Analysis of Tuesday trades:

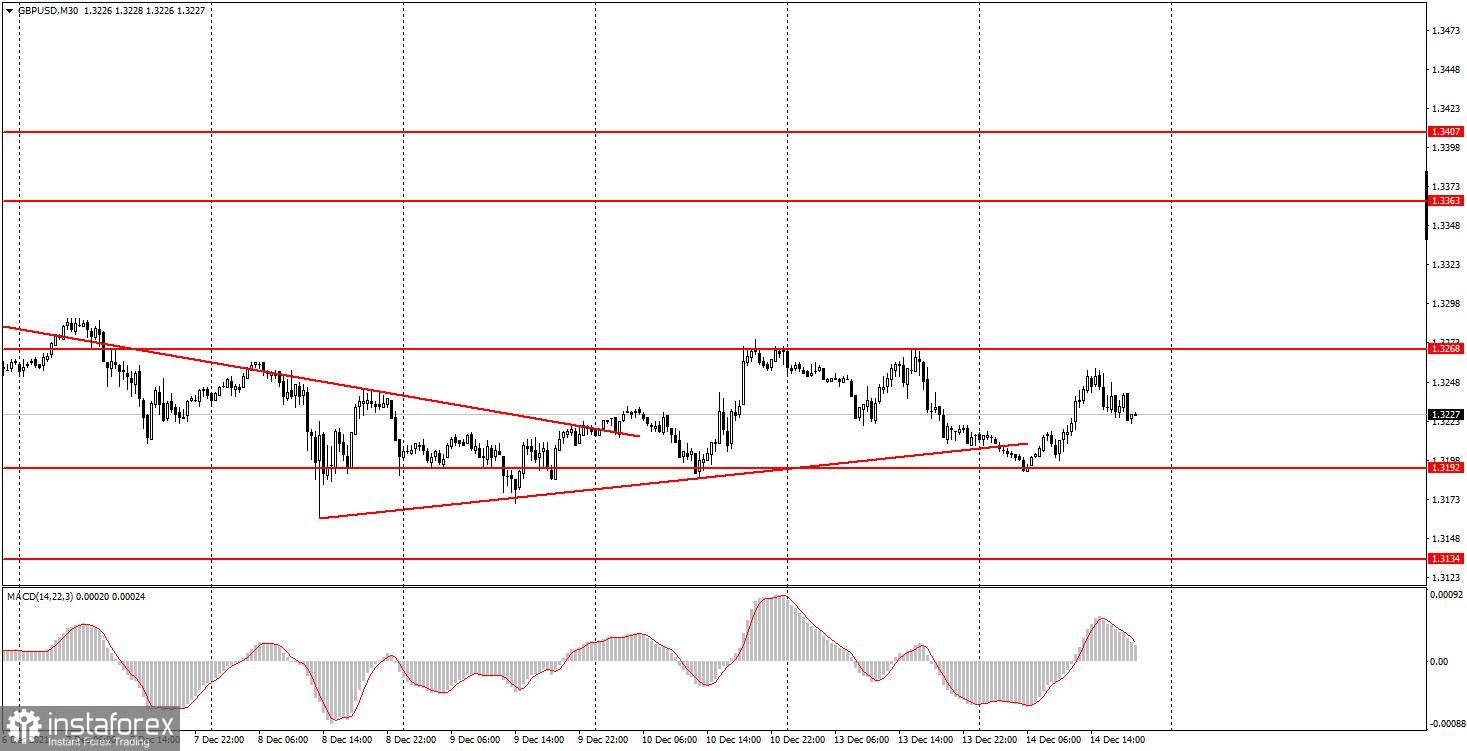

M30 chart

On Tuesday, GBP/USD went down to 1.3192, rebounded from it, and stayed within the sideways channel. The pair has been traded in the range of 1.3192 and 1.3268 for three days. However, the quote may leave the channel on Wednesday because the FOMC meeting is highly likely to trigger market jitters. Anyway, this could happen only by the close of the trading day. The pair is expected to be less volatile during the day. Therefore, it may continue to move within the sideways channel. The ascending trends line was removed from the chart. In the United States, not a single important report was published on Tuesday. Meanwhile, data on the unemployment rate, claimant count change, and average earnings in the United Kingdom boosted the pound sterling. However, the results did not trigger an immediate rise, and right after the reports came out, the British currency was edging lower (see the tick mark on the chart below).

