The world financial markets have been tired of being in suspense all the time before the unusually rich events that will not only have a local impact on world markets but will prove to be long-lasting.

Today, investors will focus on the result of the Fed's monetary policy meeting, then the publication of the bank's forecasts for the main macro indicators for the next three years, and lastly, the press conference by the US Fed chairman, J. Powell, who will be expected to provide clear and precise explanations of future actions regarding the prospective increase in interest rates. If, according to the consensus forecast, it is believed in the market that the regulator will increase the volume of asset repurchase reductions under the incentive program from $ 15 billion to $30 billion, then nothing is clear about the timing of the start of the interest rate hike process.

Now, let's look at the scenarios of the likely development of events on the results of the Fed meeting. If the Central Bank's forecast for future values of GDP, inflation, and employment shows concern about economic growth amid unemployment and inflationary pressure, while the forecast for rate increases will become steeper in its prospective growth – this will undoubtedly lead to a new wave of sales in the US Treasury government bond market and another rise in their yields. The currency market will react with a strengthening of the US dollar, and the local stock market will become discouraged again, which will lead to sales primarily of shares of companies in the technology sector.

At the same time, if Powell outlines the likely timing of the first-rate hike at the press conference, which will differ from those previously assumed, for example, rates will be raised by 0.25% already in March or even in February against the current opinion that this will happen in the middle of summer next year, it will only strengthen the reaction of the markets described above. Moreover, there are more than enough reasons for a tough statement – a strong increase in inflation in November from 6.2% to 6.8%, and an unclear picture on the labor market against the background of new covid fears associated with the Omicron strain.

Anyhow, another softened option is also possible. That is, the Fed announces a rapid reduction in the volume of asset repurchases, but does not associate the important issue of rates with certain deadlines, leaving the date open, while Powell can say in his speech that the bank will act according to circumstances, based on the dynamics of inflation growth. In this case, the market reaction may even be positive. Stock markets will receive support as well as commodity assets, prices for treasuries will continue to consolidate, approximately near current levels, and the US dollar will be under pressure. However, this is unlikely to lead to its noticeable decline. In general, it will be possible to talk about the continuation of the situation that dominates the markets now, which can be described as uncertainty.

Forecast of the day:

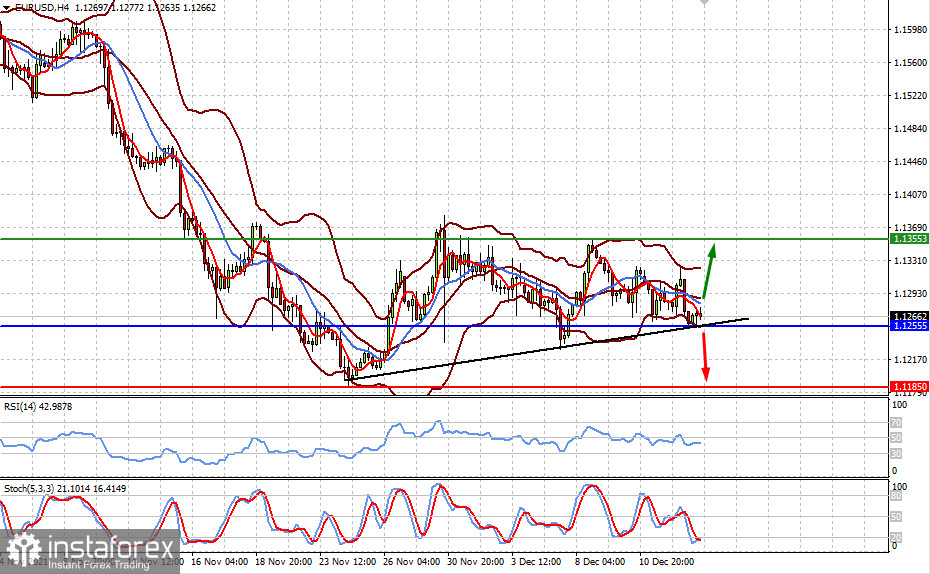

Unfortunately, the markets are again faced with a choice, so if the Fed and Powell take a tough stance on a radical change in the monetary exchange rate after the meeting, this may lead to a decline in the EUR/USD pair to the level of 1.1185. At the same time, a soft tone may cause the pair to rise to 1.1355.

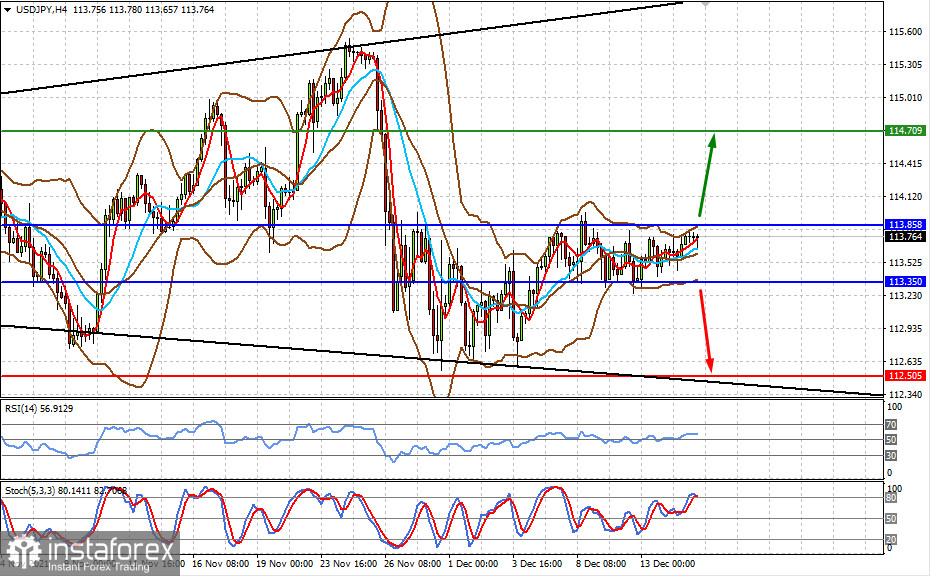

A similar scenario can be observed in the USD/JPY pair. A tough statement by the Fed and Powell will push the pair up to 114.70, while on the contrary, a softer one may cause its decline to 112.50.