential for growth and is unwilling to decline. Observing the weekly chart, this expression is extremely suitable to describe the crisis situation with EUR/USD. The pair consolidated near 1.1300, closed the weekly trading session again slightly above the significant technical level 1.1300. The uncertainty in the pair's direction is signaled by the long shadows of the recent candlesticks which are marked in this timeframe. The Federal Open Market Committee (FOMC) two-day meeting starts today and its results will be announced tomorrow night. Notably, investors are anxiously awaiting this momentous event, expecting to obtain new or more specific data regarding the tapering of the quantitative easing program, after which the Fed is likely to raise interest rates. There's nothing for it, the issue of high inflation is extremely relevant. In this case, tightening monetary policy is an absolute necessity. As for the technical details, the nearest resistance is at 1.1383, and the price zone of 1.1236-1.1228 has been supporting the pair from the further decline for the second week in a row. Thus, it is likely to assume that a break of 1.1383 or move below 1.1228 will indicate the further pair's direction. However, taking into consideration that the pair declined as low as 1.1187, it is not obvious that breakout of the level of 1.1228 will provide the details about the further movement of the pair towards the south. I believe EUR/USD has more chances to grow at the moment. From the technical point of view, the last three candlesticks close above the key level of 1.1300, leaving quite long tails (shadows) below, indicating clearly that the market is unwilling to trade EUR/USD below 1.1300. If the fundamental aspect is considered, the tightening of the Fed's monetary policy has been expected for a long time, i.e. it is included in the price of the US currency. If the Fed shows signs of slackening concerning its hawkish plans tomorrow and displays a little dovish rhetoric, the US dollar risks being hit by a wave of sell-off. The weekly chart shows that this will be the case, and the EUR/USD pair has more options for growth.

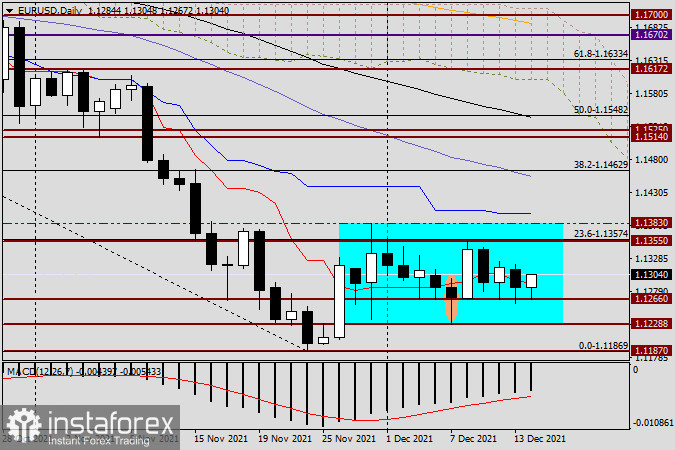

Daily

As for the daily chart, nothing has changed in the recent days. The pair continues to consolidate in the range of 1.1266-1.1355. A larger and longer range, in which the main currency pair is traded, is 1.1383-1.1228. I assume that tomorrow the Fed's rhetoric will provide the necessary driver for the further movement. As expectations of QE tapering and the following increase of rates are to a large extent followed by market participants, in the current situation the rise of the US dollar is quite possible, though rather problematic and moderate. Taking it into account, I would recommend trying to buy EUR/USD after a brief and insignificant decline to the area of 1.1300-1.1270. That's all for now. Tomorrow, the smaller timeframes will be analyzed, with the option to find the confirmation of potential purchases, as well as more accurate prices for making transactions.

Have a nice day!