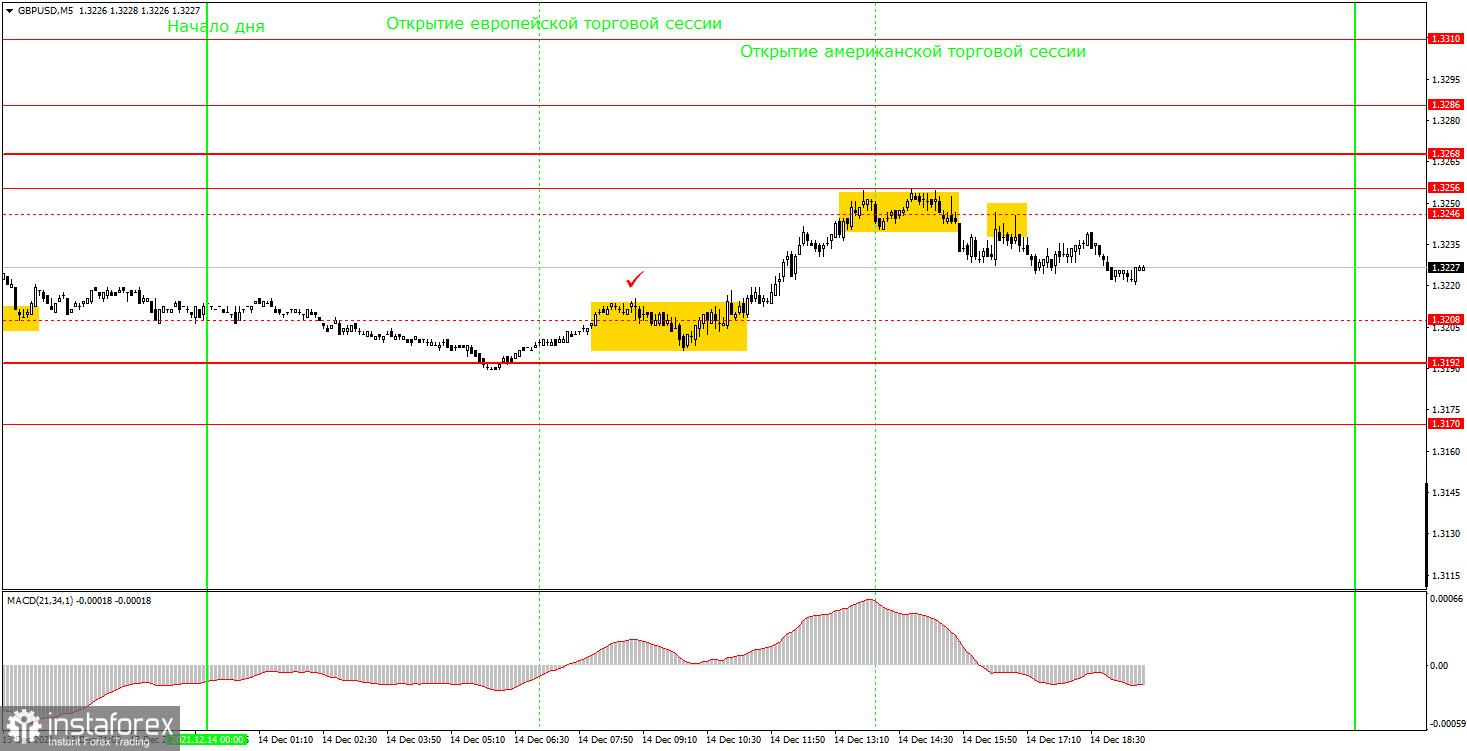

M5 chart

On the M5 chart, the movement of the pound/dollar pair on Tuesday was not the easiest at first glance. Indeed, some levels were located close to each other. So, it was important to interpret trading signals around them accurately. The first signal was produced around 1.3208 that was later removed from the chart. It was located 16 pips lower than the level of 1.3192. So, they were to be regarded as a range. The novice could open long positions there. The next signal was generated around 1.3246 that was also removed from the chart. The price broke through it and consolidated below it an hour later. That was the right moment to close long positions. The profit from long positions totaled 17 pips. Traders could open short positions there as well. Another sell signal was produced around 1.3246. The price did not reach the nearest target by the close of the day, so this trade had to be closed manually. The profit from this trade equaled 5-10 pips.

How to trade GBP/USD on Wednesday:

On the M30 chart, the pair is moving in a sideways channel in the range of 1.3192 – 1.3268. The price is likely to attempt to leave the channel today. By the end of the day, beginner traders should already exit the market and expect the outcome of the FOMC meeting. The key levels for December 15 on the M5 chart are 1.3170, 1.3192, 1.3256, 1.3268, 1.3286, and 1.3310. The price may pull back or break through them on Wednesday. A take-profit order is to be set at a distance of 40-50 pips. On the M5 chart, targets are seen at all the nearest levels. In such a case, you should lock in profit taking into account the strength of the movement. A stop-loss order is to be placed at the breakeven point when the quote passes 20 pips in the required direction. On December 15, the United Kingdom reports on its inflation rate, its outcome could affect the market. US retail sales are another important report that could provoke a reaction in the market. At the end of the trading day, the US Federal Reserve will announce its policy decision, which is likely to trigger market jitters.

Major rules of trading:

1) The strength of a signal is calculated by the time it took a signal to form (bounce or break through a level). The less time it takes, the stronger is the signal.

2) If two or more trades are opened near a certain level based on false signals (that did not trigger a Take Profit order or a test of the nearest target level), then all subsequent signals from this level should be ignored.

3) Being flat, any pair might form a lot of false signals or non at all. In any case, when seeing the first signs of a flat, trading should be stopped.

4) Trades are opened within the time period between the opening of the European session and the middle of the North American session when all trades should be closed manually.

5) On the M30 chart, trading should be carried out based on signals from the MACD indicator only if there is good volatility or a trend confirmed by a trend line or a channel.

6) If two levels are located close to one another (from 5 to 15 pips), they should be considered as the area of support or resistance.

Indicators on charts:

Support and resistance are target levels when buying or selling a pair. A Take-profit order could be set near them.

Red lines are channels or trend lines that display the current trend and show in what direction it is preferable to trade now.

MACD is a histogram and a signal line, the crossing of which produces a signal to enter the market. It should be used in combination with trend patterns (channels, trend lines).

Important speeches and reports (always contained in the calendar) can greatly influence the movement of a currency pair. Therefore, at the time of publication, market players should trade very cautiously or exit the market to avoid a reversal.

Beginners should remember that not every trade will be profitable. An effective trading strategy and money management are the keys to success in long-term trading.