Hello, dear traders!

Today, at 10 am Moscow time the UK labor market reports were released and they were quite positive. Thus, the change of the average earnings totaled 4.9%, though the rise of this indicator was forecasted at the level of 4.6%. Besides, the change in average earnings, apart from bonuses, was also higher than 4% and amounted to 4.3%. Notably, this index may indicate further inflationary growth. The unemployment rate came in line with economists' expectations at 4.2%. The number of jobless claims also declined from the previous figure of minus 14.9 and amounted to minus 49.8. Evidently, the gap is quite significant. However, the British pound reacted rather moderately to the published statistics. The growth of the pound is most likely restrained by the continued spreading of the COVID-19 variant Omicron in the UK and expecting the outcome of the US Fed extended meeting to be announced tomorrow evening. Market participants are also awaiting the upcoming Bank of England meeting to grasp the rhetoric of the British Central Bank, which is still very ambiguous and shows no signs of a specific hawkish tone. To conclude the fundamental part of the GBP/USD review and start the technical analysis of this currency pair, I remind you that today at 16:30 Moscow time the US producer prices report will be published.

Weekly

Obviously, last week the GBPUSD pair rose and closed the trades within limits of the Ichimoku indicator cloud. Taking into account that a week earlier the trades ended under the lower boundary of the cloud, the exit from it downward may be recognized as false. It provides reasonable grounds to expect current rise in quotations. Strong support around 1.3170, which stopped the pair's further downward trend and reversed the rate upwards, is highly significant. However, there are some strong and significant resistances. It will be difficult for the GBP/USD pair to overcome them without strong and major drivers. On this chart, the orange 200 exponential moving average, which is at 1.3382, can be considered as the nearest resistance. Bearish sentiment on the pair will resume only after a true break of the support around 1.3170.

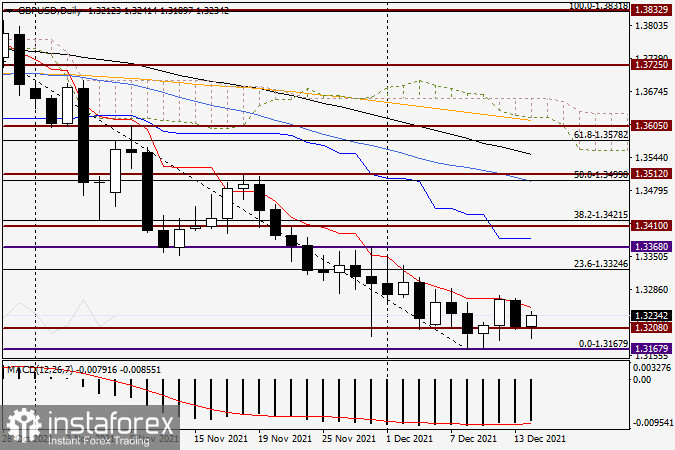

Daily

On the daily chart, the red Tenkan line of the Ichimoku indicator exerts a strong resistance to the pair's attempts to further rise. After climbing the red Tenkan line on December 10, at the next trading session, that is yesterday, the pair decreased significantly. I assume that the move to the north direction is possible only by breaking the Tenkan line with the subsequent fixation of the price above it. At the moment of completing this article, the pair was already at 1.3189 and reversed upwards, and it is now traded around 1.3235. Apparently, the market is not willing or ready to trade below the significant and strong technical level 1.3200. To sum it up and give some recommendations for GBP/USD, the technical picture seems quite uncertain so far, especially taking into account tomorrow's events related to the Fed. Nonetheless, considering the last week's candlestick I am more inclined to assume the pair's northward movement. More precise data about the prices for the opening trades is likely to be provided tomorrow, when smaller timeframes will be considered. However, tomorrow night after the announcement of the Fed's rate results and the following press-conference of the head of this agency Jerome Powell anything can happen. Before opening the trades I strongly recommend taking this factor into consideration.

Good luck!